India, one of the star members of the BRIC club, looks to be hitting a fiscal Brick wall. It’s a shame. Indian companies and managements are among the best in the world. But India is being done in by the fatal attraction of populism that is doing in so many richer “advanced” countries.

Indian democracy has proved to be a very resilient institution that has been magnificent achievement in many ways. The modern Republic of India has a “birth history” that was exceedingly violent and disruptive. In 1947, the departing British partitioned what was the Imperial Raj into what are now three countries, viz., India, Pakistan and Bangladesh. The Partition saw the loss of millions of lives and was quite arbitrary as to the division of lands. For example, what is now Pakistan was a core part of the British Raj and the Moghul dynasties which preceded the British.

With such an unhappy beginning, it is amazing that democracy has survived in India. That’s the good news. But it’s also the bad news. Unfortunately, Indian democracy is proving to be incapable of maintaining fiscal discipline or in making sensible public sector investment decisions that foster economic growth.

The Caste System Is the Key to Understanding Indian Democracy

Differences in abilities of various groups can create a major problem for democracies. Low performing groups if they have a sense of a separate identity and a history of grievances will vote for government interventions that are perceived to benefit them rather than subject themselves to the competition of a free market meritocracy where they believe they will be at a disadvantage to historically privileged groups. These low performing groups prefer to try to advance themselves via the government and their elected representatives rather than depending on the market. This situation constitutes a powerful force for populism particularly if the low performing groups form a significant part of the population.

Whereas in homogeneous Japan this is a non-problem, in India this is a huge problem, perhaps a bigger one than that encountered in the racially/ethnically divided United States. In India the big problem is caste and to some extent religion. Although many Indian leaders have sought its abolition, the Indian caste system has been a fundamental part of the Hindu religion and culture. The caste system as it is practiced in India is quite complicated with significant regional differences. The caste system goes back millennia. Until recently anyway the caste system was endogamous, i.e., people did not intermarry out of their own caste. So a sense of caste separateness is a major fact in Indian sociological history.

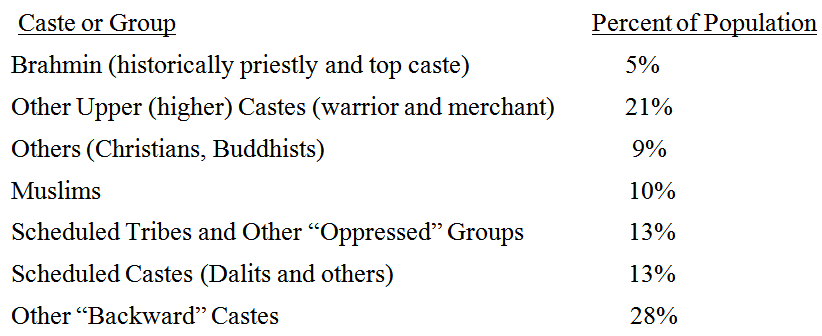

Taken from the Wall Street Journal, the table below presents a simplified breakdown of India by caste and religion:

Indian Caste and Religious Breakdown

As can be seen the Brahmins and Other Upper Castes make up a minority of Indians. Current emigration and demographic trends will further reduce their percentages. Under the British these upper or “higher” castes predominated in the Indian civil service. The Indian independence movement was led by then Brahmin dominated Congress Party. Jawaharlal Nehru, India’s first prime minister, was Brahmin whose family had its origins in Kashmir. Mahatma Gandhi, the preeminent leader of the Indian independence movement, was of the also higher Gujarati merchant class. Although most foreigners are clueless on this subject, most of the brilliant and capable Indians that they encounter abroad and in India are from these favored higher castes.

Since independence, the world of caste has changed in India. While it is true in urban and modern industrial sectors that caste has been breaking down, it is a very powerful force in the political sphere. Indian democracy has made possible the political ascendancy of the lower caste groups including Dalits (formerly called Untouchables) at the expense of higher caste groups, particularly Brahmins. Notably in south India, Brahmins have been on the receiving end of reverse discrimination and in many cases have had to emigrate. Extensive quotas have been put in place favoring lower caste groups in universities and for government jobs. Needless to say, everyone in India who is not in the higher castes wants preferential treatment. This would include India’s roughly 150 million Moslems.

What exists today in India is a government, both at the Union (national) and State levels, that is increasingly run for lower castes and other disadvantaged groups. The private sector on the other hand has managements dominated by upper caste groups. This is not a healthy situation. Strong populist pressures show themselves in the Indian budget.

In India the problem is not unfunded entitlements for old age medical and retirement benefits as in advanced countries. It is subsidies intended for basic necessities (although thanks to corruption the “intended” don’t always benefit).Forget about retirement and Bismarkian old age pensions. In still poor India, it is the unfunded “here and now” and day to day survival that counts for the lower caste groups.

The national government with an eye to the next national election has introduced a plethora of subsidy programs estimated at some 2.4% of GDP and aimed largely (though not exclusively) at lower caste groups. Such terms as “right to work” and “right to food” have been incorporated into the Indian political lexicon. These “rights” of course come at the expense of taxpayers. Rights like these have to be paid for by someone else.And these subsidy programs come at the expense of infrastructure, education and the private sector in general.

There is an old expression found in many cultures, “better to teach a man to fish, rather than giving a man a fish.” The Indian government contrary to this homespun advice is giving away a lot of fish. In India, the inefficiencies and waste resulting from the democratic process are sometimes called the “democracy tax”. The tax is quite high.

A second point unrelated to caste. The American constitution contains strong protections for property rights. The American Declaration of Independence and the American constitution were written in 1776 and 1787 respectively. Adam Smith’s Wealth of Nations was published in 1776. The same concepts of natural law and private property percolated on both sides of the Atlantic. Of course American property rights have been eroded over time by constitutional amendments and Supreme Court decisions, all derived from the populist pressures of democracy.

But the starting concept of property rights still remains embedded in the American political psyche as a bulwark against populism. If Obamacare is overturned by the Supreme Court, it will signify that the musty eighteenth century American tradition of property rights is still alive and well.But India’s constitution and political psyche is heavily influenced by Nehruvian socialism and the Marxist Harold Laski 1930s London School of Economics, not Adam Smith. Property rights do not hold the same sacred place in the Indian constitution as the American.

Crisis Ahead?

India today is running a Union budget deficit it estimates will come in at 5.9% of GDP. Throw in the states’ deficits and a much higher number emerges. India’s sovereign debt ratio to GDP is just below 70%. The current account deficit hit an unsustainable 4.3% of GDP in 4Q2011 and CPI inflation averaged just under 9% in 2011.

But keep in mind that in this respect India has one “advantage”. The international bond markets due to India’s history aren’t going to finance a massive run-up in India’s debt. India doesn’t have a rich German uncle or a European Central Bank that gladly lends all the money it wants in a reserve currency. The Indian rupee is not an international currency. Public sector India is on a very short leash in the international markets.

Unfortunately, the offset here is that India indulges in a great deal of financial repression. India’s banks, the bulk of which are government owned, are forced to over-invest in Indian government bonds. Similar policies exist in the insurance industry. A second offset, (equally unfortunate in my opinion), is that India has been a favorite recipient of soft loans from the World Bank and other donors.

Investors who visit India can be easily fooled. India’s larger companies are among the best run in the world. The information technology and pharmaceutical sectors are cases in point. Corporate governance standards are high, managements are world class and technologically savvy and English is the working language, not just an ornament trotted out for foreigners. Once you get on one of the high tech company campuses, you think you are in Palo Alto.

But these companies have to compete with a malevolent government which is crowding them out of the capital markets and overtaxing them. The latest budget proposal of the Congress controlled national government is filled with desperate measures to increase taxes on the private sector and which by international standards totally ignore property rights and common sense. (Come to think of it, given the parlous state of California’s fiscal health, perhaps investors should have second thoughts in Palo Alto as well.)

Somewhere in the next one to three years –maybe sooner --India will have another crisis. If the crisis of 1991 is any guide India will simply run out of foreign reserves, the rupee will collapse and financing for imports will dry up. Hopefully then genuine reforms will be introduced and some roll back of recently introduced welfare programs will occur.

Until then, stay away from Indian stocks.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Fatal Attraction Of Indian Populism

Published 04/04/2012, 04:56 AM

Updated 07/09/2023, 06:31 AM

The Fatal Attraction Of Indian Populism

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.