I have a hard time believing that the FOMC members actually believe what comes out of their mouths.

Follow up:

What follows is testimony from Federal Reserve Chair Janet Yellen to Congress earlier this month followed by my view of the reality of the economic situation.

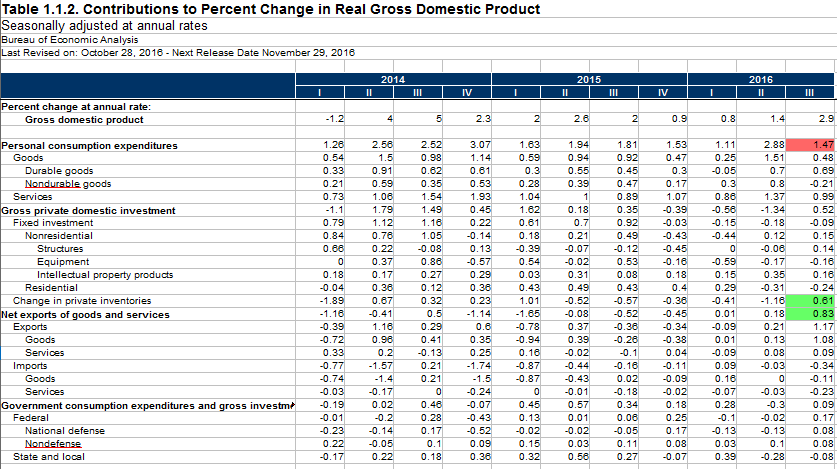

Meanwhile, U.S. economic growth appears to have picked up from its subdued pace earlier this year. After rising at an annual rate of just 1 percent in the first half of this year, inflation-adjusted gross domestic product is estimated to have increased nearly 3 percent in the third quarter. In part, the pickup reflected some rebuilding of inventories and a surge in soybean exports.

Inventories are historically high (and in recession territory) based on business inventory to sales ratios. There has been recently an improvement in the inventory to sales ratios but "rebuilding of inventories" which are historically high a negative economic event.

In addition, consumer spending has continued to post moderate gains, supported by solid growth in real disposable income, upbeat consumer confidence, low borrowing rates, and the ongoing effects of earlier increases in household wealth.

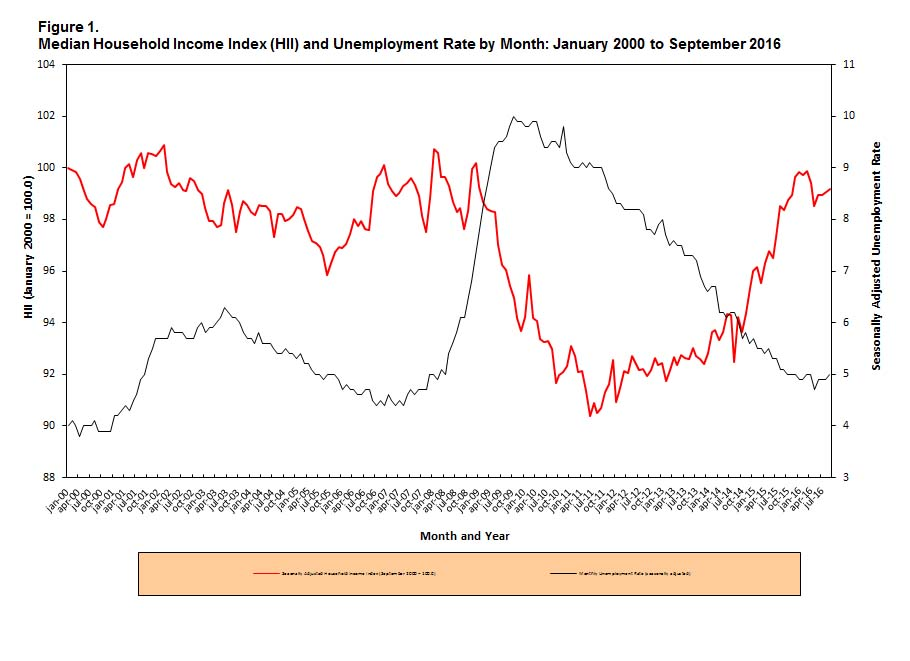

What continues to aggravate - is talking about real income instead of real median income. Since 2000, increases in real income means the upper end of the economy is doing better. From Sentier Research:

The Federal Reserve seems overly focused on GDP, which is not necessarily representative of average Joe in the USA. In 3Q2016 - GDP has demonstrated that the consumer was NOT contributing to the rise in GDP - but was because of inventory change (where inventory builds add to GDP) and a change in the trade balance.

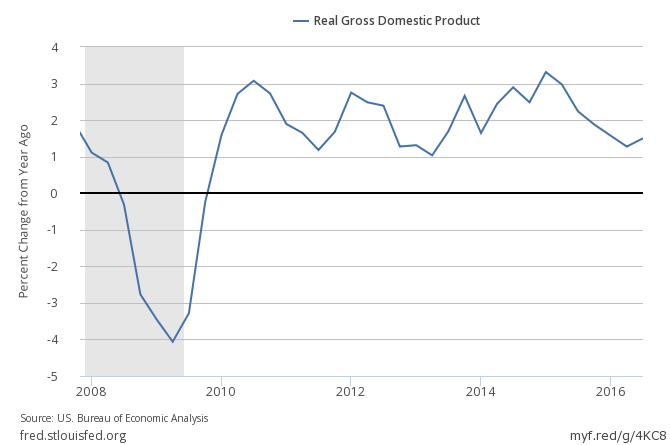

And even pretending GDP was representative of the average Joe - the headline view of "improvement" is false if one looks at year-over-year improvement.

Real GDP Expressed As Year-over-Year Change

By contrast, business investment has remained relatively soft, in part because of the drag on outlays for drilling and mining structures that has resulted from earlier declines in oil prices. Manufacturing output continues to be restrained by the weakness in economic growth abroad and by the appreciation in the U.S. dollar over the past two years. And while new housing construction has been subdued in recent quarters despite rising prices, the underlying fundamentals--including a lean stock of homes for sale, an improving labor market, and the low level of mortgage rates--are favorable for a pickup.

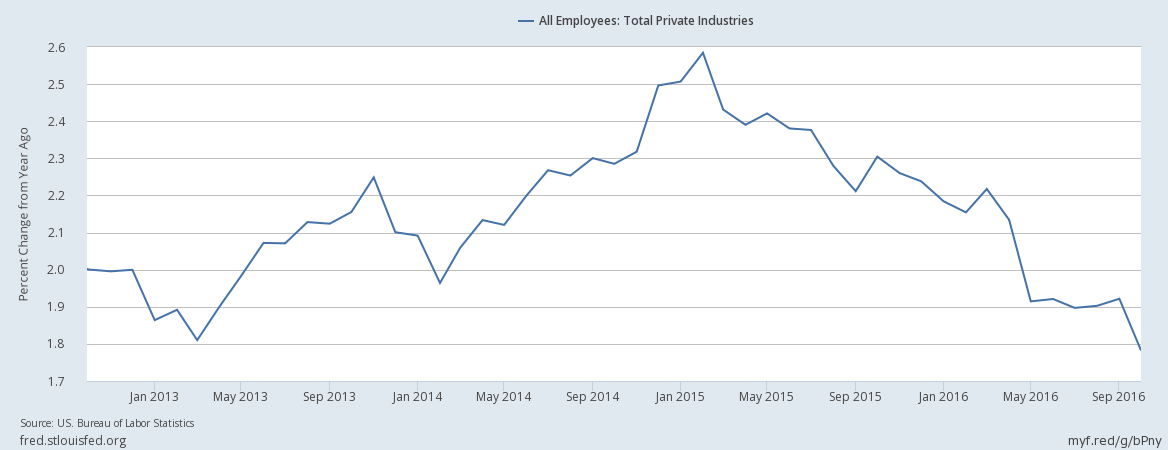

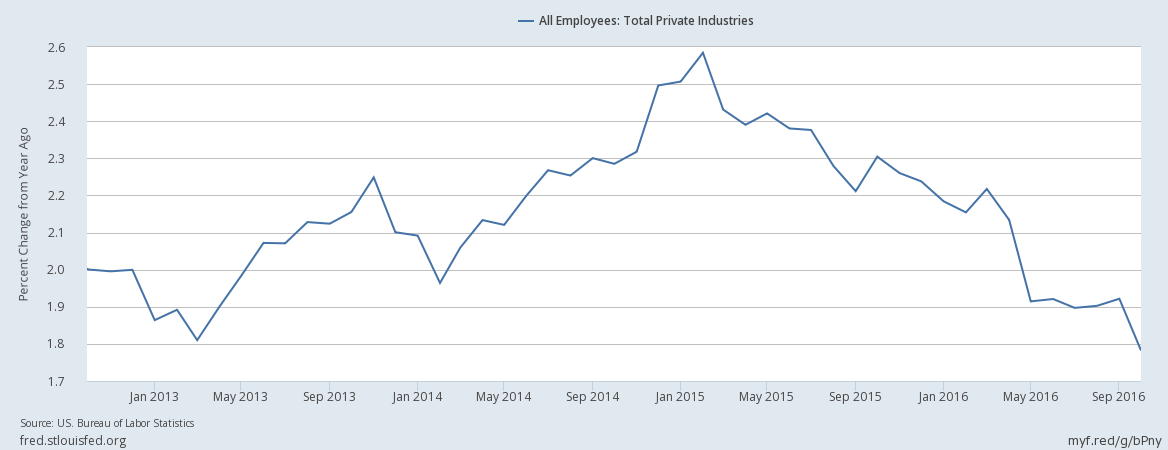

The labor market is improving, but the rate of improvement has been slowing since the beginning of 2015 - and is now at the lowest level of growth since mid-2011.

Overall View

I cannot imagine a Federal Reserve member saying the economy was about to fall into the toilet. They are spinning the economy to support an increase in the federal funds rate - and they are in this box because they keep providing "forward guidance" where rate increases will be "data dependent". So the data needs to seem to be improving to support a "data dependent" rate increase.

I do support a federal funds rate increase - but NOT because the economy is improving.

Other Economic News this Week:

The Econintersect Economic Index for November 2016 declined with the economic outlook remaining weak. The index remains near the lowest value since the end of the Great Recession. Some sectors of the economy continue to give recession warning flags. Six-month employment growth forecast indicates minor slowing in the rate of growth.

Weekly Economic Release Scorecard: