Investing.com’s stocks of the week

Yesterday morning’s economic news proved to be rather bland, all very close to expectations. Nonetheless, they confirmed the robustness of the U.S. economy though there remains some doubt with regard to core inflation.

The same applies to the Dutch legislative elections: no surprises. According to exit polls, the far-right party could easily gain 4 seats–ending up with a total of 19–but is far behind its liberal rival that is expected to obtain 31. We should see a confirmation of this over the next few days.

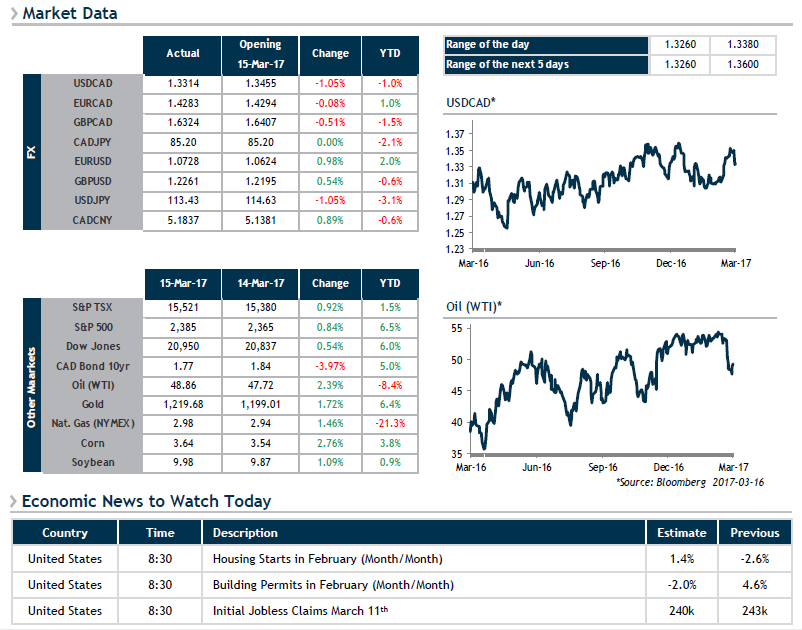

On the other hand, the Fed’s announcement spiced things up for the currency market, maybe even a little too much. Ms. Yellen stuck with her game plan, raising the key rate yesterday, with two more hikes expected in 2017 and 3 in 2018. Has the Fed succeeded in achieving a dovish hike? This rate increase was accompanied by a neutral statement, almost unchanged from the previous one. With a market that was possibly expecting three additional rate hikes in 2017, the U.S. currency had a brutal fall, maybe too much. We know that the Fed and the Trump administration would prefer that the USD not climb excessively, but will they be able to stop its climb?