The euro could finally be signalling that it is running out of momentum which means a tumble could be coming in the near future. Specifically, a possible divergence and Gartley pattern could see the EUR/USD take another plunge back to the 1.1249 mark. Moreover, important EU and US indicators are being released this week which could send the pair into free fall again.

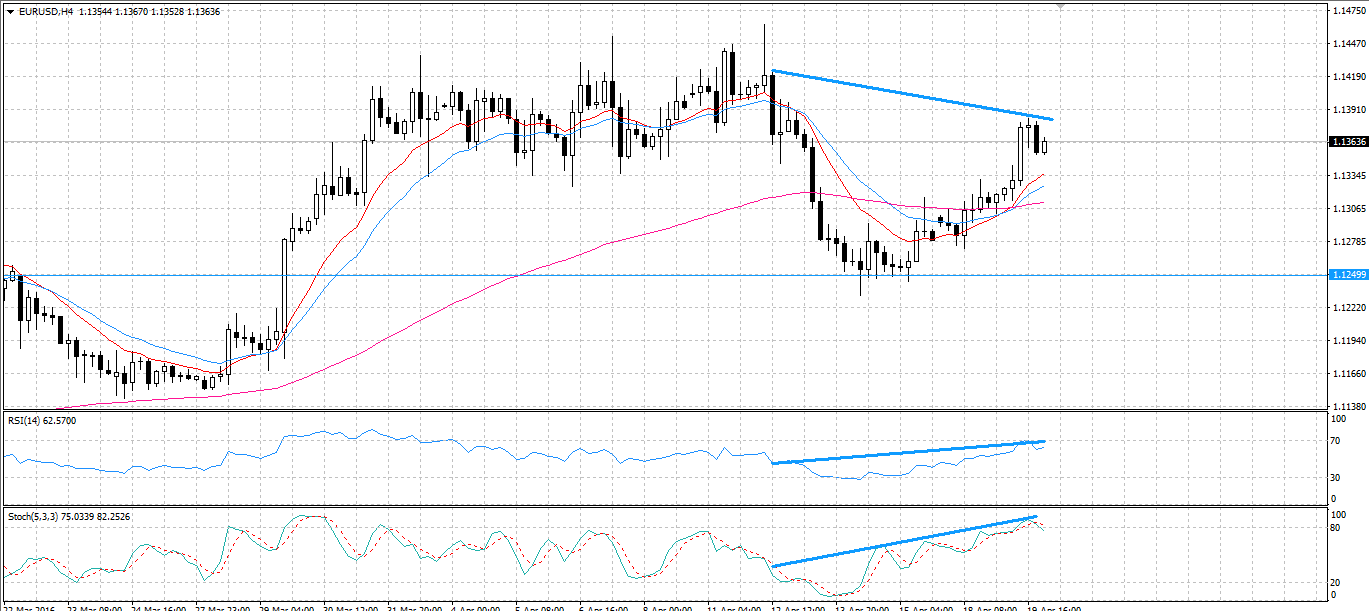

Firstly, looking at the H4 chart there is some evidence that a divergence could be occurring. As shown, there are demonstrable lower-highs on the H4 chart but also simultaneous higher-highs on both the RSI and Stochastic oscillators. As a result, there could be another downward turn for the EUR/USD in the coming week. Incidentally, there is already some evidence on the charts to show that the pair has begun to make the move lower. Therefore, the recent gains in the wake of excellent EU and German ZEW Economic Sentiment results could be a red-herring.

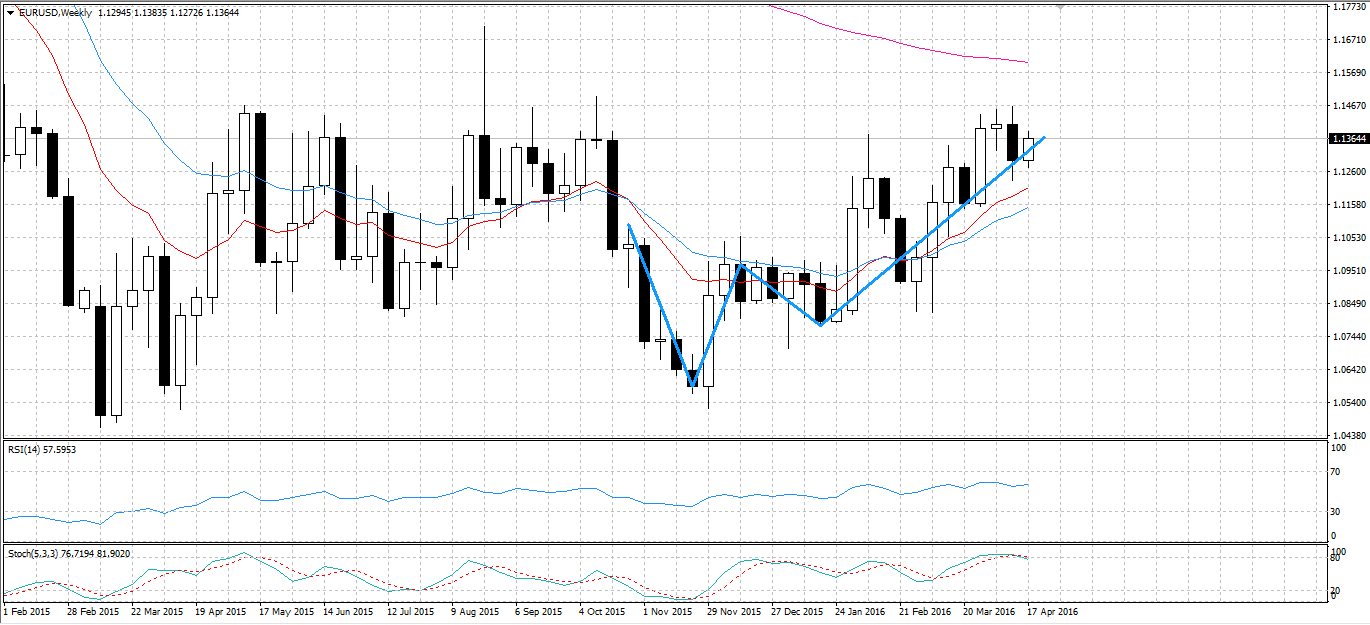

Continuing with the seafood theme, the weekly chart appears to show a potential crab formation. More specifically, a bearish crab has formed which could finally spell an end to the past few months of euro gains. As demonstrated on the weekly chart, the final leg of the pattern coincides with a very robust zone of resistance at the 1.1470 level. As a result, the recent failure to break resistance here is indicative of another potential drop for the pair as the week continues.

Going forward, there remains a number of important EU and US indicator results to be released which could help to instigate the impending fall back to support. Namely, the US Unemployment Claims result is due shortly and if the US posts yet another better than expected figure there will be significant selling pressure for the pair. On the EU front, the Minimum Bid Rate decision and Eurogroup meeting will be sure to provide a significant degree of volatility for the pair.

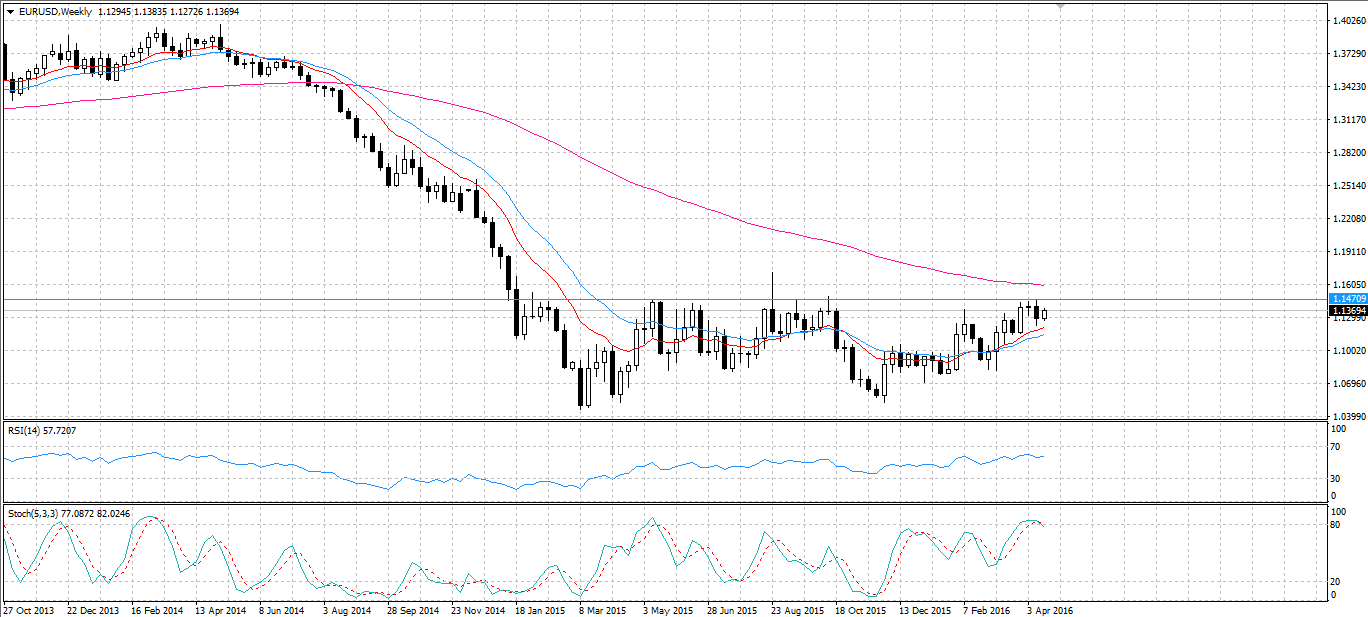

Ultimately, as the 100 day EMA closes the distance between itself and the 1.1470 zone of resistance there will be mounting selling pressure for this pair. This aside, the combination of a divergence and a bearish crab pattern are already taking their toll. As a result of this, the euro will struggle to remain buoyant should any negative sentiment arise in the later part of this week. Additionally, a recent string of strong US employment data could mean another better than expected unemployment result is imminent. If this occurs, the return of sentiment towards the USD could see a major tumble occur for the pair.

By Matthew Ashley