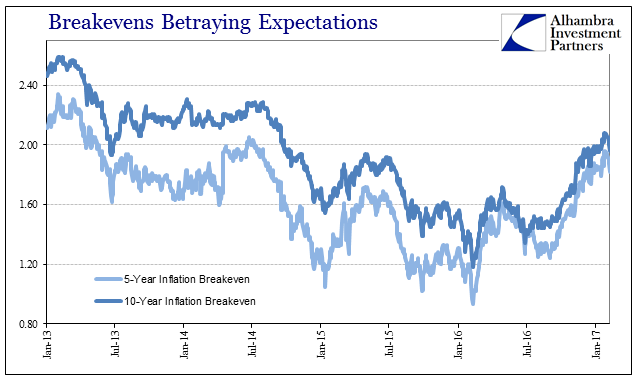

With several parts of the “reflation” trade rolling over, it is worth noting that one of the last of them to join in what may be growing reconsideration or doubt is inflation breakevens. In the 5-year and 10-year maturities, breakevens were at their lowest point on February 9, 2016, and have been moving higher ever since. However, we have to consider and separate short and intermediate prospects from those of the long run. The 5s can be thought of as more related to the level of current and near-future “demand” whereas the 10s are thought a reflection of anchored expectations.

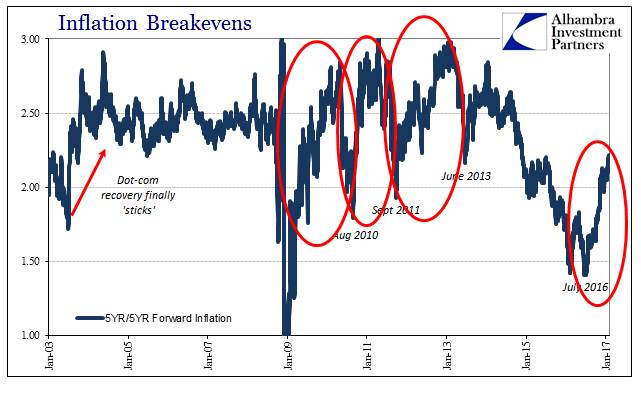

Monetary policy places a great deal of emphasis, then, upon the relationship between the two maturities. Ideally, while the perceptions of the economy may sway the shorter stuff, that should not disturb the longer run anchor. Therefore, where that is the case, what matters is not the level of these two breakeven rates but the distance or spread between the them. This is usually measured and interpreted by the 5-year/5-year forward inflation rate.

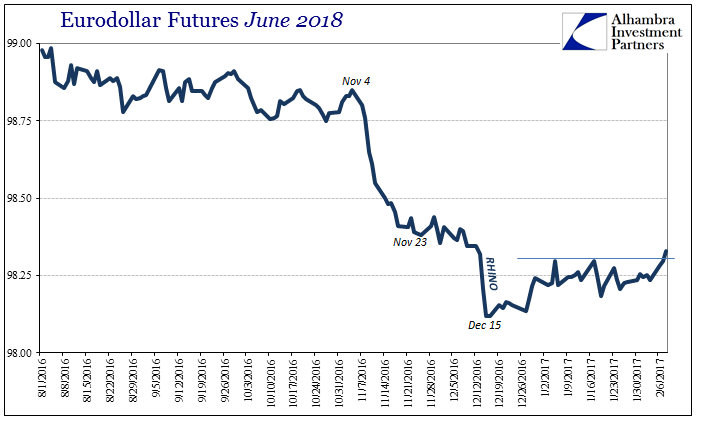

Though the absolute level of breakevens was rising for both after February 9, the spread continued to narrow in concert with the shrinking of the UST curve and eurodollar futures curve. It meant that oil prices were rising, a fact that TIPS trading would have to respect, but that the market didn’t interpret that rise as anything different from the “global turmoil” prospects of depression that had existed before it. Since around early July and the BoJ “helicopter” rumors, the 10s have risen slightly faster and more than the 5s as credit markets gained a sense of “reflation” and the prospects for a longer run return toward normalcy; not all the way, but a less pessimistic scenario for where inflation, and thus economy, may anchor as its new reduced potential.

The forward rate shows that despite the current rebound it has merely brought the indicated long run rate back up to around where it was at prior points of doubt and crisis; such was the dispiriting nature of the “rising dollar’s” effects on expectations and outlooks. This current retracement is as of yet also not quite as large or sustained as the prior three indicated above, suggesting, again, that what might be traded is not normalcy ahead but the possibility for perhaps a more “comfortable” continuing depression.

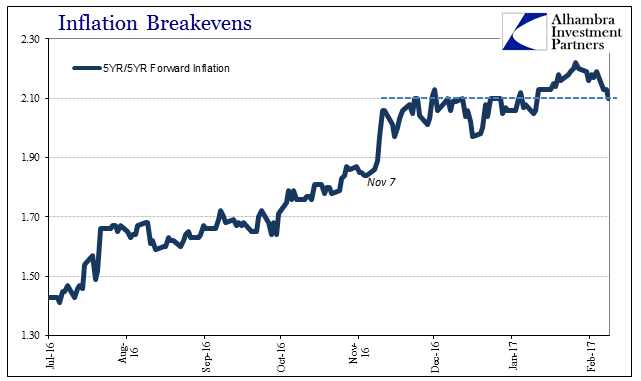

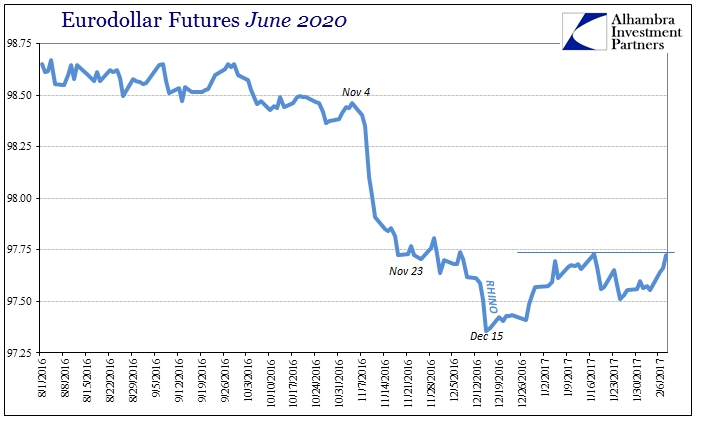

In the past few weeks, however, breakevens and the 5-year/5-year forward rate have encountered their first serious and sustained reversal; having moved back to a level that prevailed throughout the global bond rout and immediately after it. With JPY, eurodollar futures, and UST yields all facing much the same challenge as to recent resistance, it appears as if “reflation” itself is undergoing its first major and broad-based challenge.

In many ways, the so far plateau in breakevens is related to the same in oil prices, as overall inflation is primarily determined by them. The inability of oil to break out is going to have downstream effects on not just what that might mean for short and intermediate prospects, but also considerations about “reflation” as a whole and the long run. As I wrote last week with regard to gasoline as the marginal determinant for the whole energy picture:

Refineries are essentially inviting energy flow to gasoline in anticipation that consumers will buy it, and buy a lot of it (given the record high starting point of inventory). Like the rest of “reflation”, however, that remains all in the future rather than as current reality. And so, like the near-recession conditions of last year, all that gasoline goes into storage awaiting either the expected robust economic rebound, or the “unexpected” if regular disappointment and all the adjustments that must follow, including much less oil being diverted from current storage into gasoline refineries and inventory.

What that means is that at some point this all has to become more than just a possibility. Like gasoline, someone somewhere had better start buying it up and in huge quantities or else markets will rightly and quickly lose faith in what will be judged as yet another false dawn. It is a microcosm of the economy as a whole, and for more than just the US. Economic stats at the end of last year were clearly better than when the year began, but that isn’t actually a meaningful difference in and of itself. All it might propose is that it could be the start of something better, but to be more than a start someone has to actually start buying, investing (not in stocks), and producing like it.

When “reflation” first started, I suggested that economic stats wouldn’t matter because to proponents and in these market settings it was all about the future; the current economy was unrelated to it except as a basis for where real recovery might start. At some point, however, the balance must shift, where actual conditions will matter more and more as confirmation about hope vs. reality. We might be nearing that point. If “reflation” is predicated upon “different”, there better be at some point be different.

To that end, so far not so much. It stands to reason, then, the formation and hedging of doubts, even if smaller ones at first. It doesn’t necessarily mean the end of renewed hope, but maybe its first stage toward being more grounded than purely euphoric sentiment. The first reality check of the Trump era.