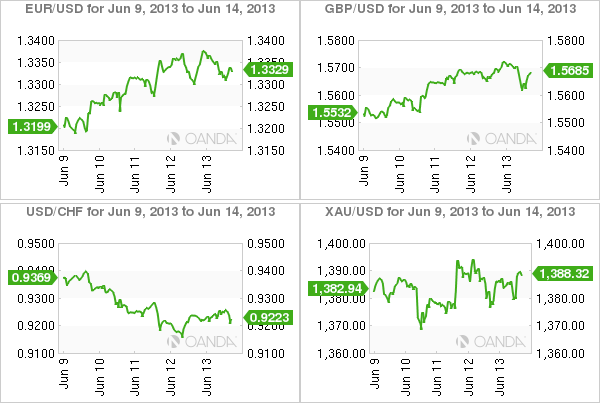

It’s all about the Fed. The crying has stopped and the bleeding has slowed, somewhat, ahead of the FOMC meet next week. The EUR’s recent price action continues to beat the bears despite it’s own soft Euro data. On Friday, the ‘mighty ‘ dollar ended up aiding the 17-member single currency even further, pushing it to finish the week in technical bullish territory.

Traders Sat This One Out

The Reuters/University of Michigan consumer sentiment for June came in below expectations and applied temporary weekending pressure on the dollar. With so many licking this week’s asset price destruction wounds, very few investors had any interest to ply their wares after Friday morning’s data releases. Instead they seemed much happier to wade to the sidelines and wait for Ben’s press conference next Wednesday.

Next Big Target

The EUR has managed to hold, for a second consecutive day, just above the accelerated trend support of 1.3300. According to technical analysts, it’s hoping to stage a clear break above resistance at 1.3342 -- the 61.8% retracement and late February high. If achieved, that would leave the immediate risks marginally higher for a possible push through the optioned-protected, next big figure -- 1.3400. Any momentum forcing the EUR below 1.3310, for a period of time, will open the door for the currency to test Wednesday’s low at 1.3279.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Euro At Week's End

Published 06/14/2013, 01:53 PM

Updated 07/09/2023, 06:31 AM

The Euro At Week's End

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.