Key Notes:

* Now well into the shortened trading week where we get another one of those packed data release schedules. This time, we get a week’s worth of US tier 1 data crammed into only three days which could have some interesting implications for thin markets. We see Q3 GDP, Core Durable Goods, Personal Spending and Unemployment Claims all in rapid succession. Consensus seems to be that USD directional flows are set in stone and that this stretch of data isn’t as important as it might have been last month.

* Sticking with the relatively high US dollar theme, there will at least be one person cheering on the bulls and that’s Mario Draghi of the ECB. A stronger dollar will help weaken the euro and ease the pressure on the central bank to continue easing into uncharted, negative territory. Emerging economies with high levels of USD denominated debt on the other hand wont be overly thrilled and opens up a whole different can of worms.

* What about commodity prices? The Australian economy is of course feeling the pain, but it’s still emerging economies who will be hit the most by the combination of the two. The oil price has gotten a lot of attention lately, but throw gold and silver into the mix too who will be sure to continue feeling the pain of traditional USD up, gold/silver down flows.

* With all the possible negative implications of an overly strong US dollar both domestically in the US and abroad, I think we’re going to see a few more tactically timed roller-coaster comments from Fed speakers in the new year. Fasten your seatbelts, the first hike was only the start of the ride. The Loop is coming!

On the Calendar Tuesday:

GBP Public Sector Net Borrowing

USD Final GDP q/q

USD Existing Home Sales

Chart of the Day:

Another Kiwi chart today and another one that doesn’t get looked at all that often in NZD/JPY.

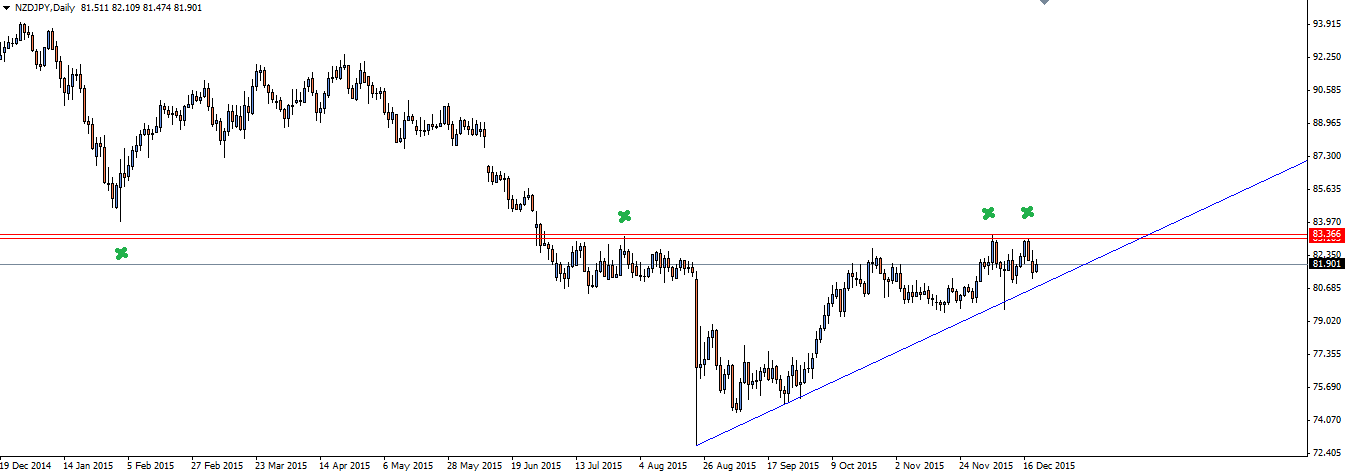

NZD/JPY Daily:

Click on chart to see a larger view.

The daily shows the level that we are watching clearly, with plenty of touches to keep us interested as price starts to coil toward a possible breakout. Is this a huge ascending triangle ready to pop to the upside or are you looking at it from the point of fading major resistance?

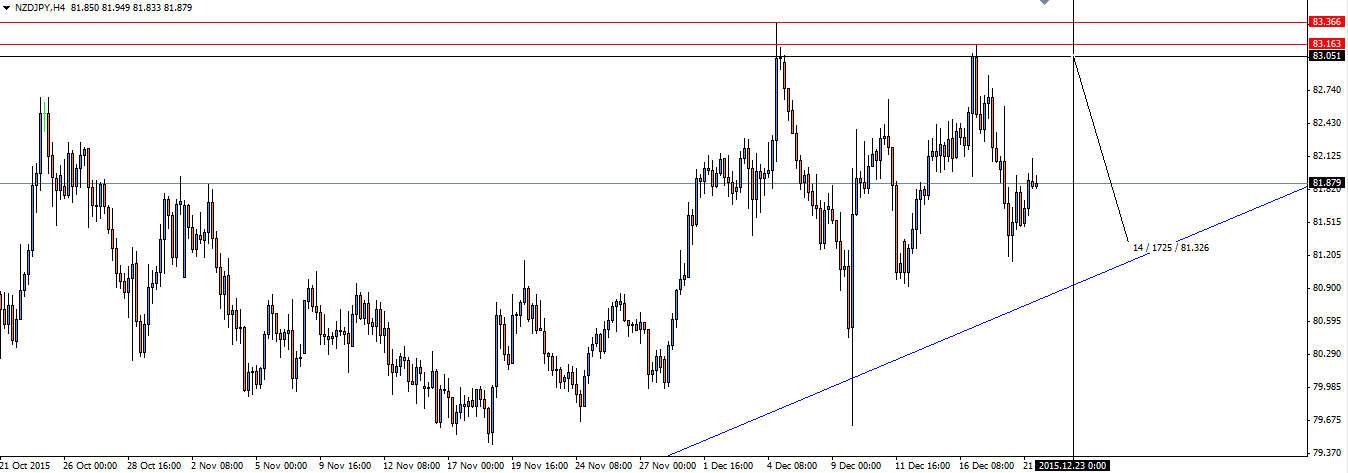

NZD/JPY Hourly:

Click on chart to see a larger view.

As you can see from the pip counter inside MT4, with Christmas week slow trading looking to have well and truly set in for us now, there’s not much use in expecting a 200 pip breakout from here. Keep the pair and the chart on your watch list and we’ll re-visit this one in the new year.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.