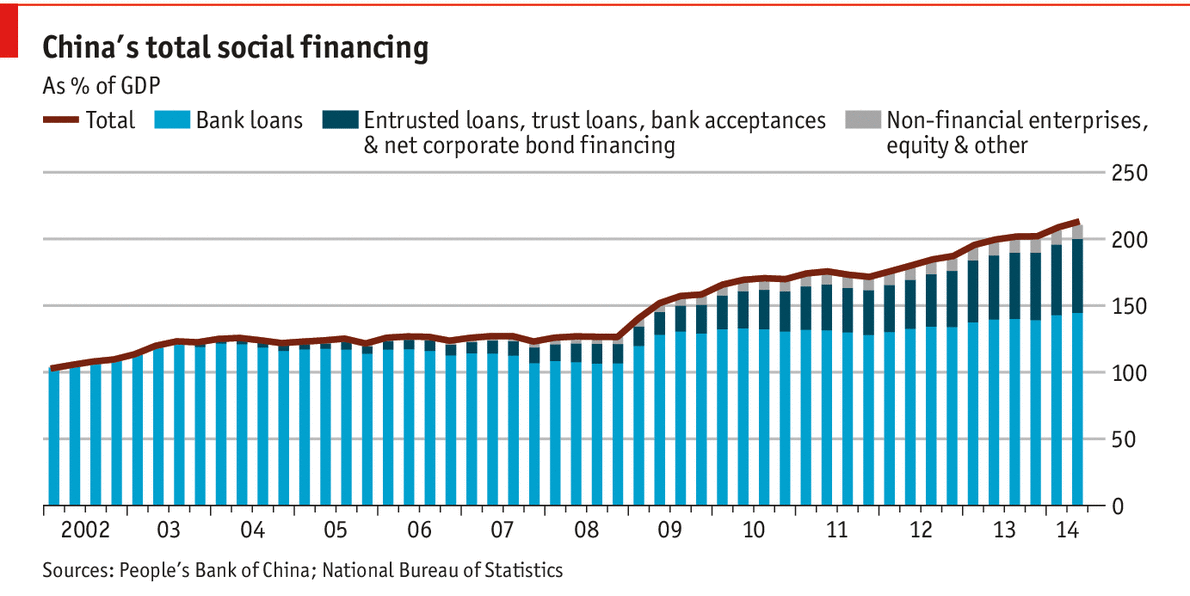

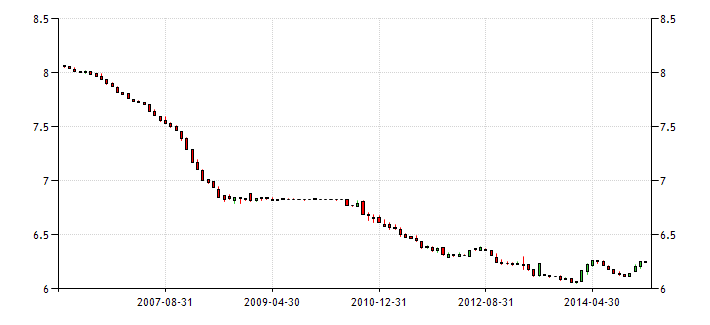

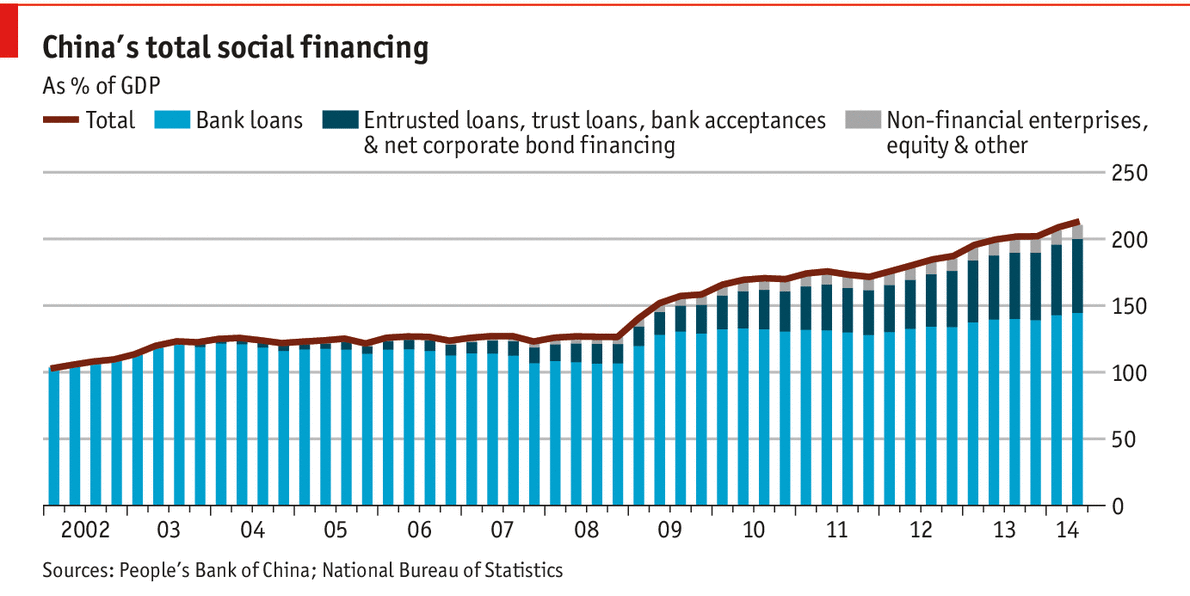

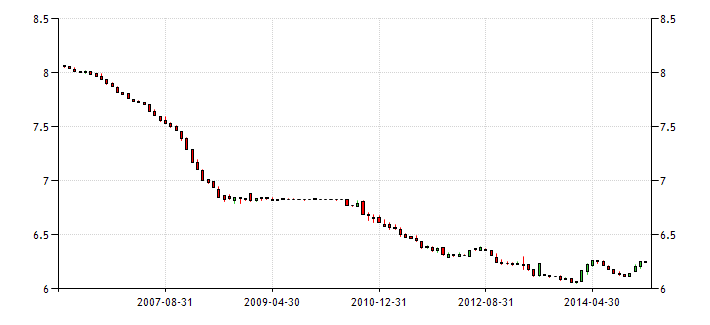

Favorable terms of trade and eager investment in manufacturing and real estate has propelled Chinese growth in recent years. Now, a high debt burden from overinvestment, rising manufacturing costs, and an appreciating currency are signs of stress on this successful growth model.

|

| Source: The Economist |

|

| Source: Trading Economics |

|

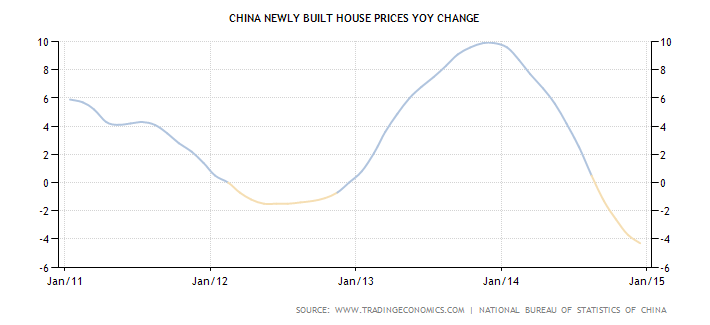

| Source: Trading Economics |

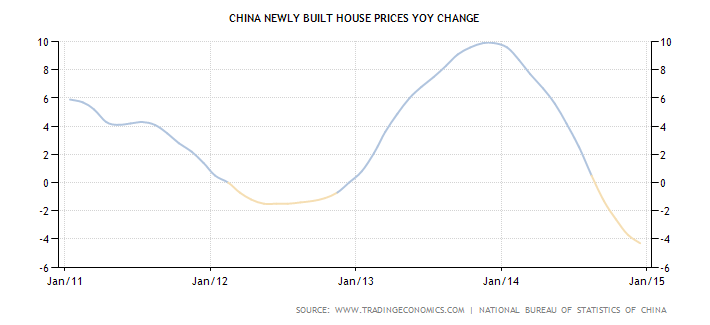

This stress appeared in troublingly low GDP last month due to weakness in both real estate and manufacturing markets.

|

| Source: Trading Economics |

|

| Source: Trading Economics |

|

| Source: Trading Economics |

Aside from a 30% YoY jump in FDI last month, we have seen large capital outflows from China and slowing foreign direct investment over a longer period. Reuters highlights two important considerations for why there be more to January's numbers than meets the eye:

But analysts cautioned about reading too much into economic indicators for January alone, given the strong seasonal distortions caused by the timing of the Lunar New Year holidays, which began on Jan. 31 last year but start on Feb. 19 this year.

…

Earlier data showed FDI in China rose just 1.7 percent in 2014, the slackest pace since 2012. The weak performance underscored a cooling economy which is spurring more Chinese firms to plow money into assets overseas in a trend that is soon set to overtake inbound investment.

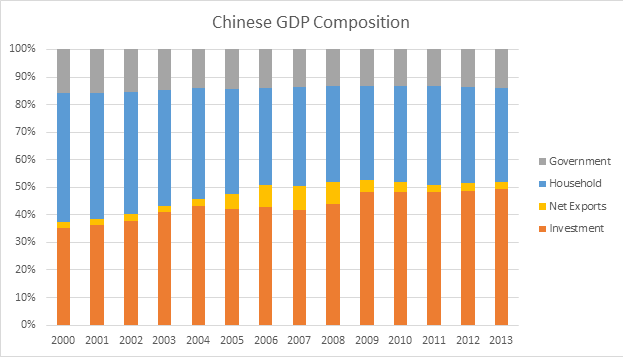

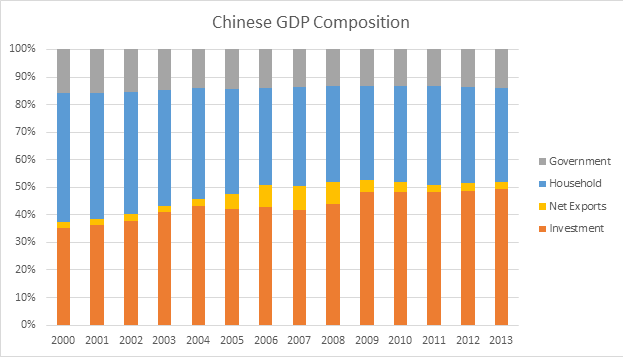

In reaction to poor economic news and large capital outflows, the PBoC lowered banks’ reserve requirement ratios (RRR) by 50 basis points on February 4th and has framed recent poor numbers in the context of development growing pains. The government assures that China will experience a soft landing during the economy's transition from export and investment-driven growth to internal consumer-driven growth. Now the question remains as to whether China will effectively encourage private consumption and service sector expansion before their old growth model runs out of steam. Though the World Bank has only posted GDP data through 2013, we don’t quite see this transition of household consumption replacing investment and exports quite yet:

|

| Source: World Bank |

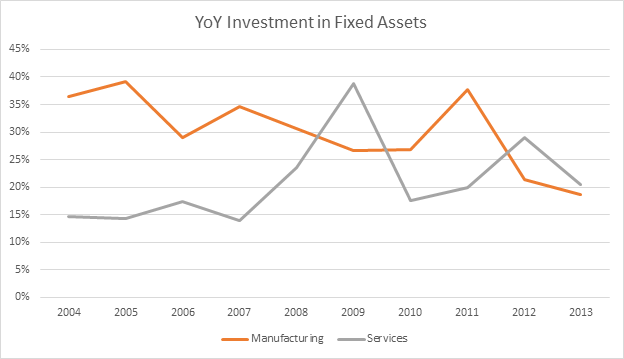

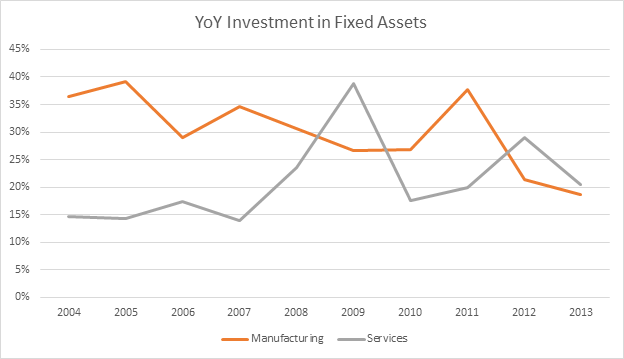

On the production side, we should expect a shift from low-end manufacturing to services. There is evidence that services is growing faster than manufacturing:

|

| Source: National Bureau of Statistics of China |

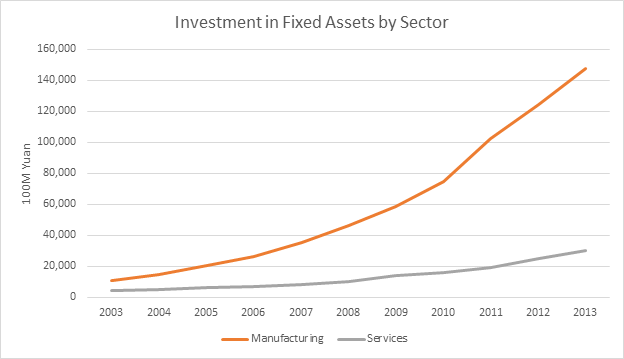

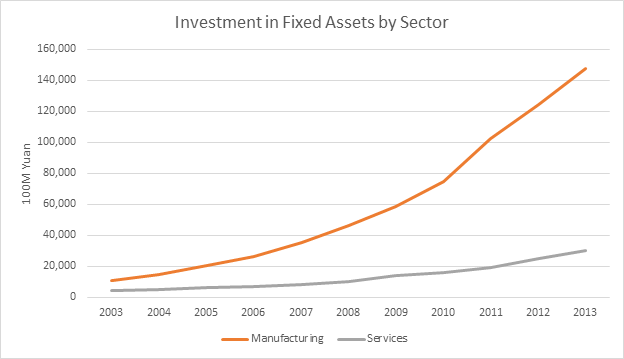

Yet services have quite a way to go:

|

| Source: National Bureau of Statistics of China |

China must rely on careful monetary and fiscal policy to prevent the gap between growth models from causing a hard landing. David Dollar at the IMF did a great job over the summer outlining China’s long-term reform agenda including infrastructure investment, financial liberalization, and opening up China’s service sector to competition. Now, we must see whether China advances with these reforms or falls back to debt-driven investment in manufacturing and real estate.