This article was written exclusively for Investing.com

On Wednesday, July 28, the Federal Reserve left monetary policy unchanged. The bank indicated that the economy was beginning to progress towards the goals it said would result in a change of policy, but noted that much more was needed. However, we expect that when the time comes, the Fed will likely need to act much more aggressively than anticipated.

During the press conference, it became crystal clear what is holding the Fed back is employment. The latest economic data would support the idea that inflation is running above trend, and Jay Powell indicated that inflation was above the Fed's 2% target. The Fed has noted many times it would like to see a string of solid job reports. Thinking about this implication and taking it one step further, the Fed seems to be so confident in its view that inflation rates will come back down to its target that it is willing to gamble on inflation while waiting for employment.

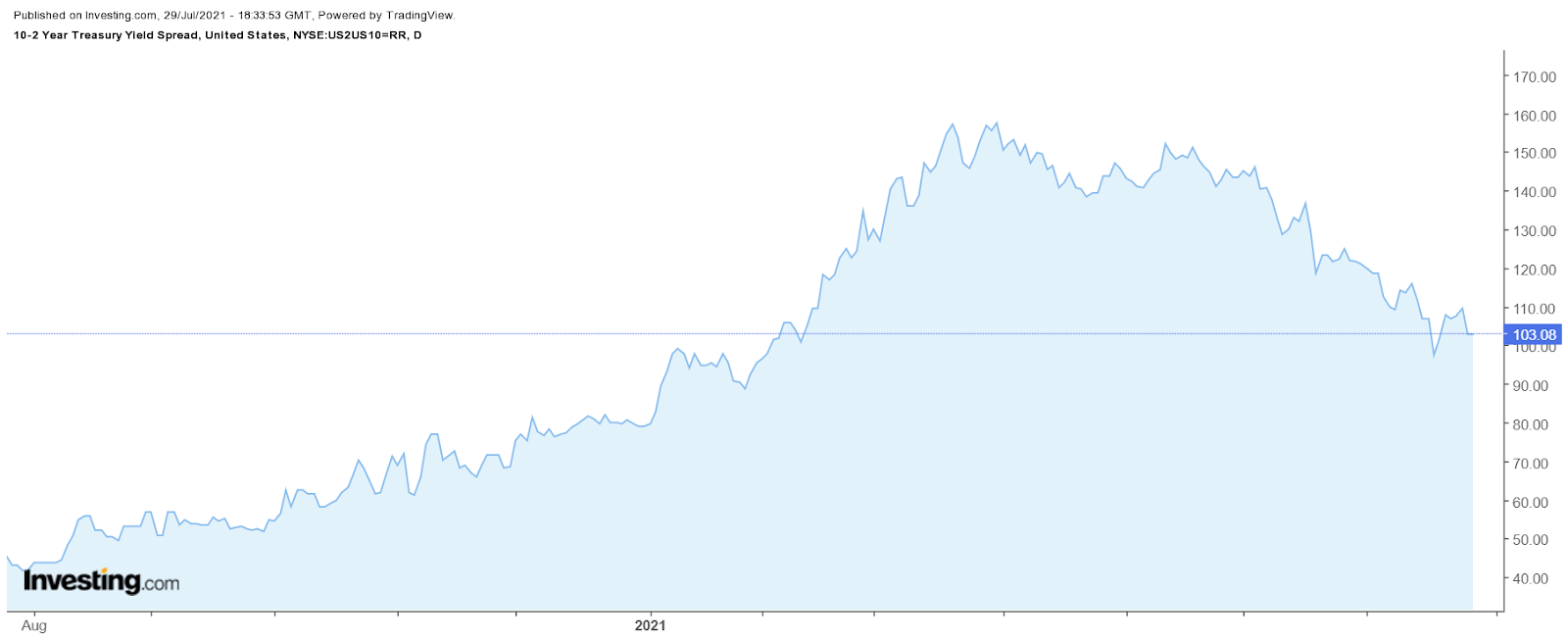

Since the June meeting, the bond market has seemed nervous, and that nervousness appears to have been reaffirmed following the July FOMC meeting. The reaction of long-term rates moving lower in recent weeks and short-term rates rising has flattened the yield curve dramatically. As we know that flattening of the curve is a cue that the bond market is projecting slower economic growth in the future.

More interesting, though, by the Fed waiting on the employment component of its dual mandate there is a risk that inflation rates will move up even more. The bond market appears to be taking the stance that the Fed may need to act much more aggressively when ending the current monetary policy and switching to a tightening stance, slowing economic growth once the cycle begins.

While it isn't evident just when the Fed will feel that further progress has been made, since there doesn't appear to be an actual target, one can assume that a string of robust employment reports is what will trigger the Fed to embark on this tightening cycle. If that is what the central bank is waiting on, that signal could come as soon as September or October.

Many states have already started to end the extra unemployment benefits in July. By September, the remaining states will have completed the additional programs. If this is the case, then the strong June employment report should carry over into the July report, followed by a strong report in August and September. It would position the Fed with three jobs reports heading into the September meeting and four reports by October. If it is a string of employment reports the Fed wants, Powell should have that string of reports by September or October.

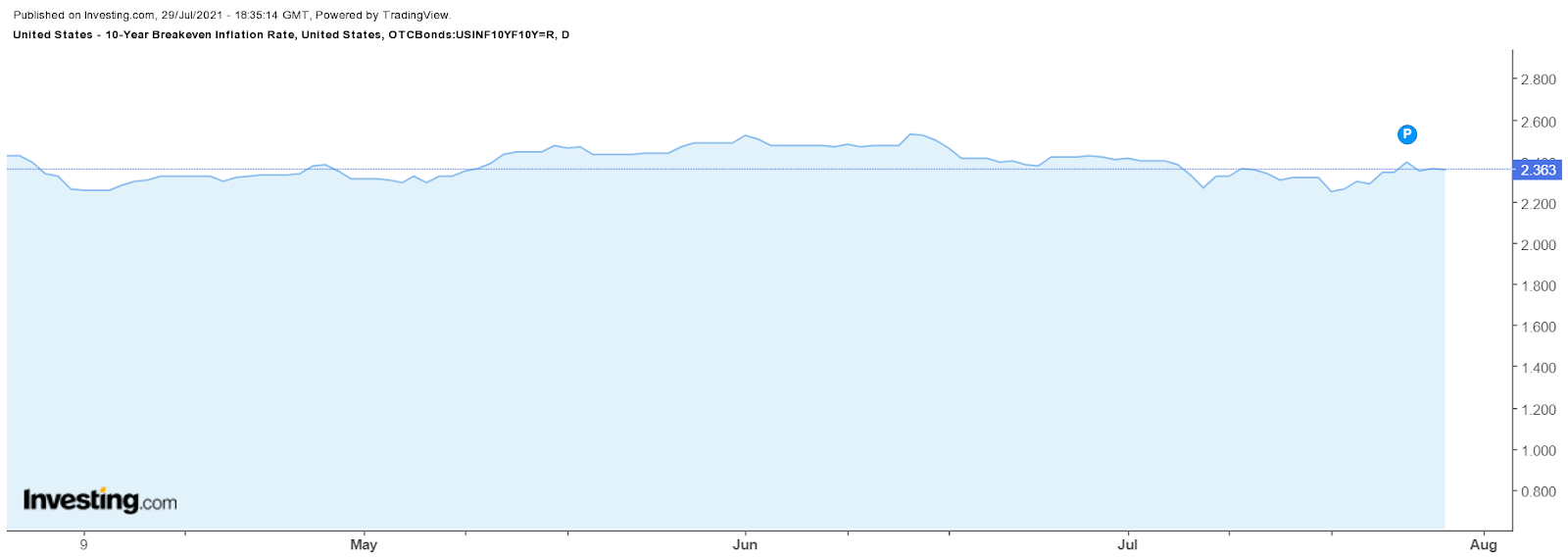

But clearly, the big gamble here is that with the Fed waiting to move on monetary policy and not starting to taper its balance sheet a little bit, it is taking a chance that the inflation rates will move even further away from the 2% target. Currently, 10-year breakeven inflation expectations are around 2.4% and have been well above 2% for some time, while 5-year breakeven inflation rates are even higher, at nearly 2.6%.

If the bond market is correct, economic growth will slow in the future and, by the looks of its sooner than most think. It will be because the Fed is playing catch-up resulting in the much more aggressive monetary policy that could have been avoided had the taper come sooner.