America makes nothing. Seems like most things we buy are made in Mexico, China, Indonesia or many other places. However, perceptions are not facts, and even the data can be spun to support a specific opinion.

The USA ranks 79th in industrial growth while China is 6th according to the CIA Factbook - on the surface, it seems the future is dim for American goods manufacturing.

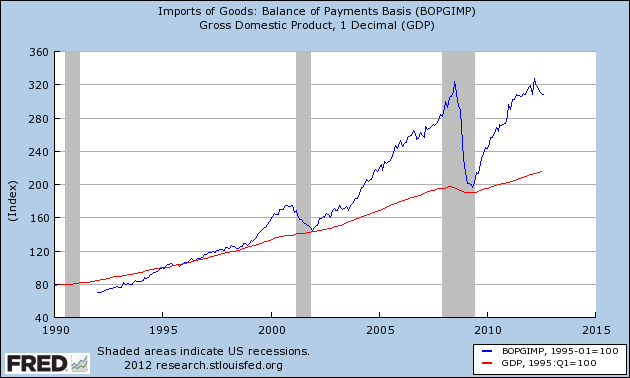

One way to view this is graphing imports against GDP to illustrate a growing import level into the USA economy. The graph above does not send out any warning signals that imports are growing relative to the overall economy (the graph above is indexed to January 1995, and uses current dollars). But consider also that goods expenditure is a growing percentage of GDP.

The graph above does not send out any warning signals that imports are growing relative to the overall economy (the graph above is indexed to January 1995, and uses current dollars). But consider also that goods expenditure is a growing percentage of GDP.

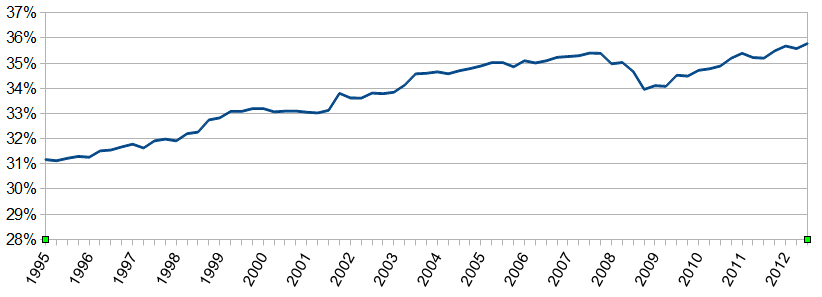

Percent of GDP’s Personal Consumption Expenditures Spent on Goods

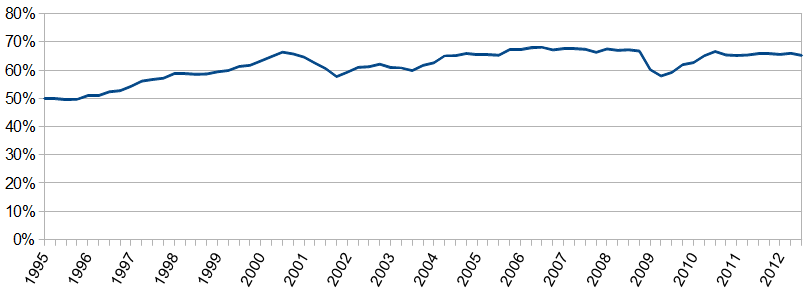

The next graph is slightly misleading as it compares total imports to GDP’s PCE goods expenditures.

Percent Imports Shown In GDP to Total Personal Goods Expenditure in GDP

The defect with the above graph is that all imports are not used by consumers; some are used in infrastructure and government. However it is revealing that goods imports do not seem to be a growing problem.

Trade and import of goods per se does not seem to be worsening – but the trade agreements which came into play since 1995 appear to have added about 15% additional imports of goods we use.

My concern is not imports per se, but strategic manufacturing – the ability to manufacture some of all essential goods. When a country does not manufacture some, it loses the ability technologically (included skilled labor) – and to regain that technology is a real struggle. This can become more than an economic issue, but also a national security issue.

Other Economic News this Week:

The Econintersect economic forecast for November 2012 showed barely moderate growth, but the the underlying data used to forecast was very mixed. To use a technical term – the data was wacky, and as an analyst leaves me with an uncomfortable feeling. However, the good data was stronger than the bad data, and our alternate forecasting tools validated our forecast.

ECRI is still insisting a recession is here (a 07Sep2012 post on their website). ECRI first stated in September 2011 a recession was coming . The size and depth is unknown. The ECRI WLI growth index value is enjoying its tenth week in positive territory. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

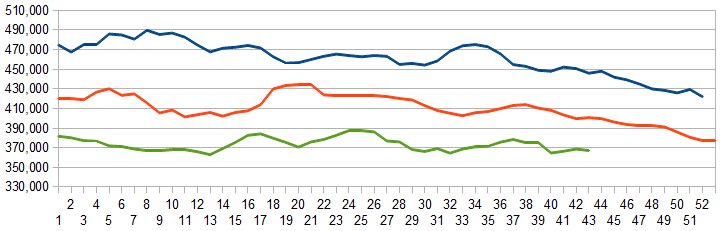

Initial unemployment claims fell slightly – from 369,000 (reported last week) to 363,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here). The real gauge – the 4 week moving average – also declined slightly from 368,000 (reported last week) to 367,250. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2010 (blue line), 2011 (red line), 2012 (green line)

Data released this week which contained economically intuitive components(forward looking) were:

- Rail movements (where the economic intuitive components indicate a moderatelyslightly expanding economy).

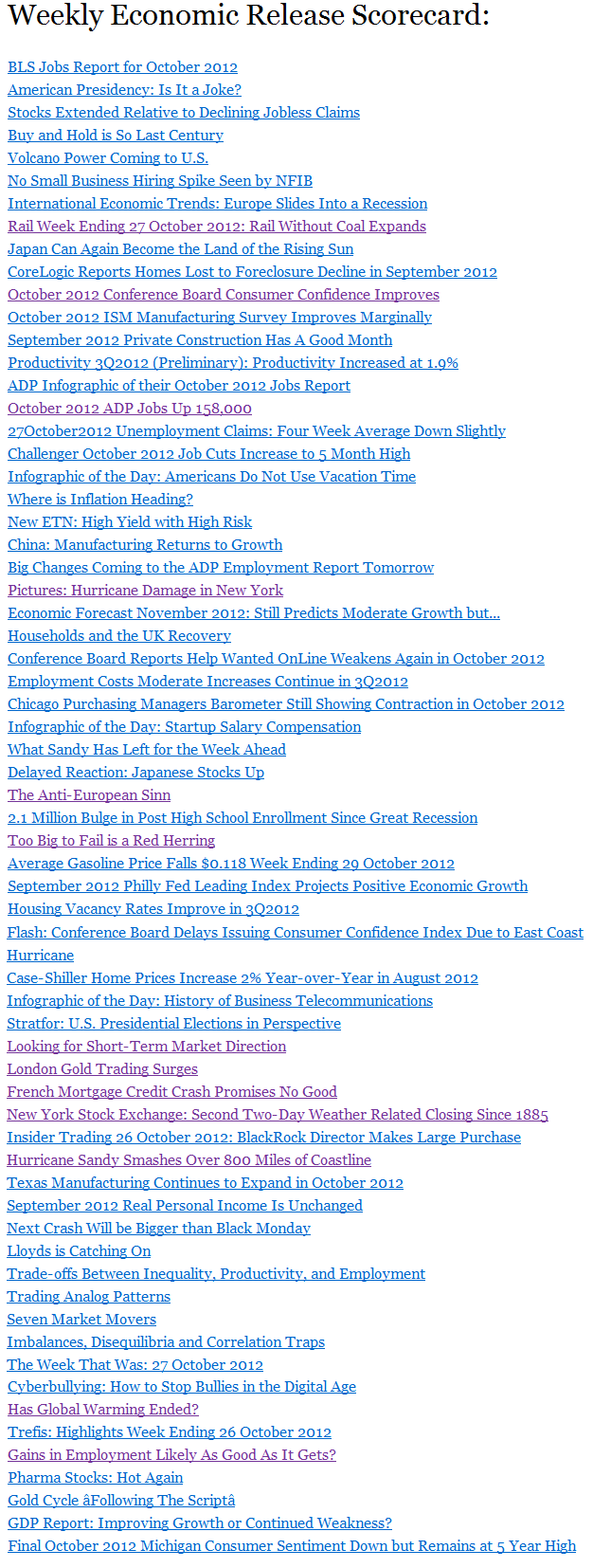

Click here to view the scorecard table below with active hyperlinks.

Bankruptcies this Week: First Place Financial, Bionovo