Fed injected another 2.3 trillion into buying bonds including junk.

The Fed has bypassed the Federal Reserve act, which means they can buy whatever they want.

Equity ETFs may be next.

The idea is to aid small and mid-sized businesses as well as state and local governments, according to Powell.

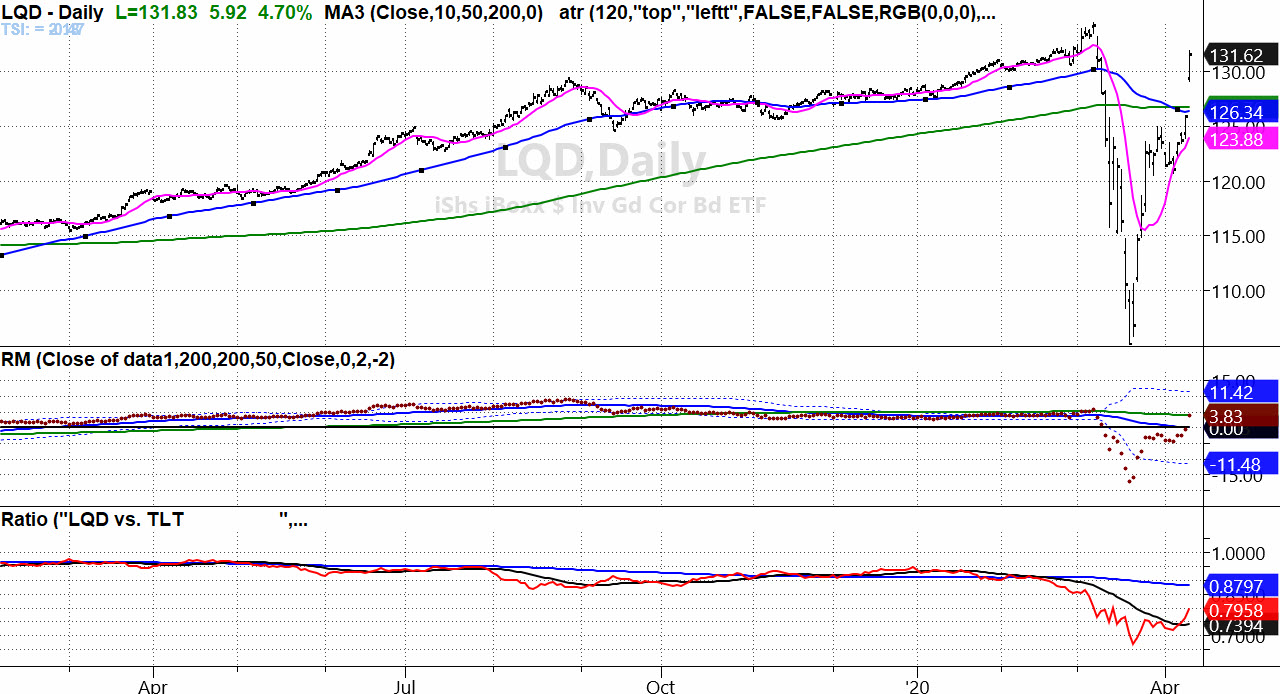

The US investment-grade bond ETF is flooded with money right now.

The total assets have surged nearly 50% in less than 3 weeks to a record 41.6 billion.

Plus, the junk bonds or the lowest investment-grade bonds were bought in a fire-sale to try to prevent what JP Morgan predicts could be $200 billion of debt of the fallen angel companies like Ford, which was downgraded to junk.

Only some of those downgraded companies will qualify for the Fed’s bond-buying program, however. But it does explain the huge surge in junk bonds on Thursday.

We wonder, what happens to those businesses that take loans and then go out of business?

With the Fed injecting trillions into high grade and junk bonds, the market appears to ignore the potential economic damage from the virus.

Can that last?

S&P 500 (NYSE:SPY) 264.50 pivotal, 270 support and a move near 290.45 if gets there-a short (retrace to the MA breakdown)

Russell 2000 (NYSE:IWM)118-120 now pivotal support. 125.80 2018 November low now resistance

Dow (NYSE:DIA) 236.80 the pivotal 200-week moving average to watch.

Nasdaq (NASDAQ:QQQ) If cannot clear 202, looking for a possible short, especially if closes below 199.90

Regional Banks (NYSE:KRE) 35.00 pivotal 40 resistance 32 support

Semiconductors (NYSE:SMH) Relative weakness as 129 now resistance, 123.20 pivotal support and under 122 some trouble

Transportation (NYSE:IYT) 150 resistance 138.50 support

Biotechnology (NASDAQ:IBB) 110-115 range to break

Retail (NYSE:XRT) 30 now support to hold 36-38 big resistance

Volatility Index (NYSE:VXX) 59.01-39.50 range to watch-over 45 suggests more upside, under 40 not so much

Junk Bonds (NYSE:JNK) Rallied right into resistance at 102.40

iShs iBoxx High yield Bonds (NYSE:LQD) 126 now key support-135 resistance