- Possible Japanese pension fund reform may jog JPY out of its rut

- Some traders may react to another US GDP upgrade today

- Prepare for a flood of Eurozone numbers and statements next week

Yesterday, the Japanese yen plowed broadly stronger versus other currencies as New York suffered one of its worst sessions of the year and closed on the low of the day. Overnight, the sour mood was not overly contagious as equities bounced back somewhat from an ugly opening and USDJPY and other JPY pairs likewise bounced back into the range on the lack of contagion and a neutral Japanese CPI release in line with expectations.

Another developing story that saw the JPY weaker overnight was a statement by Japan’s welfare minister, who is responsible for reform of Japan’s enormous government pension investment fund (GPIF). He said overnight that there was no need to put off reform of the fund, reforms that many anticipate will lead to opening up the $1.26 trillion fund for investing in risk assets and less in domestic bond. Let’s remember, however, that Japan has been accelerating its purchases of foreign stocks in recent months, according to recent flow data. This can provide the fuel for a JPY rally (as we saw yesterday) when international asset markets show weak risk appetite.

Elsewhere, the commodity currencies and emerging market currencies kept up the heavy downside momentum, with NZDUSD breaking below 0.7900 this morning and AUDUSD below 0.8800. CAD outperformance relative to its commodity peers continues, with USDCAD merely pushing slightly higher.

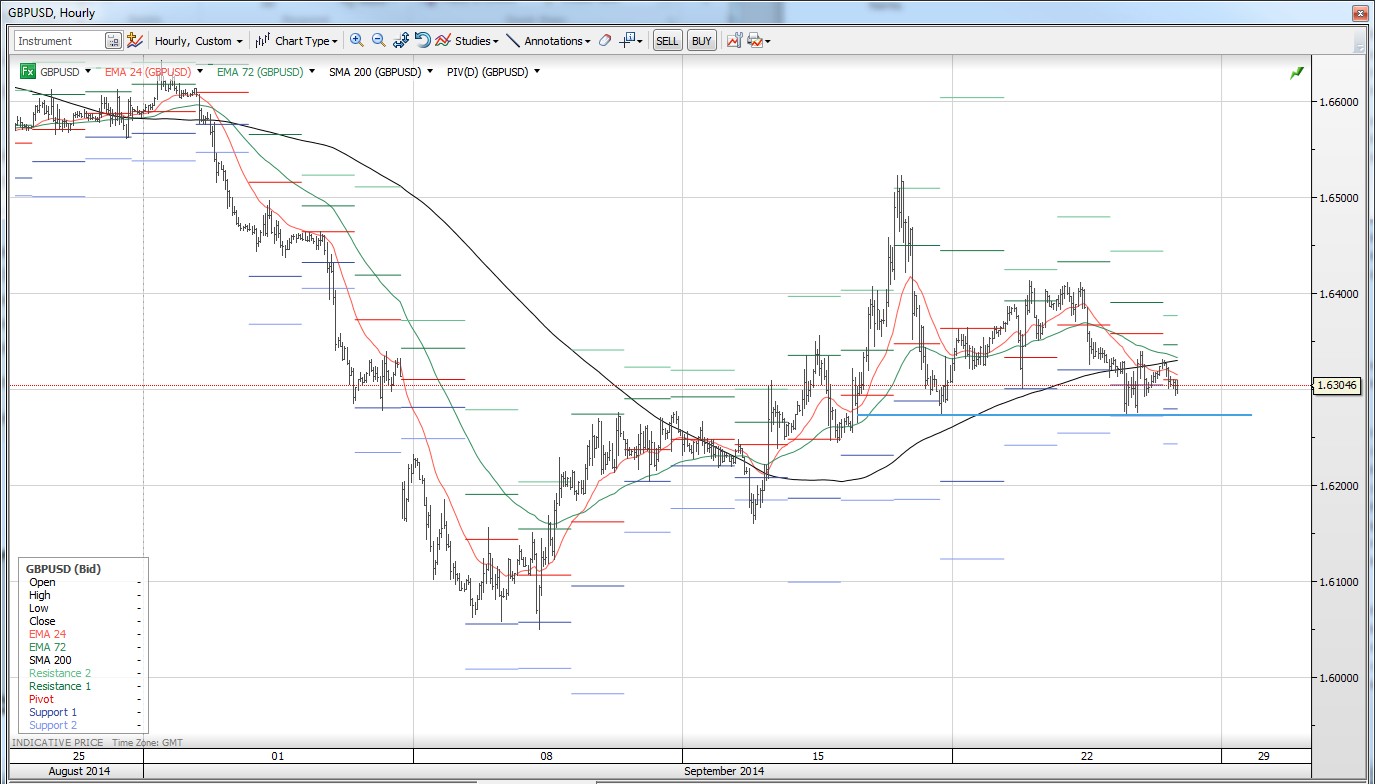

Chart: GBPUSD

There's some chance we'll get a quiet session today after all of the fireworks this week. I’ve been a bit of a frustrated bear tactically in GBPUSD this week. We did get a sell-off after testing uncomfortably higher this week above 1.6400, but I suspect the downside remains softer than the upside toward 1.6200 as the this pair pokes around and the strong USD remains the primary focus. Watch the tactically-important 1.6275 area on that account.

Looking ahead

We have very little on the calendar today, though some may try to react to another upward revision of the US Q2 GDP, which the consensus suggests will be boosted to a lofty 4.6% annualised versus the previous 4.2% estimate.

Today we should be wondering whether this very aggressive market will be looking ahead to next week and considering the critical event risks in the pipeline and whether this move will climax into the Eurozone related event risks (German Sept. CPI on Monday and Eurozone Sept. CPI estimate on Tuesday. Finally, there's the European Central Bank meeting on Thursday which may see bank chief Mario Draghi rolling out the actual estimates of the size of its ABS purchase programme (or so-called LSAPs for “large scale asset purchases”).

My suspicion is that we find a temporary cyclical low in the euro on the day before or the day of the ECB meeting, almost regardless of the news from the ECB. After all, the stretched USD bulls may want to pull in their horns ahead of the US employment report next Friday and often major event risks are pivot points for significant moves.

The other question I have is the status of the Japanese yen, with USDJPY looking like it is merely biding its time in a big bull move, while other JPY pairs have come apart at the seams (NZDJPY in particular, but the bull move in AUDJPY looks fully rejected now that we are back below the 96.00 level. ).

It is clear after yesterday that the old JPY/risk appetite negative correlation remains on significant “risk off” days. Any JPY trader should therefore have one eye on the US S&P500, for example, as a basic risk barometer. And that risk barometer tells us that we suffered a bit of a technical breakdown in risk appetite yesterday, so unless stocks bounce back strongly today, the JPY remains a threat to rally.

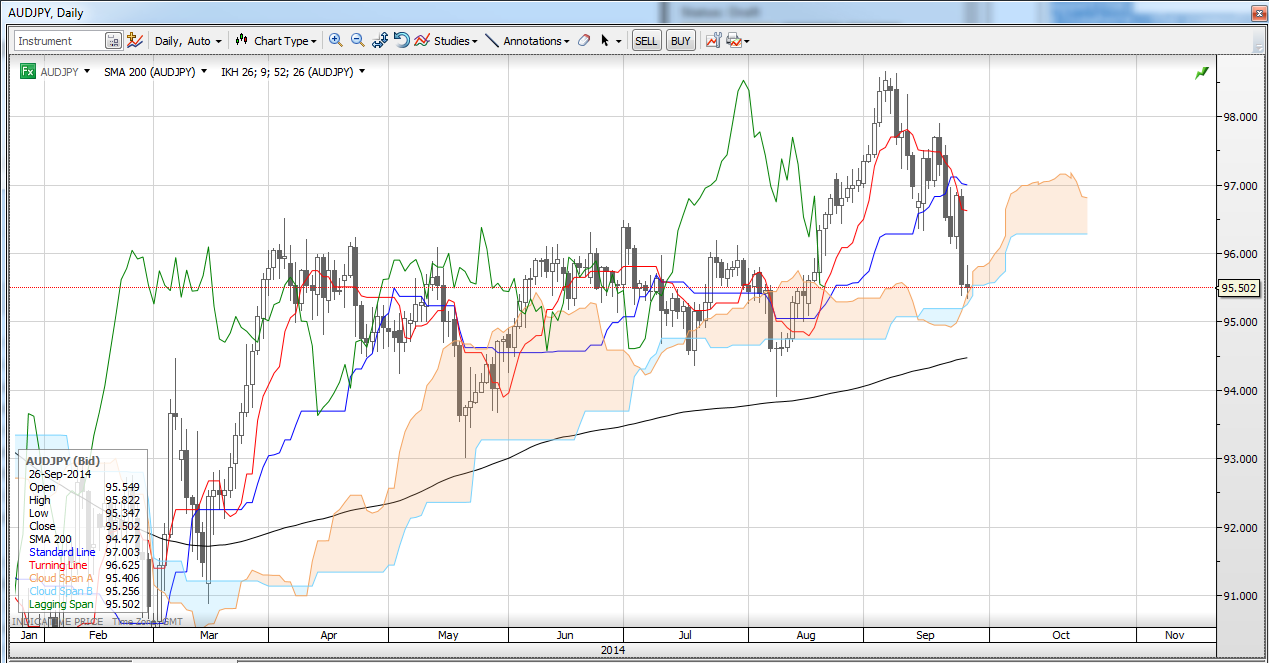

Chart: AUDJPY

This brutal move back lower has almost fully rejected the prior rally and has taken the pair back into the old range and the pair is suddenly interacting with the daily Ichimoku cloud. Further significant downside is possible on weak risk appetite and not the trend implications if we punch lower through the cloud and then the 200-day moving average.

Economic Data Highlights

- Japan Aug. National CPI out at +3.3% YoY and +2.3% YoY as expected and vs. +3.4% YoY/+2.3% in Jul, respectively.

Upcoming Economic Calendar Highlights (all times GMT)

- Eurozone ECB’s Coene to Speak (1015)

- US Q2 GDP revision (1230)

- Australia RBA’s Richards to Speak (1330)

- US Sep. Final University of Michigan Confidence (1355)