There is a LOT of optimism in the markets currently.

But why shouldn’t there be?

Speaking at Davos, the head of the world’s largest hedge fund said, “If You’re Holding Cash, You’re Going to Feel Pretty Stupid.”

We are in this Goldilocks period right now. Inflation isn’t a problem. Growth is good, everything is pretty good with a big jolt of stimulation coming from changes in tax laws. – Ray Dalio, Bridgewater

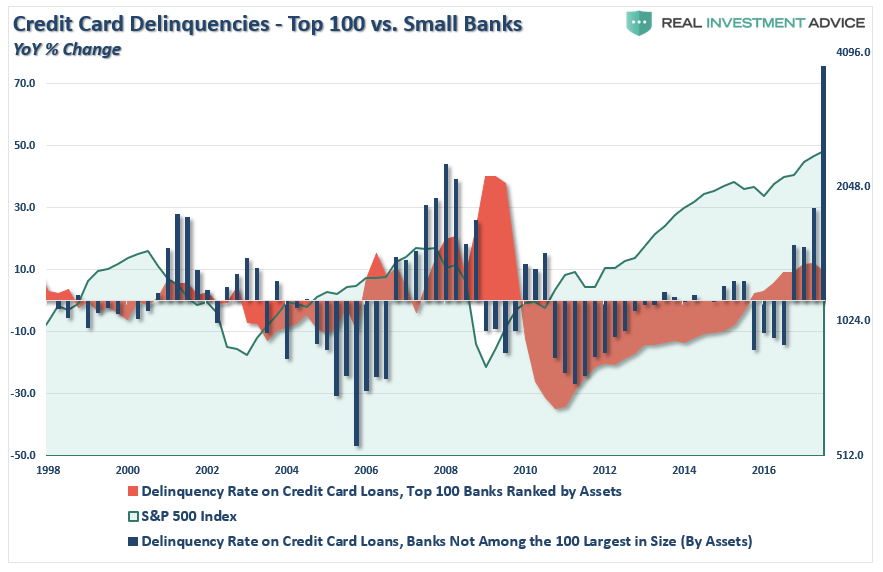

Yes, indeed. Everything does seem to be firing on all cylinders as long as you don’t scratch too deeply beneath the surface. Even if you do, and see the ugly scars of minuscule wage growth, plummeting savings rates and surging delinquencies – investors just don’t give a kazoo as markets continue to rocket higher.

Of course, I also remember this from 2007:

”A waning of the temporary factors that boosted inflation in recent years will probably help foster a continued edging down of core inflation. The U.S. economy appears to be making a transition from the rapid rate of expansion experienced over the preceding several years to a more sustainable average pace of growth.” – Ben Bernanke, February 2007.

The fed’s official forecast, an average of forecasts by fed governors and the fed’s district banks, essentially portrays a ‘Goldilocks’ economy that is neither too hot, with inflation, nor too cold, with rising unemployment.

At that time, things were literally “as good as they could get.”

In 2008, Goldilocks was eaten by the 3-bears of a collapse in stock market, credit, and real estate prices.

As Good As It Gets

But here we are once again. For investors, there is little evidence of a problem anywhere on the horizon.

Everything is literally as good as it can get.

Let’s look at weight of evidence.

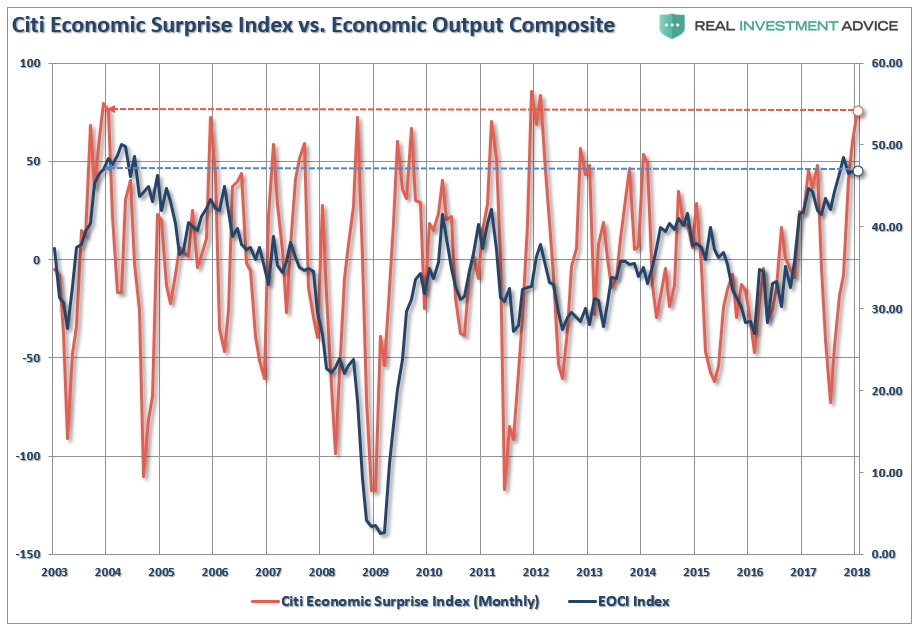

Economically speaking, things have rarely been better. The monthly Citigroup (NYSE:C) Economic Surprise index is hitting levels not seen seen 2004 and 2012. We can also confirm Citigroup’s index by comparing it to the Economic Output Composite Index which is also registering its highest levels since 2004 as well.

(The EOCI is comprised of the CFNAI, Chicago PMI, LEI, NFIB, ISM, and Fed regional surveys.)

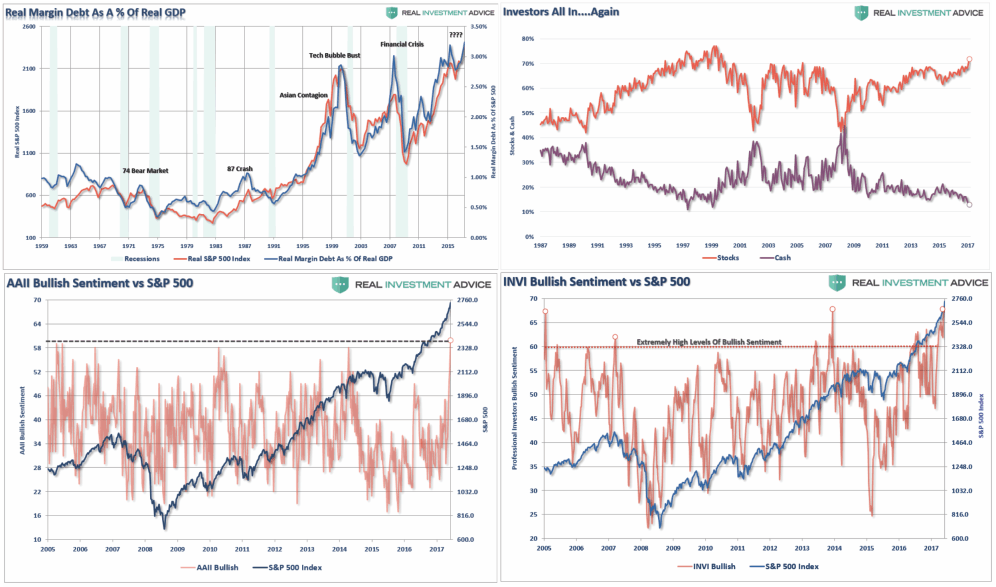

Investors have also rarely been as optimistic about the markets as they are currently. The 4-panel chart below shows the level of optimism currently from both professional and individual investors. Whether it is record margin debt, stock allocations or simple exuberance – we are at levels of rarefied air for participants.

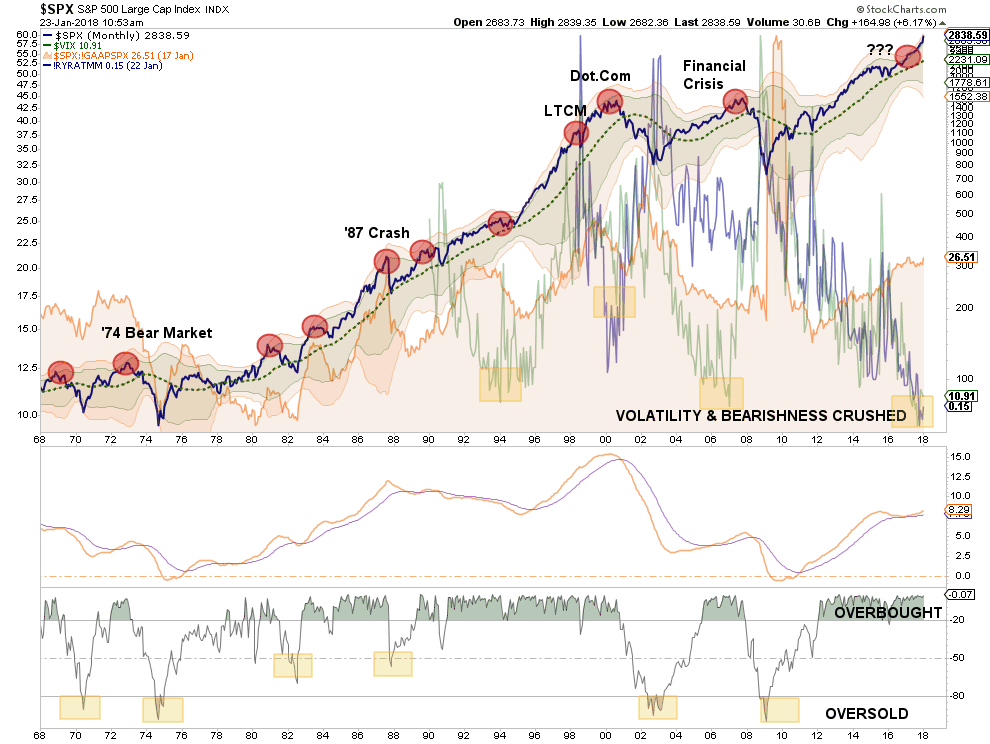

Of course, all of that has led to record low levels of complacency in the markets by virtually all measures whether it is the level of investment in bearish Rydex funds or measures of volatility like the VIX.

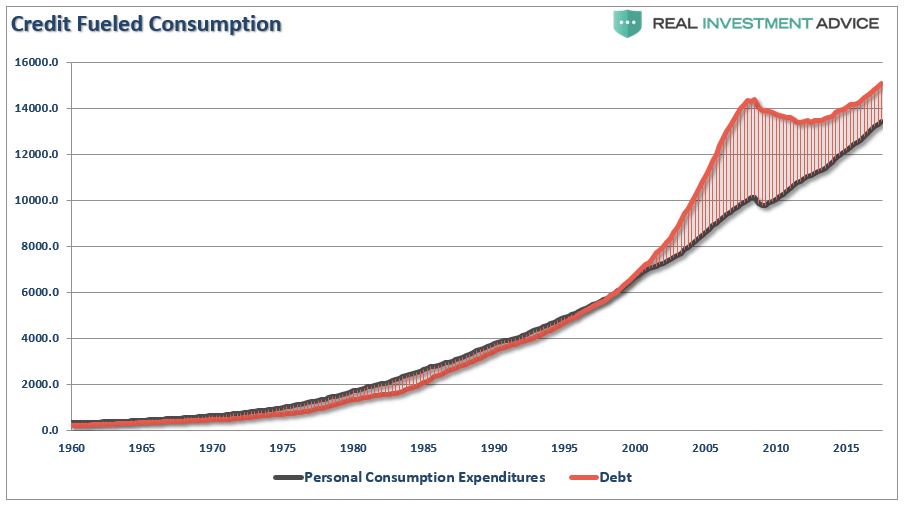

Even consumers have jumped into the game pushing debt to record levels. Why not? After all, with the stock market surging higher, debt can easily be paid off at some future point from investment gains, right?

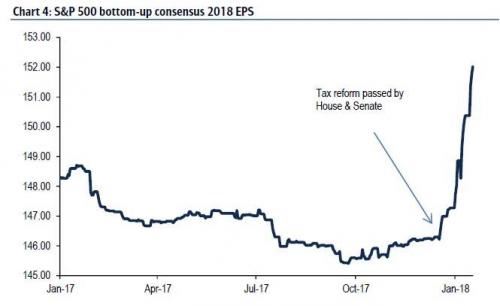

And, lastly, earnings expectations for companies have soared to record levels based on tax reform. As noted by Morgan Stanley (NYSE:MS) this week:

We have no beef with this increase and it's generally in line with our estimate that tax cuts would add somewhere between $5-10 per share to S&P 2018 EPS.

What could possibly go wrong?

Pretty much everything.

I have written in the past that records are records for a reason.

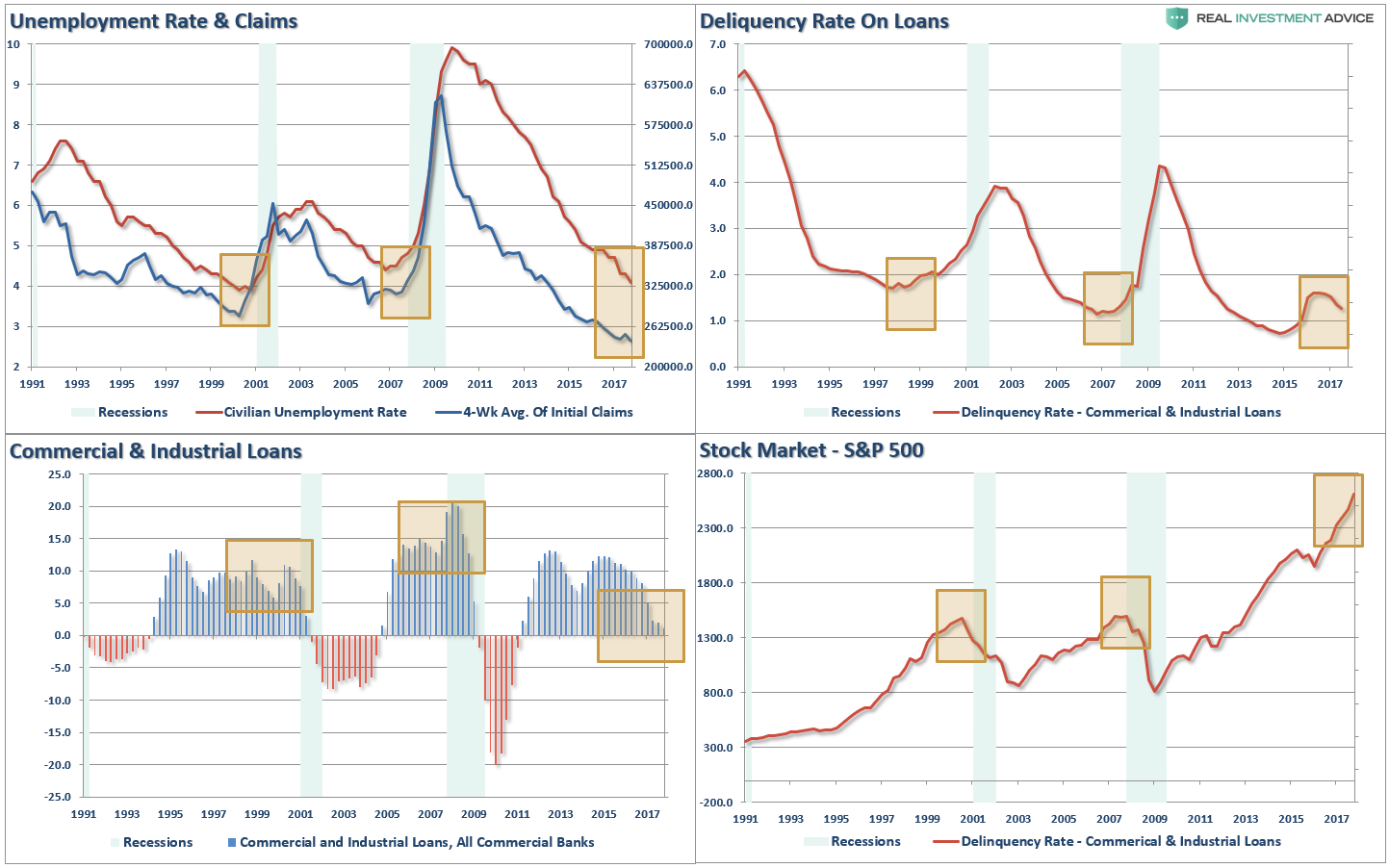

First, record levels of anything are records for a reason. It is where the point where previous limits were reached. Therefore, when a ‘record level’ is reached, it is NOT THE BEGINNING, but rather an indication of the MATURITY of a cycle. While the media has focused on employment, record stock market levels, etc. as a sign of an ongoing economic recovery, history suggests caution. The 4-panel chart below suggests that current levels should be a sign of caution rather than exuberance.”

Chart updated through end of 2017

With the stock market pushing record price levels, not to mention excessive deviations from long-term means, the risk of disappointment has been greatly accelerated.

The problem with record levels of everything is there is little room for an upside surprise to further fuel forward expectations for improvement. Since the financial markets are driven by forward expectations, the risk to investors is a series of disappointments that leads to a repricing of investment risk.

When it comes to corporate earnings, Morgan Stanley also noted:

However, we are skeptical it will exceed $155 when all is said and done. Meanwhile, the multiple has also been rising suggesting the market is now expecting a further rise toward $155 or higher.

As I noted just recently in our weekly newsletter:

Ultimately, investors will care about valuations. For now, it is hoped that historically high levels of stock valuations will be reduced by an explosion in underlying earnings growth due to the impact of tax reform. While exuberance is currently off the charts bullish, and our portfolios remain inherently long in the meantime, we are extremely cognizant of the risk of something breaking. It is what always happens.

Yes, currently, everything is absolutely, positively, optimistic. Economic growth has picked up over the last couple of quarters due to an unprecedented level of natural disasters; oil prices have risen boosting production and corporate earnings, and employment is at historically high levels if you don’t count those out of the labor force.

The positive backdrop for stocks could not be currently better.

The Single Biggest Risk To Your Money

All of this underscores the single biggest risk to your investment portfolio.

In a “honey badger” market, investors become willfully blind to investment risks as every investment rises regardless of the underlying fundamental quality. In turn, this has led to a general hubris by investors believing they are now smarter than the market. As Doug Kass recently noted, "We are at the market stage where the naysayers are explicitly ridiculed for missing out on the rally." He continues,

Ray Dalio says markets surge ahead: ‘If you’re holding cash, you’re going to feel pretty stupid.’

There is a growing business risk for investment managers who have been cautious and conservative — which is perpetuating the market advance as funds are forced into equities. Many commentators in the business media encourage investors to buy more and no longer see risk or question the rise. There are few platforms in the business media for those that hold on to an ursine market view — discussion of risks have disappeared as fear and doubt has left Wall Street. Momentum investing is in, contrarian investing is out. Many investors, commentators and talking heads cant see any meaningful risk — in valuations or in profit and economic growth. Many strategists climb over each other to raise their S&P Index price targets (much like what occurred at the tail end of the dot.com boom in the late 1990s). Speculative activity (e.g. in cryptocurrency) is multiplying

Those that are fearful of missing out are losing investment rigor — buying symbols of stocks they know nothing about. Market participants ignore any risk (including growing Washington, D.C. division that likely precludes further meaningful legislation and a Washington, D.C. reality show who’s antics could change the composition of the Congress at the time of the November 2018 election, and more importantly who’s autocratic views could jeopardize and corrode our values/law that have been sustained for centuries). Market participants are also ignoring the growing geopolitical risks and the possibility of trade issues, rising interest rates (Bill Miller sees a melt up), risks that the tax bill will trickle up — not trickle down, the ever expanding deficit and the distortive role of passive investing (ETFs) and the dominance of machines and algos. Monetary tightening is intensifying but everyone still appears to believe that all the easing was a free lunch and therefore nothing to worry about now Where we are in the market cycle is up to interpretation. Sometimes people hear what they want to hear.

Doug is right on all points. Unfortunately, it is the reversal of the market that exposes the real investment risk undertaken in portfolios and leads to crippling losses in a very short time-frame.

“Bull markets” don’t die of pessimism – they die from excess optimism.

Currently, investors are more optimistic than at virtually any other point in history.

But then again, who gives a sweet diddly hoot?

Eventually, you will.