The driving force of every stock and market is greed and fear. While many will tell you it is earnings or the economy, it is not. Earnings or lack thereof, just create the human emotion of greed or fear. Greed drives people to invest their hard earned money irrationally and fear causes a mass exodus based on pure emotion.

The best traders and investors in the world use fear and greed to place themselves on the opposite side of the majority. Remember, small investors always lose. They invest too late in a bull market or sell their stocks at the bottom of a collapse, just before the rally. Therefore, being opposite of the investing public is the profitable position when the market is at extremes.

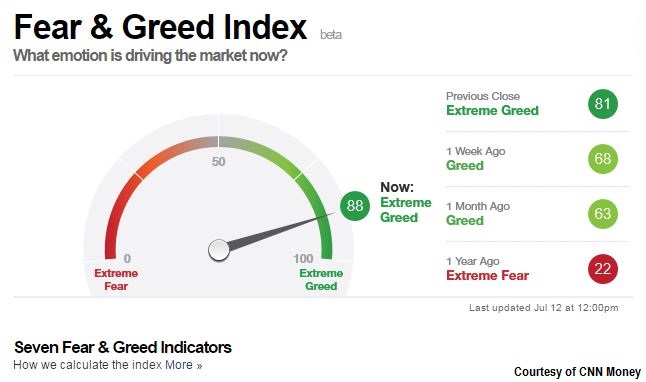

One of the best indicators of fear and greed is the CNN Fear & Greed Index. This indicator takes into account put and call options, junk bond demand, market momentum, stock price strength, stock price breadth, safe haven demand and market volatility. While not perfect, it gives you a good basis for potential reversals in the market (major tops and bottoms). The key is to understand how to read it.

Reading the Fear & Greed Index is simple. For maximum success, only pay attention to readings below 10 (massive fear) or above 90 (massive greed). History has shown us that when this indicator gets to these these extremes, the markets are about to reverse. It is a great tool to have in your tool box and helps take out the emotion created by the hype on Wall Street.

Currently, the CNN Fear & Greed Index is at 88. This tells us the markets are running on greed. However, for a strong sell signal we still want to see it at least touch 90. It may today or tomorrow. That would be the dead on short signal I am waiting for. A reversal/sell off should start within a day or so.