Equities and currencies are trading higher this morning after President Vladimir Putin ordered Russian troops conducting military exercises near the Ukraine border to return to their bases. While the crisis is far from over, this is the first sign that tensions could be easing and investors are hopeful that Putin will be less stubborn and more amenable. Only time will tell but as we watch the evolving situation in Ukraine, European assets will be particularly vulnerable to ongoing developments.

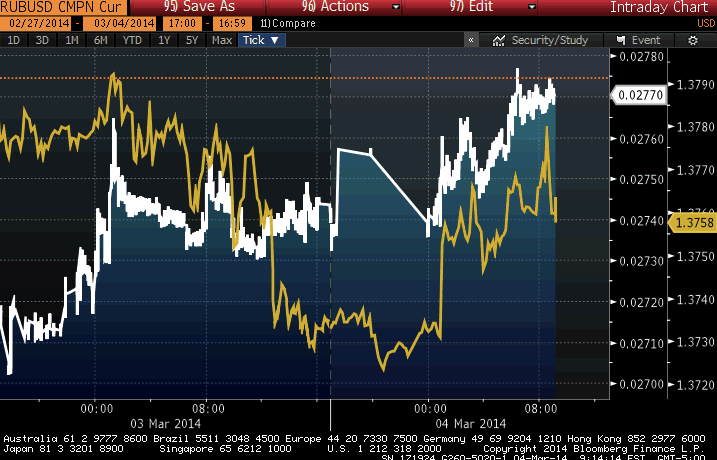

The following 2-day chart of the EUR/USD and RUB/USD shows that the euro is trading exclusively on headlines out of Russia and the Ukraine

EUR/USD And The RUB/USD: 2-Day" title="EUR/USD And The RUB/USD: 2-Day" align="bottom" border="0" height="242" width="474" />

EUR/USD And The RUB/USD: 2-Day" title="EUR/USD And The RUB/USD: 2-Day" align="bottom" border="0" height="242" width="474" />

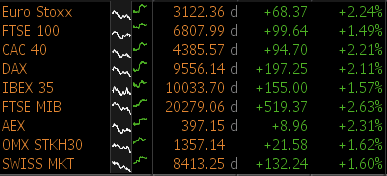

This second table shows how well European markets are responding to the latest developments.

While the EUR/USD has been extremely sensitive to the Ukraine crisis, the correlation between RUB/USD and EUR/JPY is even stronger. This suggests that if you have an opinion on whether the political crisis will worsen before it improves, EUR/JPY is a better currency pair to express your views than EUR/USD. If tensions continue to ease, EUR/JPY could hit 142. If Russia steps up its military involvement in the Ukraine, the currency pair could drop to 139.

EUR/USD And The RUB/USD" title="EUR/USD And The RUB/USD" align="bottom" border="0" height="242" width="474" />

EUR/USD And The RUB/USD" title="EUR/USD And The RUB/USD" align="bottom" border="0" height="242" width="474" />

Kathy Lien, Managing Director of FX Strategy for BK Asset Management.