Michael Phelps had to wait for his 200 butterfly semifinal heat. He had a South African competitor dancing in front of him and from the picture he seems to be pretty annoyed. But he only had to wait a few minutes for his delay to resolve. Imagine if he had to wait as long as the euro has been to resolve?

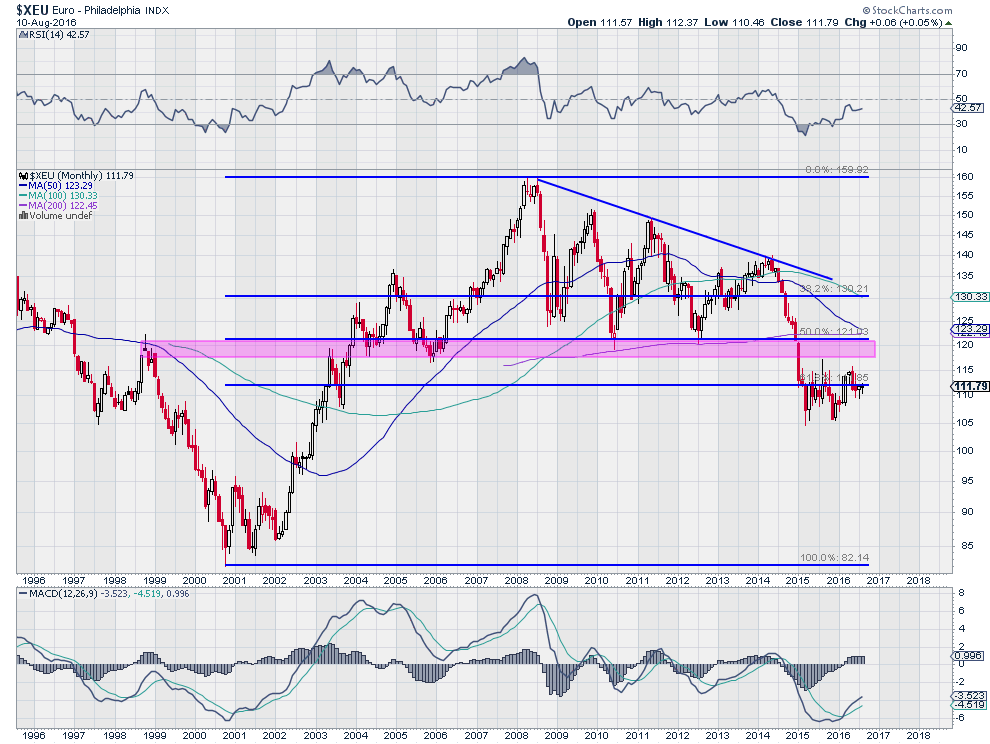

In 2014 it started lower against the US dollar from a level near 140. It moved fast down to 112 by the end of 2014. But since then, for the next 20 months, it has traded in a tight range between 105 and 115. Closing in on two years. This sideways consolidation is happening around the 61.8% retracement of the move higher from the 2000 low to the 2008 high.

Market Technicians are certainly not surprised about where it is consolidating. But I cannot imagine many have expected it to go on this long. There have been a lot of potential catalysts to jar it from this range. But nothing has done it yet.

Many signs suggest the eventual break will be to the upside. Momentum indicators have been rising, creating a positive divergence with price. But both the RSI and MACD are still in the bearish zone.

So there is just more waiting. A range bound currency until it either breaks above 115 or below 105. If it is a break of 105 to the downside then a target of a full retracement to 82 is established. A break of 115 has many more obstacles to deal with like a prior resistance zone from 117.50 to 121. Hopefully it will continue to be more patient than Michael Phelps.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.