Background

At the end of August, as UK “Blue Chips” re-tested May’s 14-year highs, I held firm to the view that UK equities were fundamentally cheap.

I saw no harm in shifting from European stocks to further increase market exposure to the London market. There was even a case for lightening up in the US in favour of the UK.

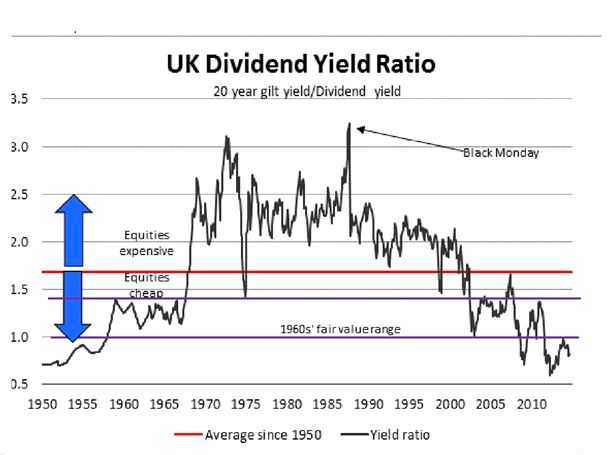

The rationale was as follows: in anything other than a deeply deflationary environment, it made no sense for investors to be continuing to value the income on gilts. The main market is one of fixed income. In contrast, the income available on the UK stock market was open to potential growth.

I saw that a dividend yield ratio — defined as the yield on 20-year gilts divided by the dividend yield on UK equities as a whole — of less than one was far too low and that it was destined to rise significantly over the next 12-18 months.

So now that we are almost a month further down the learning curve, UK equities have fallen collectively by approximately 2%. Does this imply that my analysis was wrong?

I do not think so, even though investors have reacted negatively to the news of an alleged accounting irregularity at Tesco (LONDON:TSCO). However, if one will just step back for a moment overall, the macroeconomic news flow has remained generally supportive of UK equities. Consequently, if one concurred that UK equities were cheap at the end of August, they’re even cheaper now.

Chart: ONS, Financial Times

Of course, nothing is ever certain and the one issue that could unsettle our view would be a sudden and unexplained decline in the rate of growth in the quantity of money. In the absence of any additional asset purchases since October 2012, the M4X annual growth rate stood at around 4% in July. This is not an issue we need to see as extraordinary, especially when compared and contrasted with the period leading up to the Great Recession. The growth of M4X is consistent with a sustained trend or at most moderately higher growth.

I have seen the data that suggests that, in the UK, net bank lending is starting to recover. Yes, I accept this is coming from low levels but that does underpin monetary growth.

The bull phase in UK equities therefore has significantly further to run.

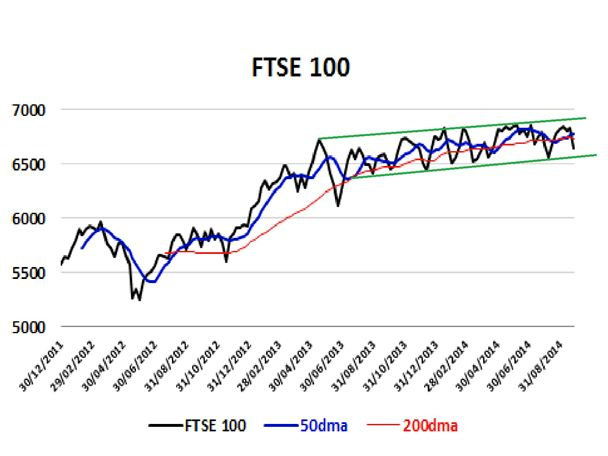

Source: Financial Times, Spotlight Ideas

Management And Risk:

Parameters:

- Entry: Long FTSE at 6642.80.

- Targets: To market the direction 6661, then…6829…7000…7100.

- Stop: 6580…just under where spot breaks the lower limit on the channel.

- Time horizon: Strategic trade.

-- Edited by Kevin McIndoe

Stephen Pope is managing partner at Spotlight Ideas.