What's going on at the Fed? Notorious dove, Charles Evans of the Chicago Fed, gave a speech in Sweden. In his prepared remarks, he said that he was in no hurry to raise rates:

To give you the punch line, I think the outlook for growth in economic activity and the labor market is good. However, inflation is too low, and it has been too low for the last 6 years. Moreover, my forecast is for inflation to rise at a very gradual pace, reaching our 2 percent objective only in 2018. Based on this forecast, and the risks to the outlook, I think the FOMC should refrain from raising the federal funds rate (our traditional short-term interest rate policy tool) until there is much greater confidence that inflation one or two years ahead will be at our 2 percent target. I see no compelling reason for us to be in a hurry to tighten financial conditions until then.

If it were up to him, he would like raise rates in early 2016 [emphasis added]:

In my view, it likely will not be appropriate to begin raising the fed funds rate until sometime in early 2016. Economic activity appears to be on a solid, sustainable growth path, which, on its own, would support a rate hike soon. However, the weak first-quarter data do give me pause, and I would like to see confirmation that they are indeed a transitory aberration. Furthermore, and most important, inflation is low and is expected to remain low for some time.

Glad we know how you feel, Charles.

Then came the surprise. Reuters reported that he said that a June liftoff was on the table if all the stars were to line up:

Evans, who in his speech argued for rates to start rising in early 2016, told reporters if the FOMC had confidence that inflation was going to move up and that first quarter economic softness was temporary, "you could imagine a case being made for a rate increase in June."

"I think we are going to go meeting-by-meeting to make that decision," Evans, a voter this year on Fed policy and among the most dovish of U.S. central bankers, said after taking part in a panel debate.

WTF! What happened to raising rates in early 2016?

For a confirmed dove like Charles Evans to make a remark like that, he must have been prepped. It is highly likely to have been part of a coordinated Fedspeak campaign to prepare the markets for an interest rate hike - call it the Fed's Magical Mystery Tour, as Fed officials fan out around the globe and trumpet their message. Indeed, the WSJ had reported that John Williams of the San Francisco Fed had warned that a rate hike was on the table at every meeting and they weren't going to telegraph any further guidance. Fed Chair Janet Yellen warned about the risks from excessive equity valuation and to high yield bonds if rates were to rise (see Bulls Shouldn't Be Expecting Help From The Fed).

Fed Presidents like Charles Evans don't speak off the cuff. In an interview after his Fed Chair appointment had expired, Paul Volcker quipped when he went out to dine at a restaurant, he felt compelled to say, "I'll have the steak but that doesn't mean I don't like the chicken or the lobster."

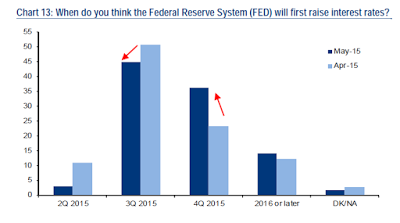

The Fed seems to be trying to nudge the markets to prepare for greater policy tightness and rate normalization. The latest BoAML Fund Manager Survey indicates that the consensus for first liftoff is either 3Q or 4Q, with 3Q being the most likely. My base case scenario therefore calls for a September rate hike, largely because the Fed seems to prefer to guide and nudge markets, rather than to surprise them.

With the SPX at record highs, the market may need further Fed "nudging." Will there be further surprise guidance contained in the FOMC minutes to be released on Wednesday?

Stay tuned!

Disclaimer: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.