Investing.com’s stocks of the week

When Google split its shares in early April, it divided the shares into two separate share classes: A-shares, which have voting rights and trade under the ticker Google (NASDAQ:GOOGL), and C shares, which have no voting rights and trade under the old ticker Google C (NASDAQ:GOOG).

The Google guys initially argued that the price spread between the two share classes would be negligible, but in order to settle a lawsuit, the company agreed to a “true up” mechanism where at the end of the first year the company will pay C share holders some compensation if there is a gap in price between the two share classes. The payout is based on a sliding scale that kicks in if the spread between the shares is 1% or greater.

So Far This Year

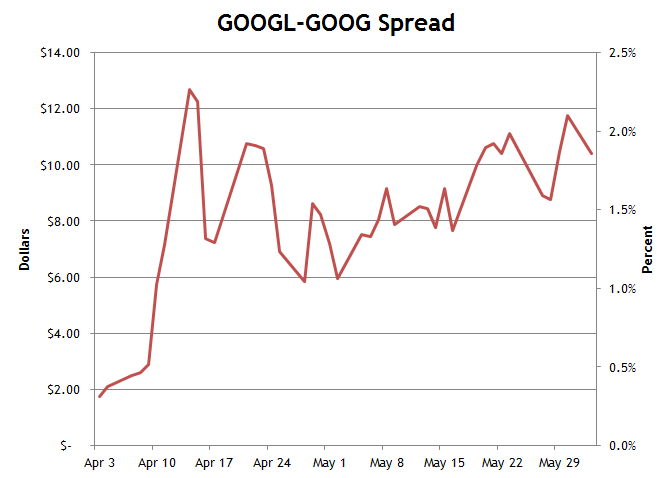

Below is a chart that shows how the spread between GOOGL and GOOG shares has tracked so far in the first two months of trading. So far the two share classes have traded at more than a 1% difference in price, which means that if this spread remains through April 2015, then Google would have to compensate C shareholders. Based on the sliding scale that’s been agreed to, the payment would work out to about $2 per share (a 0.36% yield). On 337 million C shares outstanding, that would be about $675 m.

The GOOG/GOOGL split is an interesting case study because it isolates the value of voting rights. The ~$10 spread between the two share classes implies that the right to the minority vote at Google is worth about $2.8B or just a little bit more than the Clippers. Considering that Larry and Sergey still control the company no matter what though, Google voting rights, like the Clippers, should probably be thought of as a novelty purchase.