The NYSE just released the margin debt figures for the month of May and they continue to confirm the broad reversal in risk appetites I’ve been monitoring for months now. This should serve as a clear warning regarding the overall trend in stock prices.

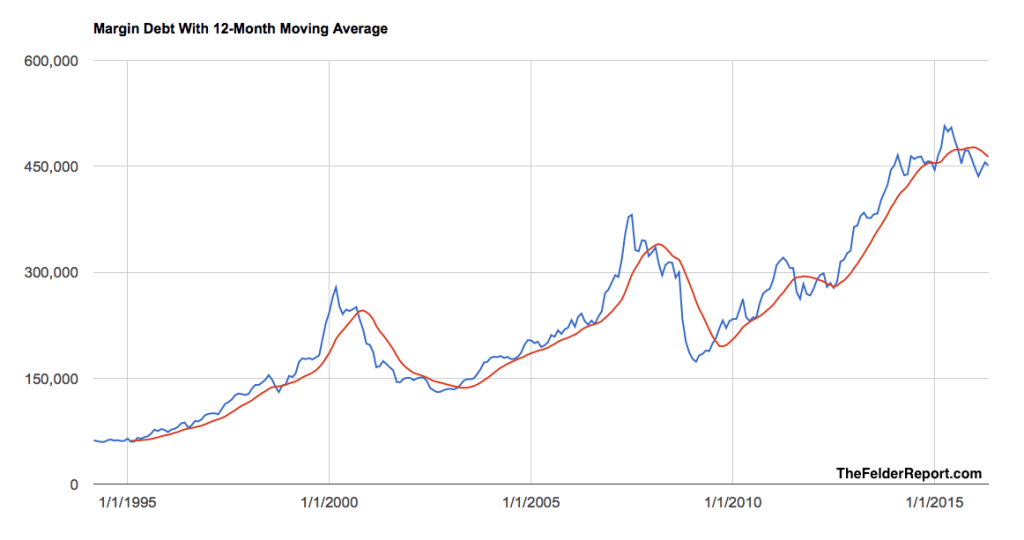

After reaching record highs early last year, total margin debt reversed course and has been trending lower for about a year now. Because risk appetites, as measured by indicators like margin debt, normally trend along with the stock market, this is a clear red flag for stocks.

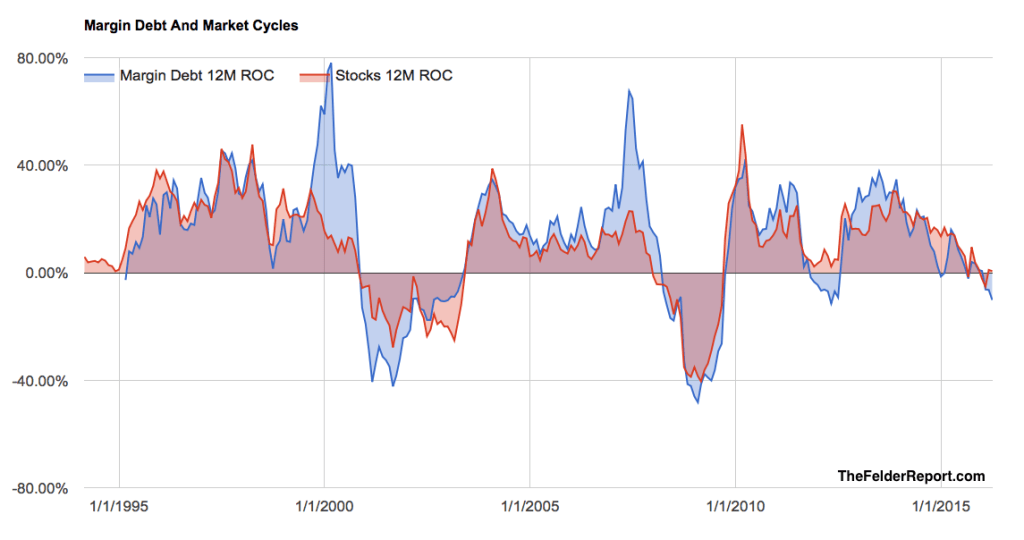

Furthermore, the 12-month rate of change has now seen two months in a row with double-digit declines. This normally only happens when stock prices are also declining year-over-year, so this is another red flag.

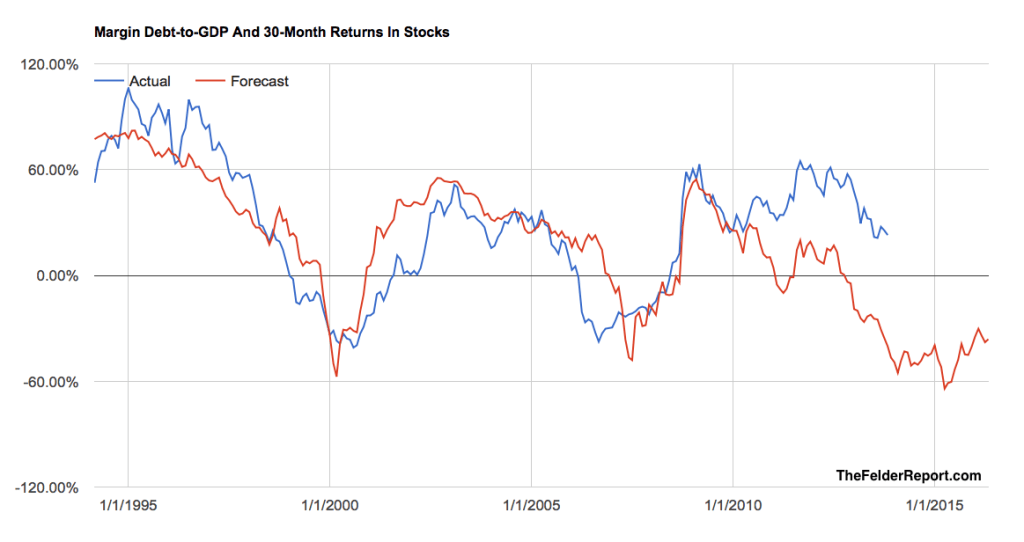

Finally, the level of margin debt-to-GDP is now reversing from record levels, as well. This might be the most valuable measure of all as it has been very highly negatively correlated with subsequent 30-month returns in stocks.

This last measure suggests that if investors using margin decide (or are forced) to pay down their borrowings, stock market returns over the coming 30 months could be very painful. Specifically, it forecasts a decline of 36% over that time.

Now this is not to say the stock market will crash by that amount immediately. It is, however, a decent way to measure risk, I believe.

In other words, owning the broad stock market today means assuming this sort of risk over the coming 2-and-a-half years. When you compare that to the potential gains currently offered, it’s hardly a compelling proposition.