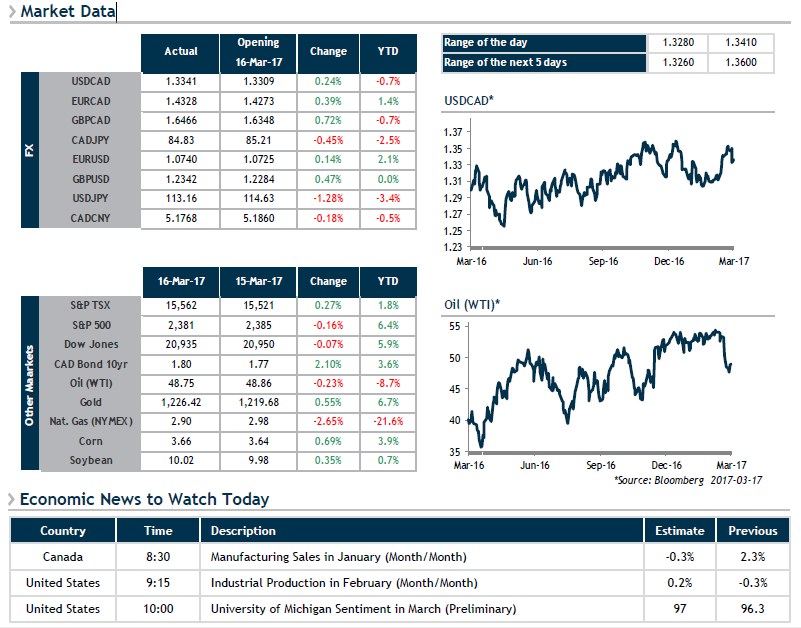

The USD/CAD pair stabilized after the previous day’s sharp drop. Markets are still questioning themselves about the speech that Ms. Yellen gave on Wednesday: with no economic changes in Canada, did it justify the USD’s drop of nearly 200 points? This stabilization was also seen with other commodity currencies such as the Australian dollar and the New Zealand dollar.

The day’s surprises originated in Europe. The pound sterling rose sharply further to the optimism shown by one of the Bank of England’s Monetary Policy Committee members who voted for a key rate increase at yesterday’s meeting. The euro also behaved very well against the USD. The European Central Bank is starting to talk about a key rate hike and an increase in inflation has been noted. With the CAD stable and the single currency up, it is mostly the EUR/CAD pair that rose quickly.

On the stock markets, Trump euphoria continues to create a wealth effect for American consumers. An old financial adage-very often validated empirically-reminds us that it is after three key rate increases one very soon after the other that stocks begin losing value. We are now at 2...