Like a phoenix from the ashes, the euro has risen recently – and quite sharply so. Does it portend more strength ahead, or what exactly can we expect ahead? The answer features our game plan for the scenario ahead...

Let’s recall our Friday’s analysis:

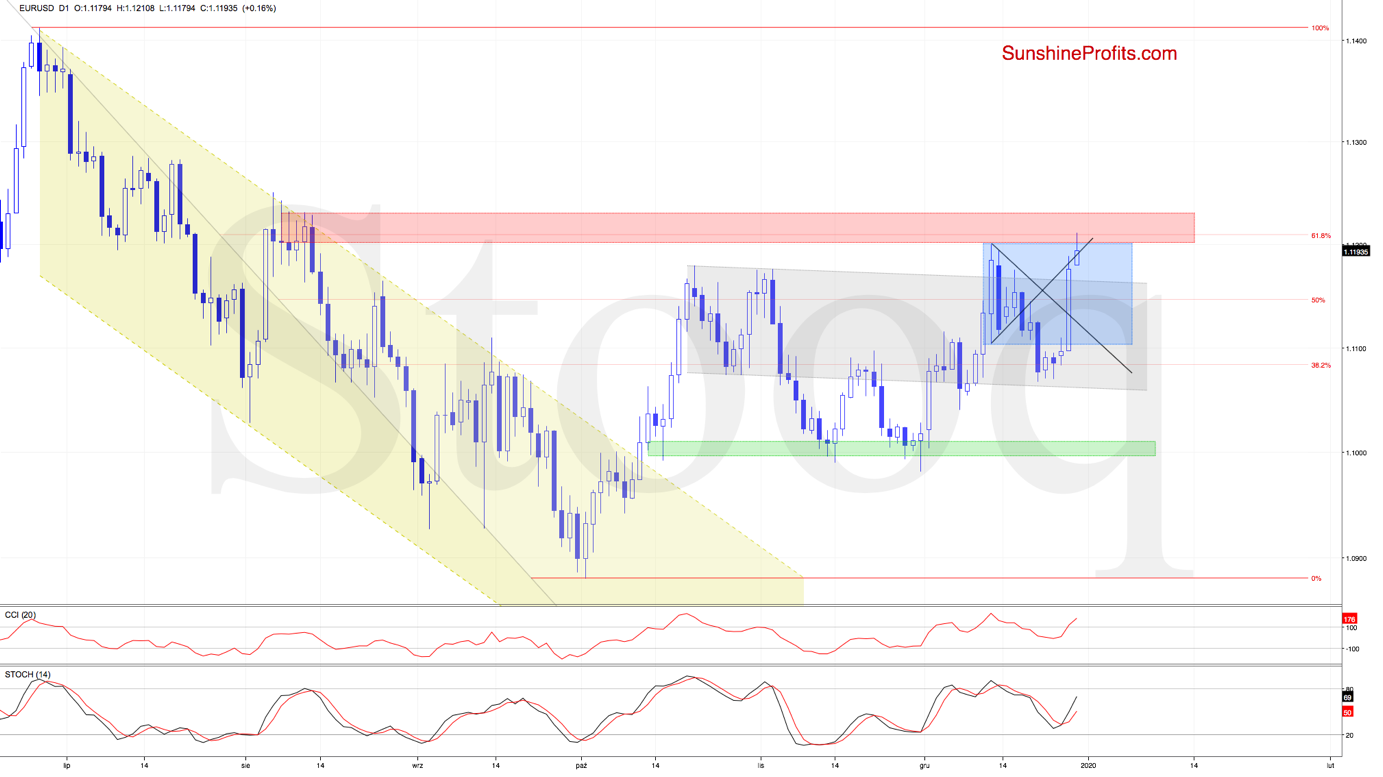

(…) EUR/USD moved sharply higher earlier today, breaking out above the declining black resistance line that is based on its previous peaks. This move also brought us invalidation of the earlier breakdown below the lower border of the blue consolidation, while the Stochastic Oscillator generated its buy signal.

Taking the above developments into account, it seems probable that we’ll see further improvement and a test of the lower arm of the black triangle, of the upper border of the declining grey trend channel or even of the recent peaks at the upper border of the blue consolidation.

The situation developed in tune with the above, and EUR/USD reached both resistances on Friday and earlier today. The move also took the pair to both the red resistance zone and the 61.8% Fibonacci retracement, suggesting that we could see a downward reversal in the very near future.

But what about the daily indicators? The Stochastic Oscillator has generated its buy signal, and there is still some upside potential in it. The best course of action would be to observe the exchange rate and in case we would see reliable signs of the bulls’ weakness, we’ll consider opening short positions.