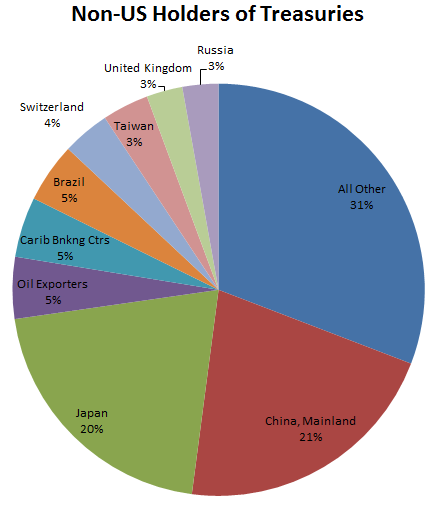

The latest report on foreign treasury holdings is showing China and Japan holding similar amounts of US government paper, with oil exporters and the Caribbean Banking Centers (Cayman Islands, the Bahamas, etc.) in third and fourth place.

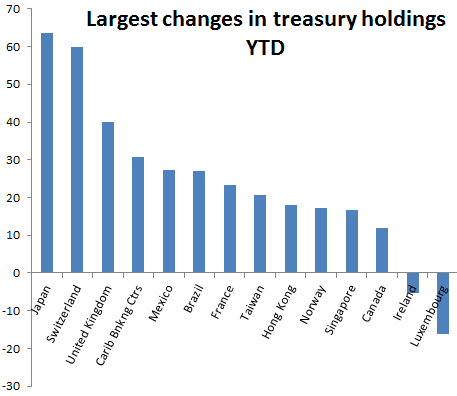

Overall foreigners continued to buy large amounts of Treasuries in 2012. Japan was the largest purchaser, with total holdings now close to that of China. Trying to keep the yen from appreciating further (strong yen had put tremendous pressure on Japanese exporters) was one of the reasons for the increase. Defending the yen from appreciating involves increasing USD foreign reserves - which end up invested in Treasuries. And the reason the yen has been so strong has to do with the eurozone crisis, with global investors using Japan's currency as a safe haven (particularly to get away from anything correlated to the euro).

WSJ: Tokyo's Treasury purchases have come amid an effort to defend the yen against appreciation that could hurt exports, while China has been giving its currency more leeway to appreciate against the dollar. Japan has indicated it may intervene again in the currency market after the U.S. Federal Reserve's recent decision to embark on another round of stimulus.

The second largest increase in holdings came from Switzerland. The Swiss central bank (SNB) had built a tremendous exposure to the euro, which it had to buy to defend the franc from appreciating (see discussion). This exposure put Switzerland at risk to further euro depreciation, which could become extreme in the case of the eurozone breakup. Not wanting to take this much risk, the Swiss chose to diversify their foreign reserves into dollars - which led to Treasury purchases.

Ironically the eurozone induced global fears have helped fund the US budget deficit, as both Japan and Switzerland were forced to defend their currencies and buy Treasuries. Next time the US Treasury may not be so lucky.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Eurozone Crisis Forced Japan, Switzerland To Buy Treasuries

Published 10/17/2012, 02:51 AM

The Eurozone Crisis Forced Japan, Switzerland To Buy Treasuries

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.