The EUR/USD dropped rather suddenly on Friday afternoon, after the prospect of deflation re-emerged within the European Union and devalued the European currency.

Friday’s EU economic release confirmed that inflation levels fell to 0.7% in January, far below the European Central Banks’s (ECB) 2% target level. Analysts were expecting inflation levels to rise to 0.9%. The last time inflation levels unexpectedly fell, the ECB surprisingly cut their interest rates to 0.25% and the markets are now curious as to whether they may act again during Thursday’s interest rate decision, causing the EUR to devalue.

The threat of deflation is a serious problem for the ECB, with a fall in prices likely to derail the already precarious EU economic recovery. It is feared that a fall in prices will damage corporate profits and be detrimental to wage growth. In late November, it was reported that the ECB would consider introducing negative deposit rates, if inflation levels decreased again and there is a possibility that this change of guidance may be introduced as early as this coming Thursday.

The recent EUR/USD downturn has also been encouraged by a bullish USD. US Economic performances have impressed recently, with Consumer Confidence scoring a 5-month high, alongside confirmation that the US achieved 3.2% economic expansion. Additionally, Advance Retail Sales and Small Business Optimism have exceeded expectations, with Initial Jobless Claims continuing to show gradual improvement. Finally, the Federal Reserve tapered another $10bn from their Quantitative Easing policy, with all signs suggesting that the US economy is indeed on the right tracks again.

I am looking for the USD to extend its bullish run of form this week, with my expectation that Friday’s non-farm payroll will reconfirm that the US employment economy is undergoing continuous improvement. I understand that January’s dismal non-farm payroll raised a few eyebrows, however, it is important to note the horrendous weather conditions that the US faced over December. This would have made data collection particularly difficult to accurately undertake and subsequently, I am looking for January’s non-farm payroll to be substantially uplifted on Friday.

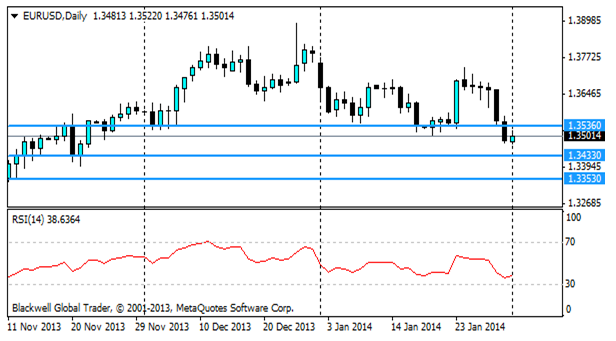

In reference to my technical observations for this currency pair, I have noticed that the EUR/USD has just pushed below the 1.3536 support level. Additional support levels can be found at 1.3430 and 1.3353. Although the latter support level maybe 200 pips away, the last time the ECB changed their monetary policies, the EUR/USD suffered 200 pip losses. Additionally, when looking at the RSI, I can see that it has not yet reached the oversold boundaries, and could possibly be looking to extend lower.

Overall, this Thursday’s ECB interest rate decision is going to be a highly anticipated event. The ECB has proven in the past that they are not afraid of pulling punches and surprising the markets, to rectify any issues within their economy. With deflation being such a concern to the ECB, it would not fully surprise me if they adapt their monetary policies again this Thursday, even if they only reduced their interest rates 3 months ago.