The Federal Reserve raised its policy rate range 25bp to 4.5%-4.75% and indicated it isn’t finished yet. With the economy losing momentum, the jobs market showing tentative signs of cooling, and inflation on a downward path, we expect one final 25bp hike in March. Recessionary forces will then make the case for rate cuts later in the year.

Fed keeps hiking despite positive signs of inflation

No surprises from the Federal Reserve with them opting for a 25bp hike with no dissenters. They do acknowledge that "inflation has eased somewhat", but they can't claim victory yet since inflation "remains elevated" in an environment where "job gains have been robust". As a result, they maintain the line that "ongoing increases in the target range will be appropriate".

So as expected, we get a smaller incremental increase after December’s 50bp move and the four consecutive 75bp moves before that. The wording “ongoing increases” implies they have at least two further hikes in their minds, with Fed Chair Powell talking about the possibility of "a couple more" interest rate hikes before policy is sufficiently restrictive in his mind. We have our doubts that this will be achieved and continue to look for just one 25bp rate hike in March with a pause after that.

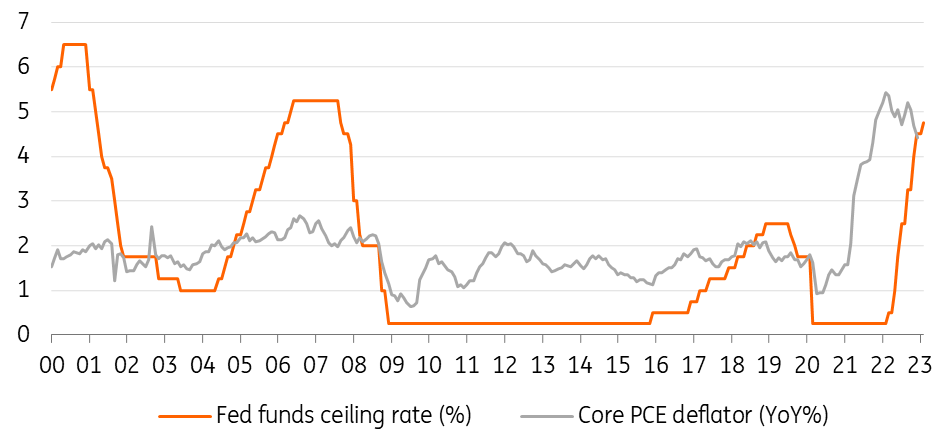

The fed funds rate is finally above the core rate of inflation

Source: Macrobond, ING

One more and done

The real policy rate has finally turned positive - both the ceiling and the lower band of the Fed funds target rate range are above core inflation for the first time since 2019, which is a key metric the Fed had hoped to achieve. At the same time, the economy continues to lose momentum and we suspect inflation will fall quickly from here, on a topping out of housing rents, lower car prices, and a decline in corporate pricing power. The jobs market remains the area of strength that worries the Fed, but we doubt this can remain as strong as it is in the face of spreading corporate gloom and weakening activity.

A May pause with cuts from September

By the time of the next FOMC meeting on Mar. 22, we will have had two further jobs reports and two CPI reports. We expect CPI to be running at 5.7% by then (versus 6.5% currently) with core inflation at 5.1% (5.7% currently) at that point. The big falls are expected through 2Q. Jobs growth will be slowing but will still be positive. It should be enough to go for a final 25bp hike, but we doubt they will continue to say “ongoing increases” at that point and will instead switch to a data dependency stance without committing to a pause.

The subsequent meeting is May 3rd, and by that point, we think the Fed will have enough evidence to call the top in rates and pause. Over the past 50 years, the average period of time between the last rate hike in a cycle and the first rate cut is six months, which would point to September as being a “live” meeting for the first rate cut. By then, we think the recessionary forces will be building with inflation in the region of 3%, which will give the justification needed for the first cut.

Treasury market impact

The market is now clear that a March hike is on. That keeps the rate hiking pressure in the mindset over most of the rest of Q1. And the ECB will add to that tune.

While “over-hiking” can be good for the long end, this is also a higher carry cost associated with higher front-end rates, and that’s a bond negative in a static state market. In other words, if you are long bonds and yields don’t fall, you’re in a negative mark-to-market position. That’s a partial argument for further compensatory upward pressure on market rates.

The other argument comes from the shape of the curve, which remains remarkably inverted. In fact, it’s unprecedented (at least in the past four decades) for long-tenor market rates to be this far through the fed funds rate, specifically while the Fed is still hiking.

The other rates have also been raised by the same amount, the full 25bp. That goes for the reverse repo facility (4.55%), the permanent repo facility (4.75%), and the rate on excess reserves (4.65%). This is all broadly as expected. And no special mention of the bond roll-off, which continues as was.

There is no reference to outright bond selling either, but hard to believe this is not ever discussed; it’s just that it tends not to make the minutes (if it is chatted on behind the scenes).

Little pushback from Fed leaves the dollar offered and carry trade in demand

It seems the neutral FOMC statement and the news conference have seen the Fed avoiding offering much of a pushback against conviction expectations of a peak in the Fed Funds rate in March and a subsequent 50bp easing cycle through the second half of this year. Indeed, markets have priced an extra 10bp of easing this year. That leaves the core, early-year trend of a weaker dollar and firming activity currencies intact.

EUR/USD can now press 1.10 in Europe, although stretched-long euro positioning, especially from the asset management community, may see EUR/USD struggling to sustain gains above that benchmark.

No surprises from the Fed also see volatility continuing to fall. New lows in the MOVE US Treasury volatility index typically see a spillover into the FX volatility space. True, we have sizeable event risks coming up in the form of the ECB/BoE meetings and Friday’s US jobs report. But assuming these can be negotiated without any nasty surprises – e.g., a strong jobs number or higher average earnings – lower volatility looks the trend into March.

Lower US rates volatility will encourage more interest in the FX carry trade – where investors very much focus on risk-adjusted returns. Continuing to score positively here should be the Mexican peso, where FX option adjusted returns are 50% higher than for those in Latam’s other higher yielder, the Brazilian real. Assuming Banxico hikes another 25bp next week in line with the Fed, Mexico’s real interest rates will move further into positive territory, and USD/MXN should head down to the 18.50 area.

Disclaimer: This publication has been prepared by ING solely for information purposes, irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more