Master limited partnerships, or MLPs, are a unique corner of the energy sector that produce high yields without the strict ties to interest rates. These dividend generating machines are allowed to pass a majority of their profits to shareholders through distributions, which make them attractive for income seekers. In addition, they don’t follow the same price patterns as traditional stocks and bonds, which is a bonus for those looking to diversify or balance a broad mix of assets.

I like to classify MLPs as an alternative income asset class because of these unique properties. MLPs don’t operate like a traditional energy company. Rather, they offer a toll-road style business that operates pipelines, storage facilities, and other infrastructure needs for oil and natural gas commodities. This makes their business models less susceptible to the whims of the commodity markets and offers a steadier stream of reoccurring revenue.

Many investors like to own MLPs directly within a taxable account because there can be some tax benefits available for sophisticated shareholders. Each direct investor in an MLP is considered a limited partner and thus is sent a K-1 at the end of the year according to their proportionate share of the financial outcome.

However, there are also a number of ways to own these securities through a diversified and liquid investment vehicle that offer their own benefits and risks.

There are currently a total of 25 MLP ETFs and ETNs trading on U.S.-listed exchanges. While many of these funds show similar characteristics, there are often very unique index construction techniques that set them apart from each other.

The largest fund in this space is the Alerian MLP ETF (NYSE:AMLP), which has over $9 billion in total assets. AMLP tracks the 25 largest MLPs by market cap and has a current 30-day SEC yield of 7.04% as of the end of 2014. Top holdings include: Enterprise Products Partners LP (NYSE:EPD), Magellan Midstream Partners LP (NYSE:MMP) and Plains All American Pipeline LP (NYSE:PAA).

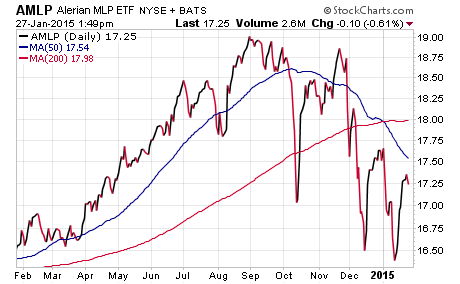

As you can see on the chart above, AMLP has been guilty by association with regards to the deflation in energy prices over the last six months. This ETF has seen a marked increase in volume and volatility as a result of the downgraded expectations for energy-related companies. However, on a relative basis, this MLP index has held up far better than traditional oil producer stocks.

One of the differentiating factors in owning AMLP versus a direct investment in a master limited partnership is that you will not receive a K-1 at tax time, which can be a headache to deal with. Instead, all distributions will be reported on a 1099 like most conventional ETFs. It also means that AMLP incurs a hefty expense ratio — about 8.5%, according to some calculations — most of which is to cover tax liabilities.

If you are looking for a more diversified MLP ETF with defensive properties, you may want to consider the First Trust North American Energy Infrastructure Fund (EMLP). This actively-managed ETF selects both MLP and traditional utility companies operating in the U.S. and Canada. EMLP has a wider base of 66 holdings and total asset of over $1 billion.

The benefit to this unique strategy is the broader diversification into the utility space, which is often a stalwart sector during periods of stock market volatility. However, the tradeoff is that EMLP has a watered down 30-day SEC yield of 2.76% compared to the much higher income from AMLP.

If a high income stream is a priority, the Yorkville High Income MLP ETF (NYSE:YMLP) should be on your radar. This ETF follows the Solactive High Income MLP Index, which selects holdings according to rules-based criteria for current distribution rate and historical growth of the distribution. YMLP has a current 30-day SEC yield of 11.59%.

YMLP has 25 holdings that vary significantly in structure and asset allocation from the industry benchmark. This ETF may be an opportunity to supplement AMLP has a tactical holding for broader coverage of the MLP space or used to enhance the overall yield of an income portfolio.

If cost of ownership is a core tenet of your screening criteria, the Global X MLP ETF (NYSE:MLPA) and Global X MLP & Energy Infrastructure ETF (NYSE:MLPX) are worth consideration. Both funds have one of the lowest expense ratios in this sector, with management fees of just 0.45%. MLPA follows a more traditional asset allocation to the industry benchmark with 35 holdings, while MLPX has exposure to 41 securities that are geared more towards energy infrastructure corporations.

No matter what index you ultimately choose, these ETF options can help strengthen your dividend stream and enhance the capital appreciation potential of a balanced income portfolio. With many of these funds currently well off their highs, the opportunity for new capital to be incrementally added is worth consideration. However, because of the heightened volatility, I recommend that you pair new positions with a stop loss or sell discipline to manage downside risk.