The Fed supposedly has a dual mandate -- growth promoting employment and price stability -- to keep inflation in check and avoid deflation. The focus over the last 5 years has been on the employment goal. The price stability angle has been an after thought. But since mid 2013 the risk of deflation has risen dramatically.

Who Cares

No one seems to care. Not the FOMC. Not Ben Bernanke. Not, at this point, Janet Yellen. But one entity does seem to care about deflation. The iShares Barclays TIPS Bond Fund (TIP) has been protesting loudly.

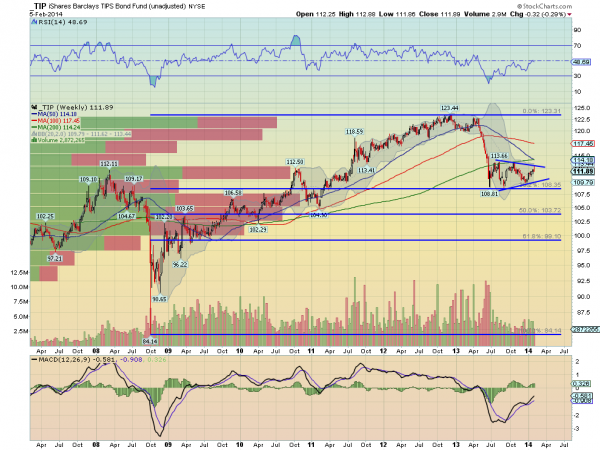

From the chart below, TIP dropped 38.2% of its move higher from the 2008 low and has been consolidating in a symmetrical triangle. The center of the triangle at about 110.50 is 13 points below the peak. What is concerning is that the price action has some aspects that could send it lower still. The measured move on a break down would take it to 97.50 and there is little price history to support it below that point. That would be just under the 61.8% retracement of the move higher.

The Chart is printing a Death Cross this week, with the 50 period Simple Moving Average (SMA) closing down through the 200 period SMA. But there are some positive aspects as well. A break of the triangle higher carries a target back to the 123.50 area. The Relative Strength Index (RSI) is rising, but yet to break the mid line. And the MACD is rising, which supports the upside. Some uncertainty. That is what the triangle is all about. Is inflation ready to return to more normal levels or is deflation upon us. The TIP’s will signal the collective market bias.