I see that the brief recess we got from braggadocio is gone. Not only that, but he explicitly mentioned the stock market again as evidence of how great things are. So, yeah, our time machine back to January 26 apparently works!

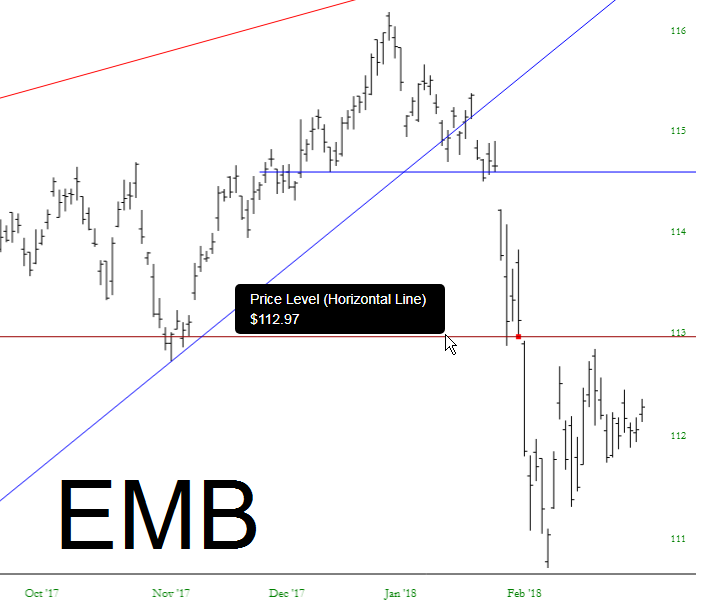

Anyway, I wanted to turn our attention this Spring Forward morning to the three ETFs I find so interesting for their formations. They all seem to have topped out, and they all seem to have a clean stop-loss level defined by a gap. I have highlighted the level of these gaps in each image. First there is the emerging markets bond fund:

iShares JPMorgan (NYSE:JPM) USD Emerging Markets Bond (NASDAQ:EMB) Chart

The high-yield corporate bond fund:

iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG) Chart:

And, our old favorite, the high-yield (“junk”) fund:

SPDR Barclays (LON:BARC) High Yield Bond (NYSE:JNK) Chart:

I gotta tell ya, the market action on Friday was troubling (but so was the Friday before, and that turned out to be meaningless). I’m on the edge of my seat to see whether February 2018 is just a repeat of February 2016, or something altogether different.