Investing.com’s stocks of the week

Consider junk bonds, er, “high yield securities” (back in the Classic Rock era we just went ahead and called them what they were. Today the marketing folks are in charge, hence we now have “high yield securities” instead of “junk bonds”) and also muni bonds, er, “tax free securities.”

The Proxies

For testing purposes, we will use Vanguard High Yield (VWEHX) and Vanguard Intermediate-Term Tax-Exempt Fund (VWITX) because we have data going back to 1979. Because of switching restrictions, for actual trading purposes one would more likely be better served with an ETF such as HYG or JNK (for high yield bonds) and MUB for munis.The Test

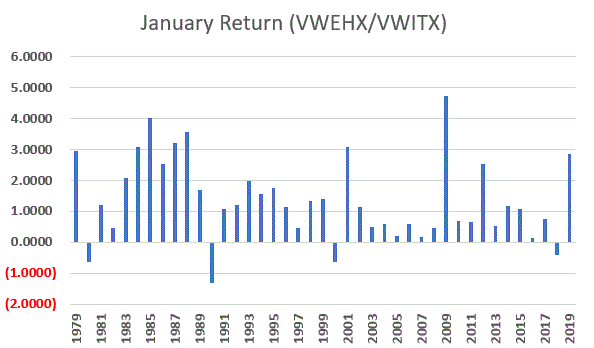

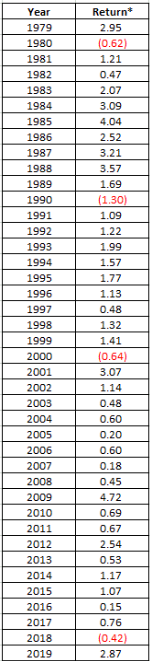

For our purposes we will hold VWEHX and VWITX every year ONLY during the month of January. The year by year results appear in Figures 1 and 2.

For the record, the Junk/Muni Combo:

*Showed a gain 37 times in 41 years (90.2% of the time)

*The average return was +1.36% (which works out to 17.6% annualized)

*The “worst” January was 1990 which showed a loss of (-1.30%)

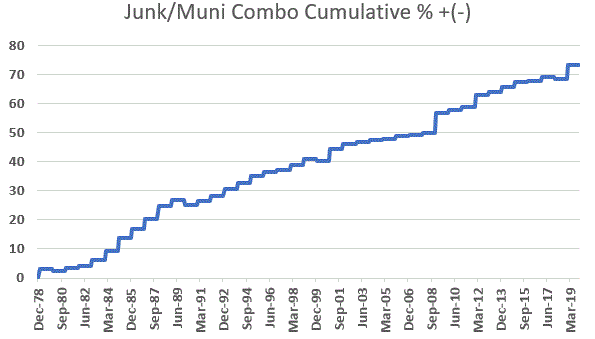

Figure 3 displays the cumulative gain achieved by holding these two funds only during the month of January every year since 1979.

Summary

Is this a viable, actionable idea? Well, that’s not for me to say. It’s only a 1-month trade and the returns are good on an annualized basis but not “eye-popping” on a raw 1-month basis.

Still, anything that is 90% accurate over 40 years is probably at the very least worth knowing about. So now you know.