The Federal Reserve FOMC meets next week to review the economy and argue monetary policy. For those who see economic policy as black or white, I have a bridge to sell you.

Low interest rates are economically stimulative – or at least should be. Yet many years into the Fed’s ZIRP (Zero Interest Rate Policy) the economy is still struggling to gain traction--and the Fed’s stated policy is these rates will remain low until late 2014. Can you imagine the economy of the 70′s if ZIRP would have been applied then? ZIRP works well with a certain set of dynamics, but with an existing heavy debt load in both the private and public sectors, the stimulative effects have proven to be weak.

Reading between the lines – the Fed is not seeing economic traction anytime soon. Consider that USA monetary policy is based on gold standard conventions which becomes less and less effective as government debt grows. Further modern day monetary policy for a major currency is effected by leakage and actions by other currencies.

The Fed cannot allow interest rates to raise when:

- the servicing costs of government debt would strangle the economy; or,

- if the government goes on an austerity program, which will contract the economy, and loose monetary policy must prevail to try to mitigate a shrinking economy; or,

- the stalemate in Washington is not allowing long term solutions as the debt continues to grow. Under this circumstance, the Fed must accommodate the lack of leadership for fiscal policy.

In short, the USA is between a rock and a hard place – as it is almost certain that rising interest rates would apply abnormally large brakes on the economy. Realistically, there is little difference between 0% and 0.5%, so politically based monetary policy movements are possible.

Yet, there are too many parallels with Japan (mainly debt plus demographics) to believe the USA can escape economic doldrums without a major shift to a less of a gold standard approach to monetary policy.

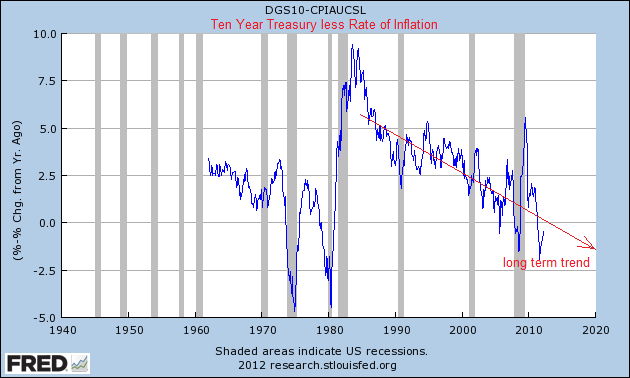

In the meantime, unless you are in the 1% – prepare for a less affluent future. In the olden days (pre-New Normal), your plan for retirement was based on less risky bonds for income and cashing out the old hacienda so that one could make lifestyle decisions. For those already retired, and the boomers – time to look for Plan B as shown on the below chart which shows real return on 10 year Treasuries.

Since 1980, there has been a general downtrend of real yield in bonds. Real yield is inflation adjusted – and the Fed’s approach to monetary policy is to look at core inflation (inflation less food and energy. The younger Asian and South American economies consume a bigger proportion of the global output – food and energy will start driving core inflation.

As long as this trend of growing proportion of non-USA consumption growth remains in play, USA monetary policy will continue to be a less and less effective tool to fight inflation.

Other Economic News this Week:

The Econintersect economic forecast for April 2012 shows a less good growth. There has been a degradation in our government and finished goods pulse points.

ECRI has called a recession. Their data looks ahead at least 6 months and the bottom line for them is that a recession is a certainty. The size and depth is unknown but the recession start has been revised to hit around mid-year 2012.

This week ECRI’s WLI index value declined marginally to 1.2. This ended twelve weeks of index improvement. This index continues to indicate the economy six months from today will be marginally better than today.

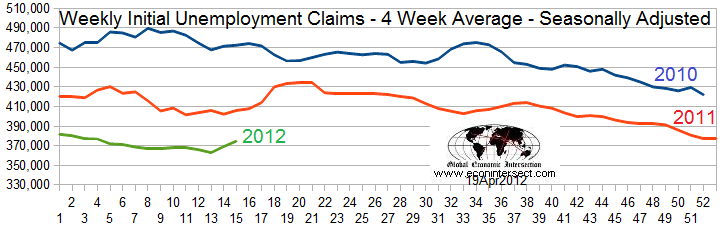

Initial unemployment claims essentially increased from 380,000 (reported last week) to 386,000. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here). The real gauge – the 4 week moving average – rose from 368,500 (reported last week) to 374,750. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Data released this week which contained economically intuitive components (forward looking) were rail movements and the manufacturing portion of Industrial Production . Rail movements are soft even without considering the overall contraction caused by coal, while IP manufacturing softened somewhat, but still remained clearly in expansion territory.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks

Bankruptcies this Week: None