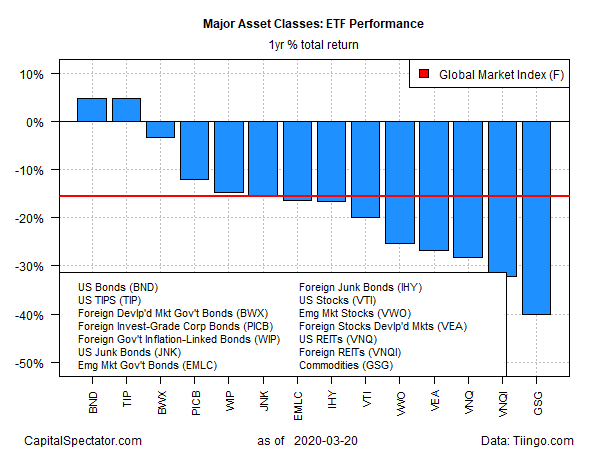

As risk-off sentiment deepens around the world due to the coronavirus pandemic, red ink has spread to nearly every corner of the major asset classes. For the one-year trend, however, there are still two slices of global markets holding on to modest gains, US bonds, based on a set of exchange-traded funds.

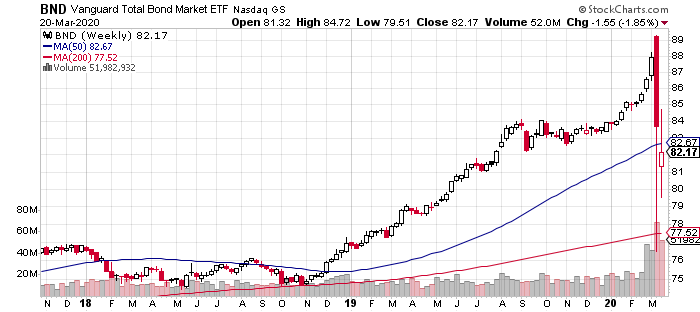

Vanguard Total US Bond Market (NYSE:BND) posted a 4.9% total return for the trailing one-year window through Friday, Mar. 20. The fund holds a mix of “investment-grade” bonds, although it’s a safe assumption that the ETF’s support of late is heavily and perhaps exclusively due to its Treasury holdings. By contrast, much of the corporate bond landscape, including investment-grade credits, has taken a hit lately. For the moment, BND’s Treasury holdings are a net positive in offsetting losses from the non-Treasury components of the portfolio on a one-year basis.

On a shorter-term basis, however, the pressure is building. Last week BND lost 1.9%, which followed a hefty decline in the previous week.

The iShares TIPS Bond ETF (NYSE:TIP) is also in moderately positive territory for the one-year trend via a 4.8 total return. In recent days the fund, which holds inflation-indexed Treasuries, has suffered sharp declines but mounted a strong but partial rebound last Thursday and Friday.

Otherwise, the major asset classes are underwater for one-year results. Most of the ETF proxies are suffering varying degrees of double-digit losses as of last week’s close vs. the year-ago levels (based on trailing 252 trading days). The steepest decline: broadly defined commodities: iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG) has tumbled 40.4% over the past year.

The Global Market Index (GMI.F) is suffering too. This unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights is down 15.6% for the trailing one-year window. That’s a deep cut, but GMI’s loss is middling vs. the rest of the field.