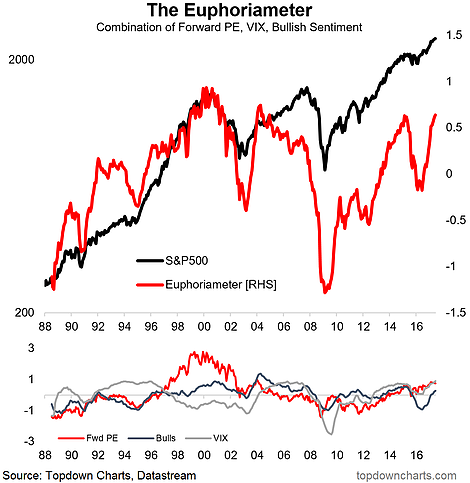

The "Euphoriameter" has hit a new post-crisis high in June, indicating increasing levels of euphoria among investors. The indicator tracks 3 gauges of sentiment: 1. Investor Surveys: the bullish sentiment readings from the AAII survey and the II survey; 2. Risk Pricing: the smoothed level of the VIX (i.e. the trend in complacency or fear); and 3. Valuation: the forward PE ratio, which reflects investor confidence in price vs future earnings. All 3 indicators are basically in agreement - which is rare.

That is, investors are more bullish than usual, more complacent about risk than usual, and more confident in future corporate earnings than usual. The question it raises is whether this is 'irrational exuberance' or rational exuberance. The truth is exuberance usually starts from some rational reason such as low interest rates, strong economic growth, improving earnings, expectations of stimulus, better global economy, etc. And some of these conditions certainly exist. But another way of looking at it is that expectations are increasingly high, and thus vulnerable to disappointment.

The "Euphoriameter" has climbed to a post-crisis high after giving a buy signal at the market bottom in early 2016. We are yet to see the same type of extreme euphoric levels of the dot-com bubble, but it wouldn't take much to get there from here.