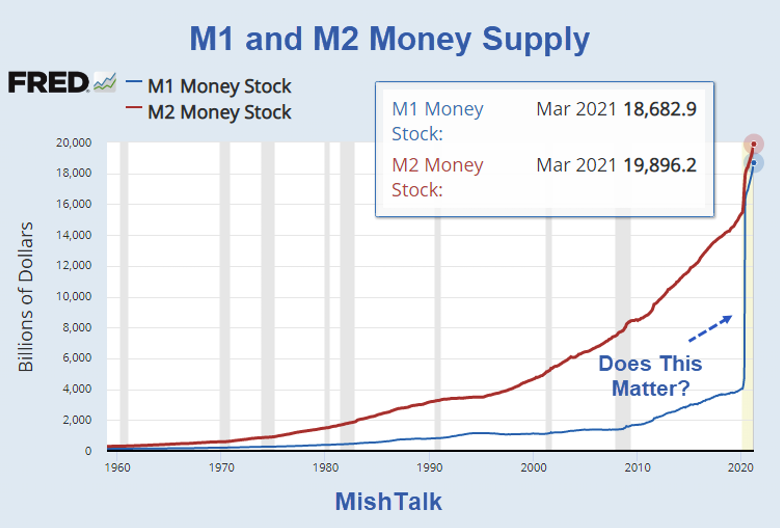

The Fed stopped updating both M1 and M2 weekly reports. What's going on?

The Definition of Monthly

When the Fed stopped weekly reporting of money supply numbers I told a friend "they still report monthly".

Yesterday, I pulled the latest numbers and I noted we need a new definition of monthly. The reports were nearly two months old.

I updated the chart just now and the data is now just a month old.

Here is the new schedule of Money Stock Measures.

"These data are released on the fourth Tuesday of every month, generally at 1:00 p.m. Publication may be shifted to the next business day when the regular publication date falls on a federal holiday."

Two Month Lag

The Fed reports "monthly" data of numbers that it actually knows instantaneously, with a 1 to 2 month lag.

Changing Definitions

In addition to changing the frequency of reporting, the Fed changed the Definition of M1.

Seasonally adjusted M1 is constructed by summing currency, demand deposits, and OCDs (before May 2020) or other liquid deposits (beginning May 2020), each seasonally adjusted separately.

OCDs are Other Checkable Deposits. Other liquid deposits includes OCDs as well as money market deposit accounts.

What's the Fed Hiding?

Steve Hanke, Professor of Applied Economics at Johns Hopkins University discusses the setup.

Key Quotes

- Before we get started let me remind you of President Bill Clinton's maxim: 'It's the economy stupid.' My maxim is 'It's the money supply stupid.'

- The reason is, money supply determines the course of nominal GDP. And nominal GDP includes real growth and the inflation rate.

- Chairman Powell has very explicitly claimed that money doesn't matter in recent testimony. He's basically said that money and the measurement of money doesn't really matter because it's unrelated to inflation.

- In principle, they don't think [this data] is important. They want to deep-six the monetarists, basically and push them off to the sidelines. They want to bury Milton Friedman once and for all and be done with it, and their preference would probably to not report any monetary statistics.

Hello Fed, Inflation is Rampant and Obvious

Yesterday I commented Higher Prices at the Grocery Store as Ag Futures Surge the Most in 8 Years

More importantly, year-over-year home prices are up 11.2%, some cities even more. The Fed does not see this or count it if they do.

The problem for the Fed is bubbles burst, and this set is the biggest yet. Expanding bubbles constitute inflation. Popping is the reverse.

With nearly everyone looking for stronger inflation and higher bond yields please consider The Fed Wants to Stimulate Bank Lending, Charts Show the Fed Failed.

Something has to give.