If things weren’t derivative enough for you before, you can now add one more level of indirection to your volatility investments. Options are now available on ProShares‘ 2X VIX short-term UVXY and their -1X inverse short-term SVXY.

Until recently both of these funds were almost invisible compared to Barclays‘ VXX and VelocityShares‘ 2X TVIX and -1X XIV offerings, but the recent halt in share creations for TVIX has left UVXY as the only 2X short-term volality fund and its volume has surged.SVXY’s volume is still low compared to XIV’s, but it has been growing also. These new options are similar to VXX’s options; they are American exercise style and expire on the same day as equity options.VIX options are European exercise and expire on the same day as VIX futures.

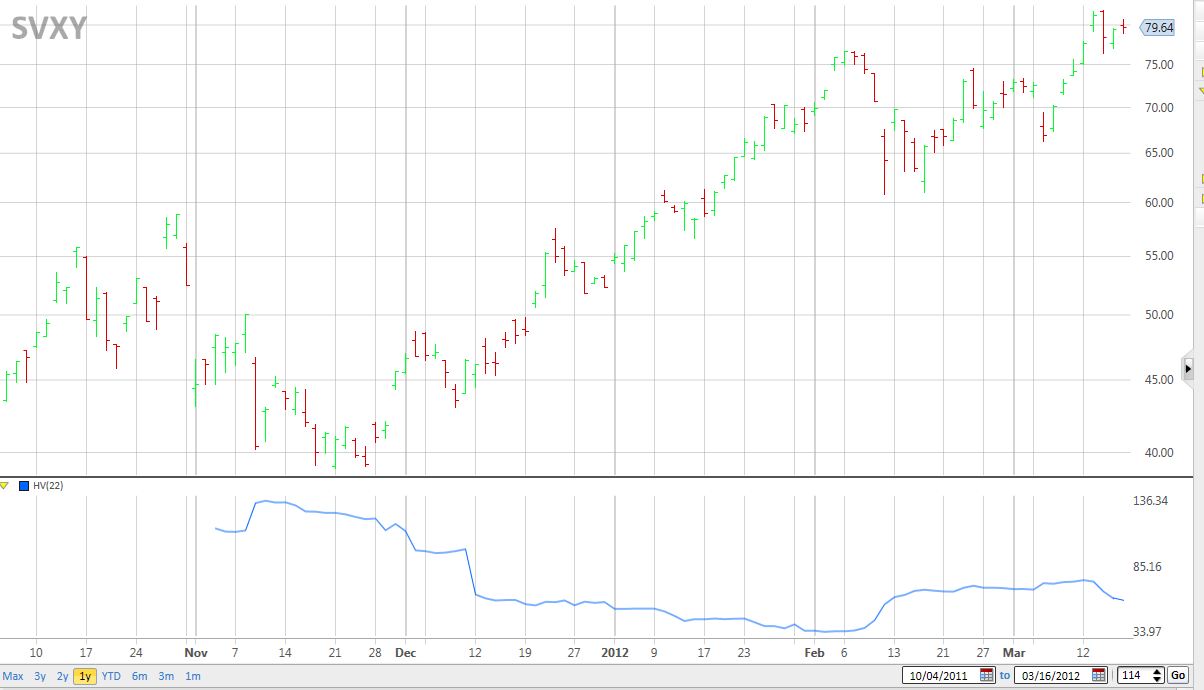

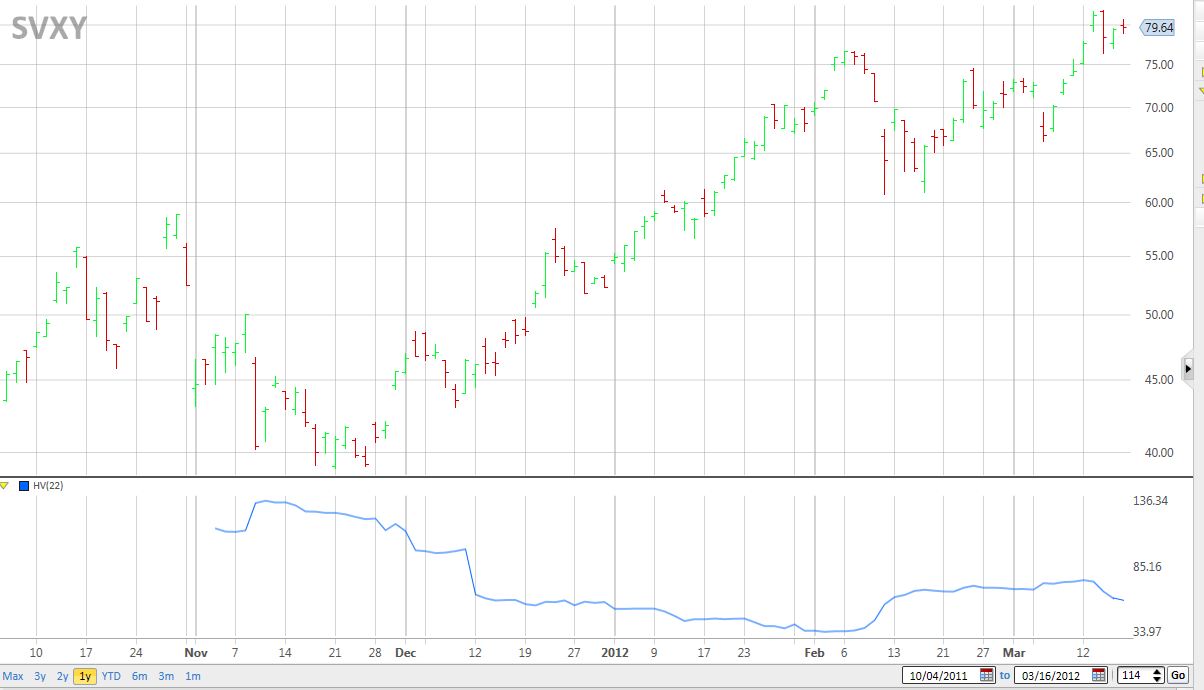

These new options won’t be cheap.Volatility funds are themselves volatile, which drives the premiums higher. The charts below show the historical 22 day volatilities (HV) of UVXY and SVXY.

I expect the implied volatility (IV) of these new options to be at least as high as the recent HV levels of around 130 and 70. The option chains below show today’s prices.

19-Mar Option Chain for UVXY

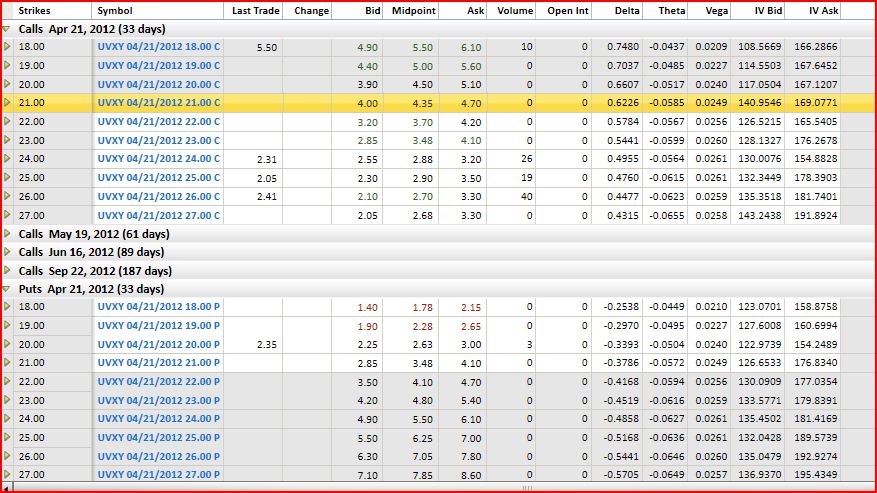

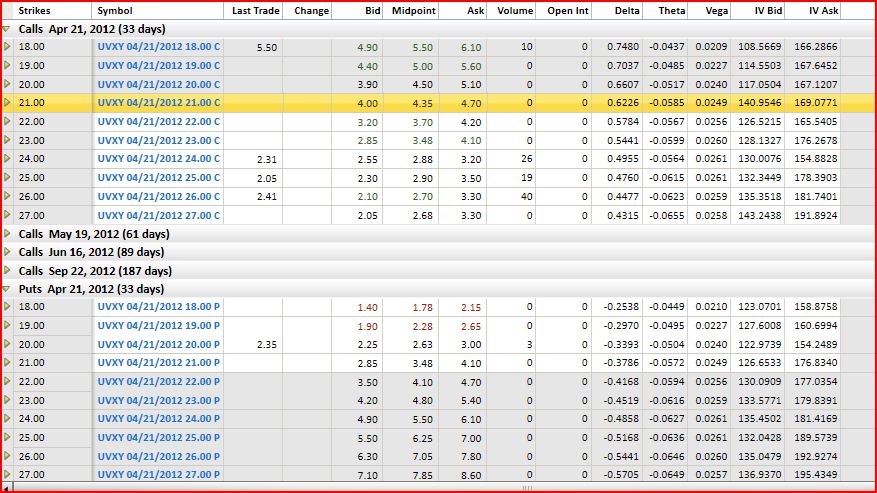

19-Mar XVXY option chain

The market makers appear to be pricing the IVs at around 150 (UVXY) and 70 (SVXY).In comparison April ATM VIX options are carrying an IV of around 65 and VXX ATM options have an IV of 40.UVXY’s option IVs have to be some of the highest ones around…It will interesting to see if these options become popular. They are expensive, and their bid/ask spreads are currently wide, but options open up a whole host of interesting strategies. If you do trade these products, limit orders are must.You can probably get fills close to mid-way between the bid and ask prices.

Until recently both of these funds were almost invisible compared to Barclays‘ VXX and VelocityShares‘ 2X TVIX and -1X XIV offerings, but the recent halt in share creations for TVIX has left UVXY as the only 2X short-term volality fund and its volume has surged.SVXY’s volume is still low compared to XIV’s, but it has been growing also. These new options are similar to VXX’s options; they are American exercise style and expire on the same day as equity options.VIX options are European exercise and expire on the same day as VIX futures.

These new options won’t be cheap.Volatility funds are themselves volatile, which drives the premiums higher. The charts below show the historical 22 day volatilities (HV) of UVXY and SVXY.

I expect the implied volatility (IV) of these new options to be at least as high as the recent HV levels of around 130 and 70. The option chains below show today’s prices.

19-Mar Option Chain for UVXY

19-Mar XVXY option chain

The market makers appear to be pricing the IVs at around 150 (UVXY) and 70 (SVXY).In comparison April ATM VIX options are carrying an IV of around 65 and VXX ATM options have an IV of 40.UVXY’s option IVs have to be some of the highest ones around…It will interesting to see if these options become popular. They are expensive, and their bid/ask spreads are currently wide, but options open up a whole host of interesting strategies. If you do trade these products, limit orders are must.You can probably get fills close to mid-way between the bid and ask prices.