These days we are constantly hearing about currency wars taking place across the globe. Almost every leading country is trying and racing to devalue their currency in order to boost their exports. Just look at the recent action by the Japanese government and the Bank of Japan (Japanese central bank). The Japanese finance minister actually stated that his goal was to get the Nikkei 225 Index up to 13,000 by the end of March. You cannot make this stuff up. Never before has a prominent government figure made such a comment.

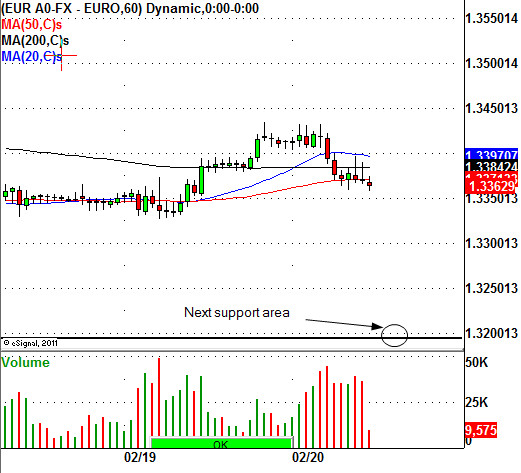

Last week, there was a G-20 meeting in Moscow, Russia. This was a pow wow between central bankers and finance ministers. Many talking heads in the media reported that the goal of the meeting was to stop all of the money printing that is going on in almost every major country in the world. We know that nothing has really changed since that meeting. Many Euro-zone countries are complaining that the Japanese Yen is too weak and that the Euro currency is too strong. The Euro topped out on February 1, 2012 around the 1.371 level. Wednesday, the Euro was trading down to the 1.336 level. Traders should expect the Euro to trade down to the 1.32 level where there will be some daily chart support. Should that support level fail to hold up there could be a lot more downside for the Euro.

In the wacky world of currency trading the charts will be very important. Some ways of playing the currency markets are by using the currency shares. Here are a few currency shares that traders can trade and follow, they are the CurrencyShares British Pound Sterling Trust (\FXB), CurrencyShares Euro Trust (FXE), CurrencyShares Japanese Yen Trust (FXY), and the CurrencyShares Australian Dollar Trust (FXA).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Euro Still Has Further Downside

Published 02/21/2013, 12:22 AM

Updated 07/09/2023, 06:31 AM

The Euro Still Has Further Downside

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.