On Thursday, the ECB may have attracted the headlines with a surprise interest rate cut, but what crept under the radar was the news that the US GDP expanded in the 3rd quarter, growing annually at 2.8%. This bullish news took many by surprise and led a surge in US currency strength.

Despite this, there is a hidden element in the US GDP release which would have internally disappointed. Consumer spending

How important is consumer spending for the US economy?

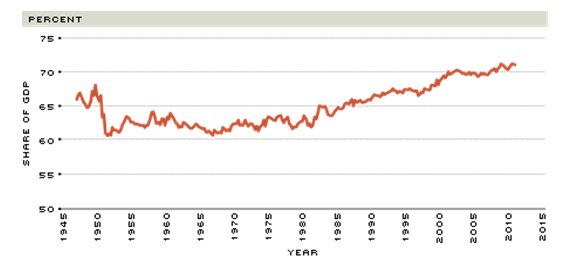

Very important. According to the Federal Reserve Bank of St. Louis, consumer spending accounts to the largest proportion of US GDP.

The World Bank has previously expressed that consumer spending equates to nearly 70% of the US economy. The latest US GDP release showed that consumer spending reduced to 1.5% growth, a 20% contraction from the previous quarter.

In European countries, the consumer spending levels are around 50% - 60% of GDP.

A slowdown in consumer spending could indicate a decline in median household income, something the U.S Central Bureau has previously been bearish regarding. Currently, median household income is 8.3% lower than pre-recession.

One reason why we are noticing a decline inconsumer spending growthis likely related to the United States not adding the expected quantity of jobs to their payroll. A high proportion of the employment created have been in lower paying industries.

Overall, the US GDP impressed and surprised onlookers. Right now, the US hierarchy will not be overly concerned by consumer spending slowing down, but it will certainly be something that will be closely evaluated in the upcoming future.

Finally, reduced consumer spending explains why inventory build up also raised eyebrows. Inventory build up refers to products that have been produced, but not yet sold. A scenario any corporation would rather avoid.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Hidden Worry Behind The Impressive US GDP

Published 11/13/2013, 03:40 AM

Updated 05/14/2017, 06:45 AM

The Hidden Worry Behind The Impressive US GDP

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.