The FOMC’s failure to deliver on its first step towards normalization of monetary policy surprised many market participants and other observers. Despite improving GDP growth prospects and improvements in labor market conditions, the Committee chose to delay acting. Chair Yellen provided some clarity at the ensuing press conference to the Committee’s reasoning by emphasizing what she had been saying all along: that the Committee wants to see additional improvement in labor market conditions and more progress towards its inflation objective.

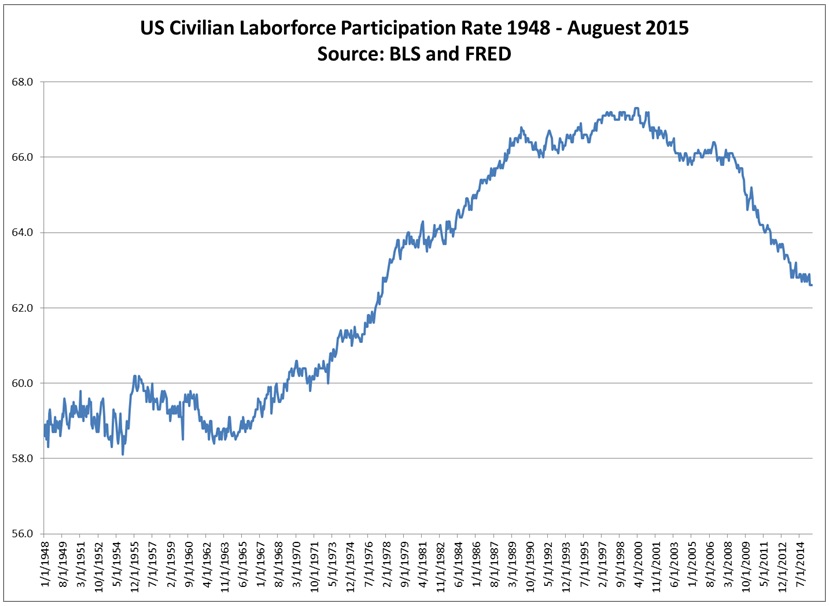

But here is where it got confusing. She noted the impacts that the appreciation of the dollar and slowdown in economies abroad were having, but she declined to indicate how important those factors were in tipping the committee towards inaction. At the same time, she emphasized that the Committee’s projections were not significantly different from last June’s, and she tended to discount the recent pullback in inflation numbers as being transitory. Chair Yellen pointed to the Committee’s expectation that inflation next year will move significantly back towards its two percent objective. So if little has changed and the inflation projections are on track, what more does the Committee need to see? On this point, she fell back on the need to see more improvement in labor market conditions, pointing specifically to the desire to see a further drop in the U-6 measure of unemployment and reversal of the recent decline in the participation rate. On this latter point she did make a slip that no one in the press conference picked up on. She said the participation rate had fallen below its recent trend. Well, as the chart below shows, the participation rate has been declining ever since it peaked in 2000 at 67.3%. So it is not clear what trend line Chair Yellen was referencing.

Furthermore, we don’t even know what a reasonable participation rate target should be. The chart obviously gives no clue as to what the equilibrium rate should be, and there is no guidance from other countries. Additionally, while the Great Recession clearly had an impact on the participation rate, other demographic factors are now coming into play to push it down, such as the aging of the US population and changing preferences for leisure vs.work in the population.

Additional confusion has now been introduced by the September “Summary of Economic Projections.” As Chair Yellen indicated, there has been a slight downtick in the median projections for GDP growth in 2016 and 2017, some further improvement expected in unemployment from 2015 through 2017 (to a rate below the Committee’s long-run estimate), and a slight downward revision in projected inflation. All of these differences are at most one to two tenths of a percentage point. At the same time, confidence in the forecasts has declined, as evidenced by a general widening of both the measure of the central tendency and the forecast range.

But the really interesting information is reflected in the so-called dot chart. First, all but 4 participants are clearly leaning towards a rate increase in 2015, with 7 seeing one increase in the range of 25-50 basis points. Another six have the federal funds range even higher by the end of 2015. So this would seemingly put both the FOMC meetings at end of October and middle of December in play for a rate hike. This looks to be inconsistent with Thursday’s overly cautious no-change decision, given the modest revisions in the forecasts. Second, moving to 2016, the dots imply several policy moves are envisioned, and this too appears inconsistent with Chair Yellen’s and Vice Chairman Fishers’s recent emphasis that further moves would be gradual and patient. Again, the dots also suggest a more aggressive path than implied by the Committee’s very benign and modest projections for GDP growth and lack of progress on the Committee’s inflation objective. Third, there is the striking position taken by one participant who indicated that the appropriate funds rate should actually be negative and kept there through 2016.

The questions are where this position came from did and who is advocating it? Certainly, such a negative rate assumption is out of character for longer serving FOMC participants who have solidly supported the zero interest rate policy and not hinted at even the possibility of pursuing a negative rate policy in their recent speeches. A negative policy rate is also inconsistent with the SEP forecasts. Assuming the negative funds rate was proposed by the participant with the most pessimistic set of forecasts, the lowest GDP forecast was 1.7% for 2015, 2.1% for 2016, 1.9% for 2017 and 1.6% for 2018. Similarly, the most pessimistic forecast for unemployment was no higher than5.3%, and that was in 2018. Those projected outcomes are not significantly different from what others were envisioning. The only area where there appeared to be cause for such pessimism was in the lower bound on the inflation forecast, but that never fell below 1.5 % beyond 2015. When questioned about the negative rate proposal at her press conference, Chair Yellen brushed it off with a smile, saying that it never got serious consideration or discussion. One commentator suggested that the proposal might be seen as a symbolic protest from a likely non-voting FOMC participant. But to my knowledge such a protest has never happened at any time since the SEPs have been prepared. It is one thing to make a policy suggestion at the FOMC meeting, but the forecasts are prepared in advance, so putting such a stake in the ground before even hearing the views of other participants is really pushing the boundaries of collegiality and the way that the FOMC normally does business.

So how can one sum up what we now know about policy preferences? Chair Yellen seems to be laser focused on the employment situation, consumer spending and the committee’s inflation objective. We don’t know much about the others. The current situation and how the FOMC teased markets with the idea that September was actually on the table and then reneging reminds us of a group of kids standing on the diving board trying to get up courage to take their first plunge. President Lacker, by virtue of his dissent, has already jumped. Most members are still standing on the board but have taken an hesitant step back. A few are still nervously on the ladder, while one has already retreated to the baby pool.

At Cumberland, we have argued that the data and situation in the US would have clearly warranted a move on Thursday. A rate increase would have sent the message that the economy is on track. We believe that a return to normalcy has fewer risks to the economy than perpetuating the continued uncertainty for markets and investors about when the normalization process will begin. It now remains a total guessing game in terms of what the FOMC will do and when. Words like “substantial improvement in the labor force” or “when we are confident that we will achieve our inflation objectives” are merely placeholders and not useful information.