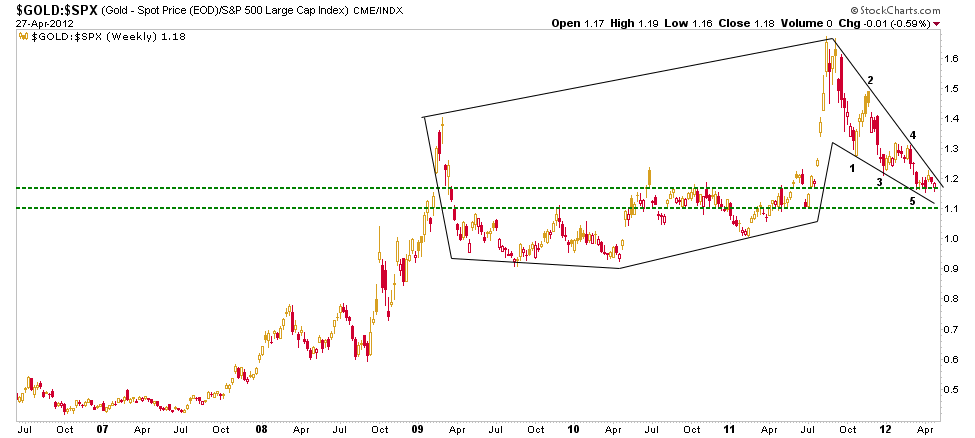

Saving the best for last, behold the Au-SPX ratio and its Cup (3 years in the making) & Handle (conveniently, a Falling Wedge with 5 distinct waves that people who count such things might like to see). A 5th wave could still be in the making down to 1.1, but this is a really bullish structure and I am not afraid to say so.

The Cup & Handle in AU-SPX could be viewed as another take on the Au-TYX ‘gold vs. human hopes for prosperity’ angle noted earlier. Stock market players do not tend to like gold stocks during phases where gold underperforms broad equities. Now, that beautiful and bullish looking Wedge has managed to destroy gold stock sentiment and get at least one notable trend following analyst to call US equities over gold. Fine sir, but that looks like a terrible risk vs. reward proposition to me.

Isn’t it funny that a segment titled ‘Transitioning to the Macro’ ends up coming back to the gold stock sector again and again? Here I will remind you that NFTRH is not a gold stock newsletter. What it is is a newsletter with a particular view of the macro economic backdrop from which it extrapolates investment themes. The gold stock sector will eventually benefit from the chronic economic contraction now in progress. But it will do so on the market’s terms and in the market’s time.

While we are snipping, here is another clip from the 'Wrap Up' segment of #185:

Finally, I want to again bring up a point made recently. In the wake of the euro crisis, a macro picture was painted of the US whereby its short-term interest rates were manipulated to rise in relation to its long-term rates. This was Goldilocks, the best of all worlds with an economic bounce and few signs of inflationary pressure. But we noted that here in an election year as the current administration and its enablers prepare to do what is needed for reelection, the economy may appear firm and stock markets may well remain bullish on balance. But at some point the bullishness could include those items cast out of the initial macro painting; namely precious metals and commodities.

The move in Copper last week could be an indication that a phase is beginning that would see any coming strength in ‘inflationary 2012’ as being more honest, scrapping the Goldilocks fairy tale, with a growing inflationary component.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Gold Stocks Vs. SPX Ratio

Published 05/02/2012, 09:13 AM

Updated 07/09/2023, 06:31 AM

The Gold Stocks Vs. SPX Ratio

NFTRH185 transitioned from an intensive breakdown of a developing bullish case for gold stocks into a more broad discussion, 'Transitioning to the Macro' from which this brief extract is clipped:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.