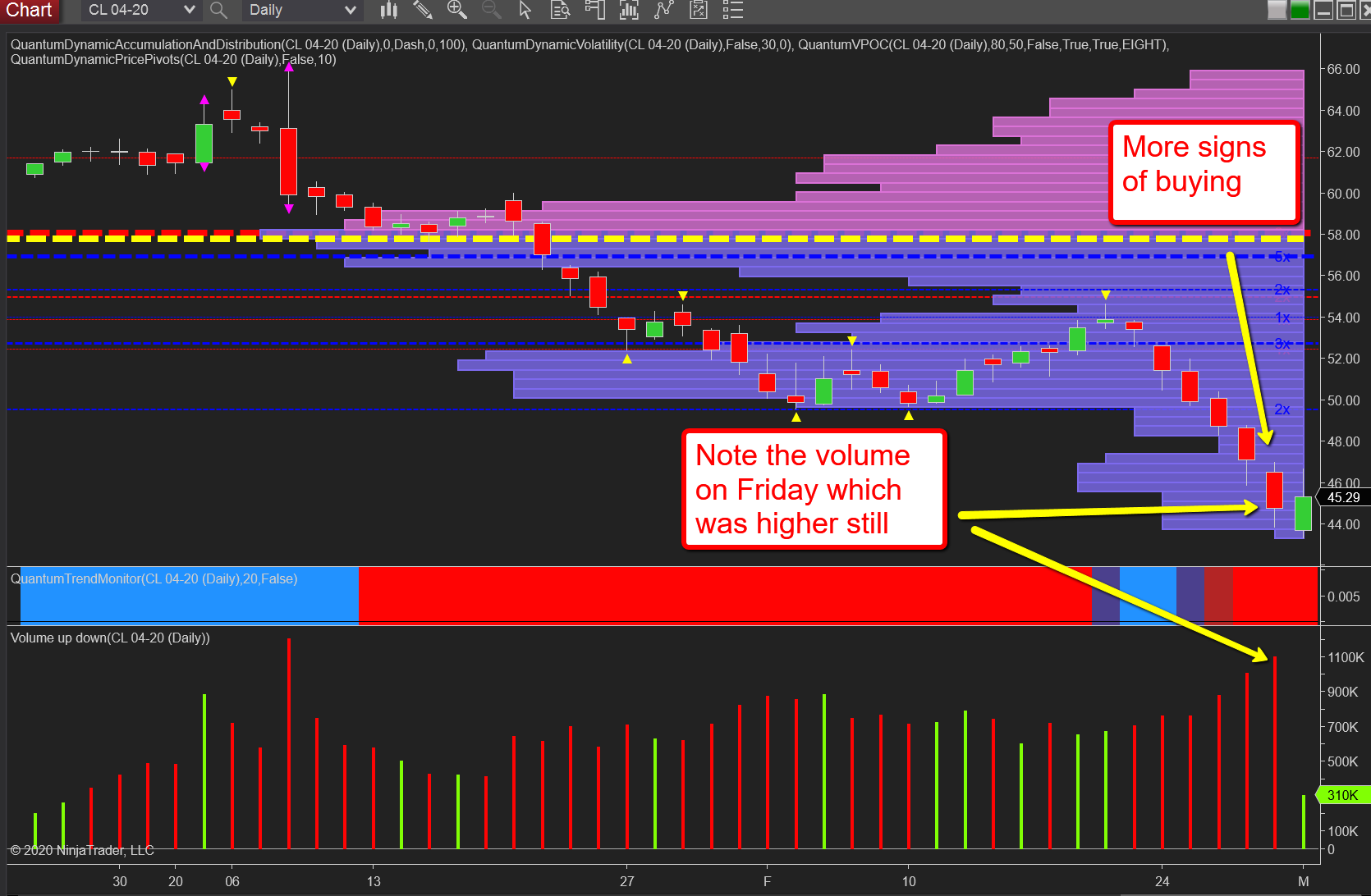

I highlighted stopping volume on the daily chart for WTI in last week’s analysis, and Friday’s price action provided further evidence of this as this market attempts to rally, along with several others.

As I pointed out last week, a move that has momentum, which is normally the case in a sustained move lower, bringing such a move to a standstill and then reversing, requires a huge amount of effort as the market has momentum.

And like a large tanker, when the engines are switched off, it will continue on for several miles thereafter before coming to a stop. It is the same here, and on Friday we saw a further bout of buying. Not how we have higher volume than on Thursday, and as such we should expect to see a much wider spread down candle.

We have not. The candle is much the same size and with a wick below, so we can conclude this is further ‘mopping up’ volume.

However, this market like several others at present continue to look fragile and weak and will take time to calm, but the first signs are developing. Over the next few days and weeks expect to see a congestion phase develop, with further mopping up of selling pressure before a longer-term reversal and rally higher develops.