Most likely, this was the last Fed hike of this tightening cycle.

Even before the press conference, the omission of the key sentence ‘’some additional policy firming may be warranted’’ from the statement release was a clear signal.

Moreover, the statement about what comes next was eerily similar to the one used in June 2006 when the Fed paused its hiking cycle for 13 months.

At this point, the base case is that Powell feels he is done: after raising rates by 500 bps in 15 months and considering the ongoing Quantitative Tightening on top, wouldn’t you feel like pausing, too?

Sitting with rates at 5% and watching how ‘‘The cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments’’ play out is exactly what the Fed wants to do here.

But after months spent underestimating how hot and persistent inflation would be, what gives the Fed enough confidence that 5% Fed Funds are restrictive enough to sit and watch how they cool inflation off?

History.

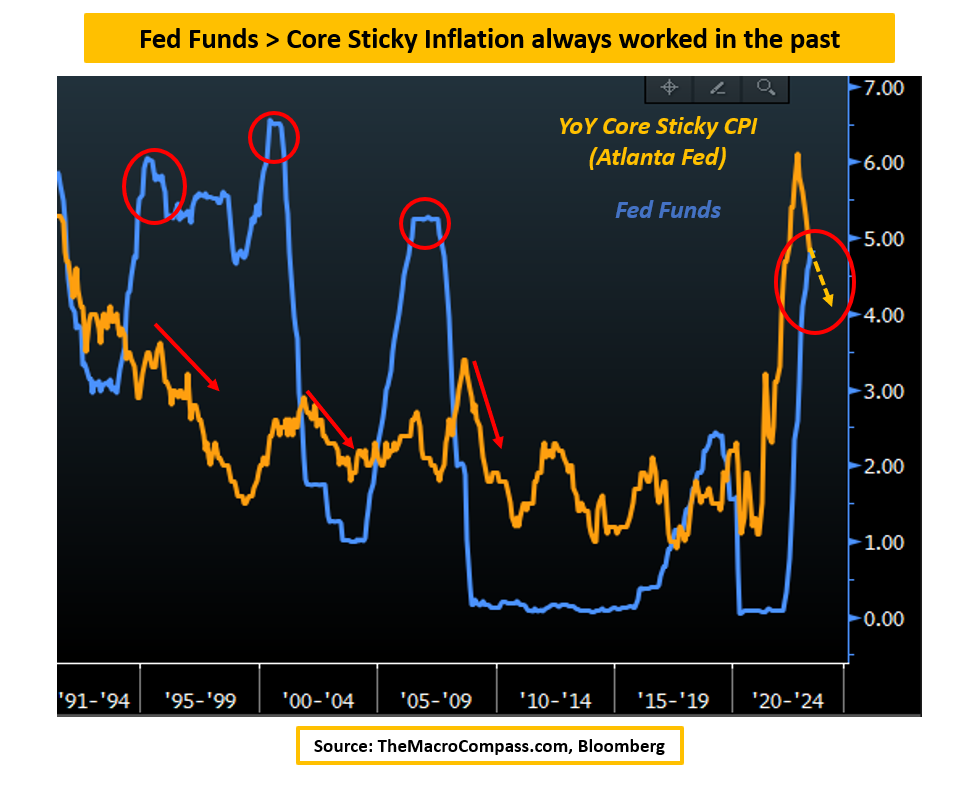

Over the last 30+ years, every time Fed Funds (blue) were raised above the levels of core sticky inflation (orange), policy turned out to be restrictive enough to cool inflationary pressures back to 2% or below.

By summer, core sticky inflation should be trending in the 4% annualized area while Fed Funds will be sitting at 5% - and history suggests that means the Fed has tightened enough.

Now the real questions are: how long does a pause last, how did markets historically perform in this period, and how are they likely to perform this time?

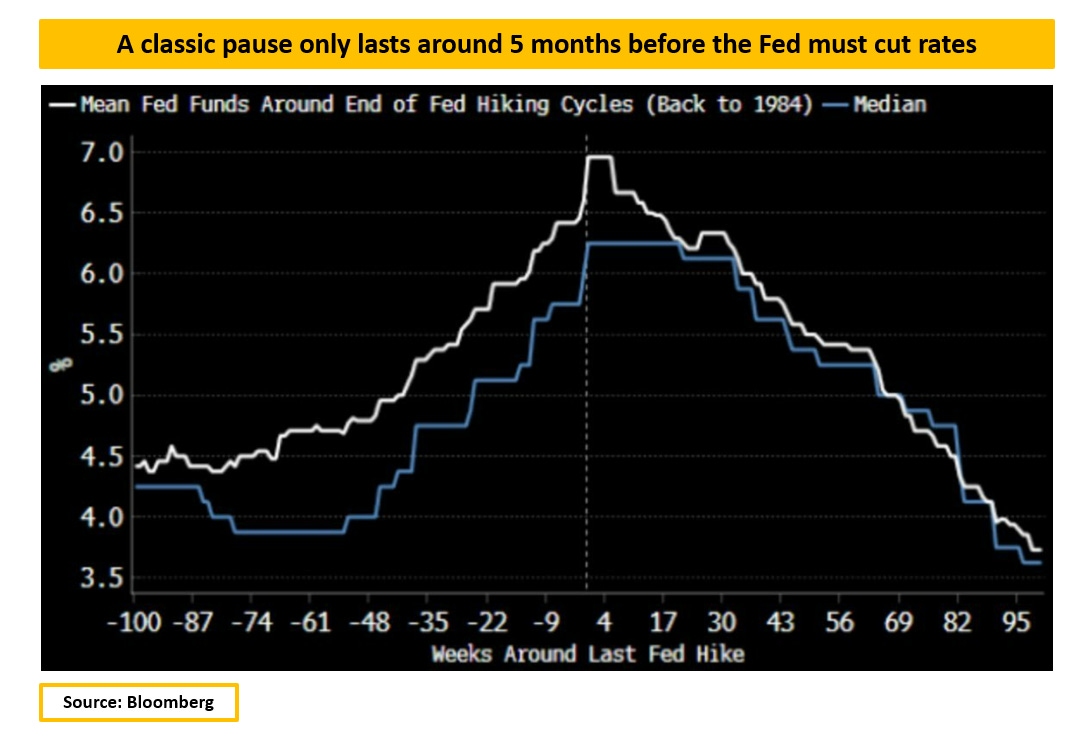

This excellent chart shows how the median Fed pause at the peak of the hiking cycle lasts only for about 5 months, and it is followed by pretty marked easing cycles.

The dispersion around the duration of these pauses is big: in the 80s, we could only pause for a month, while in 2000 or 2018, we paused for 7-8 months before seeing Fed cuts.

Back in the summer of 2006, the pause was as long as 15 months, and it led us to the Great Financial Crisis.

This time, the bar for the Fed to both raise and cut interest rates is very high.

As Powell himself said, 5% Fed Funds plus ongoing QT are an undoubtedly restrictive policy tool, and if you sum up the banking stress and tighter credit conditions, you are looking at quite the cocktail.

Why would you volunteer to tighten even further unless really forced to?

On the other hand, until inflation trends back to 2%, you are obliged to look through the various alarm bells: banking stress, credit tightening, and housing market dysfunctionalities – the hurdle to cut rates is very high, too.

Which brings us to markets: if this pause is going to last for a while, what should we expect?

In a nutshell: something to break.

***

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.