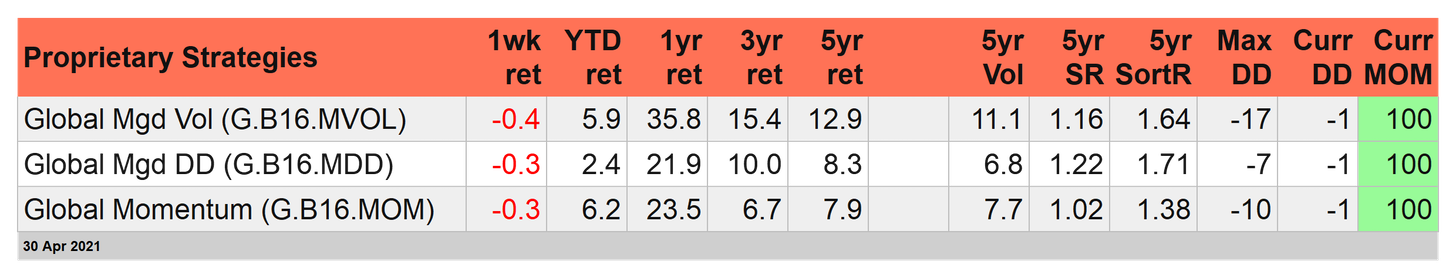

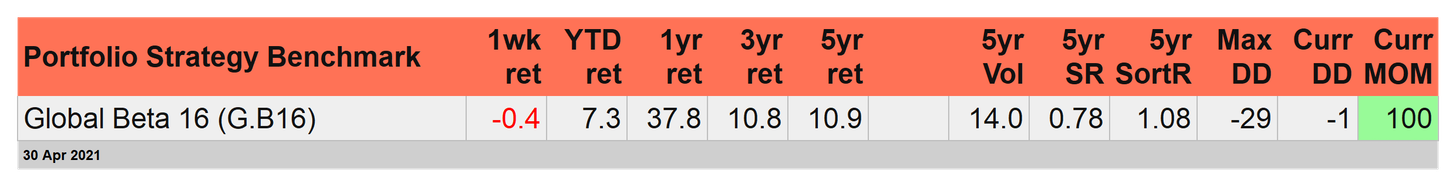

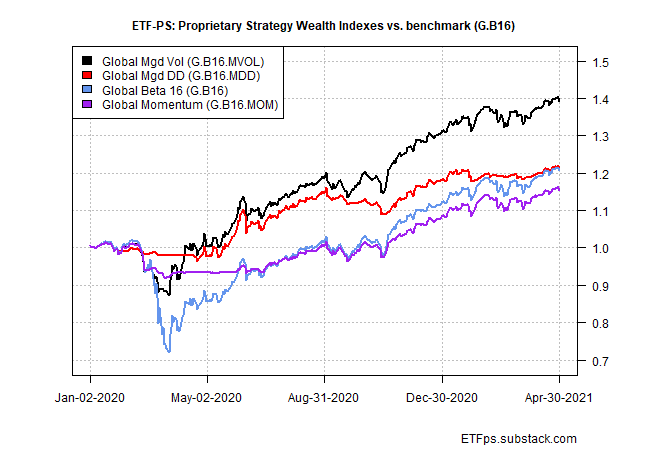

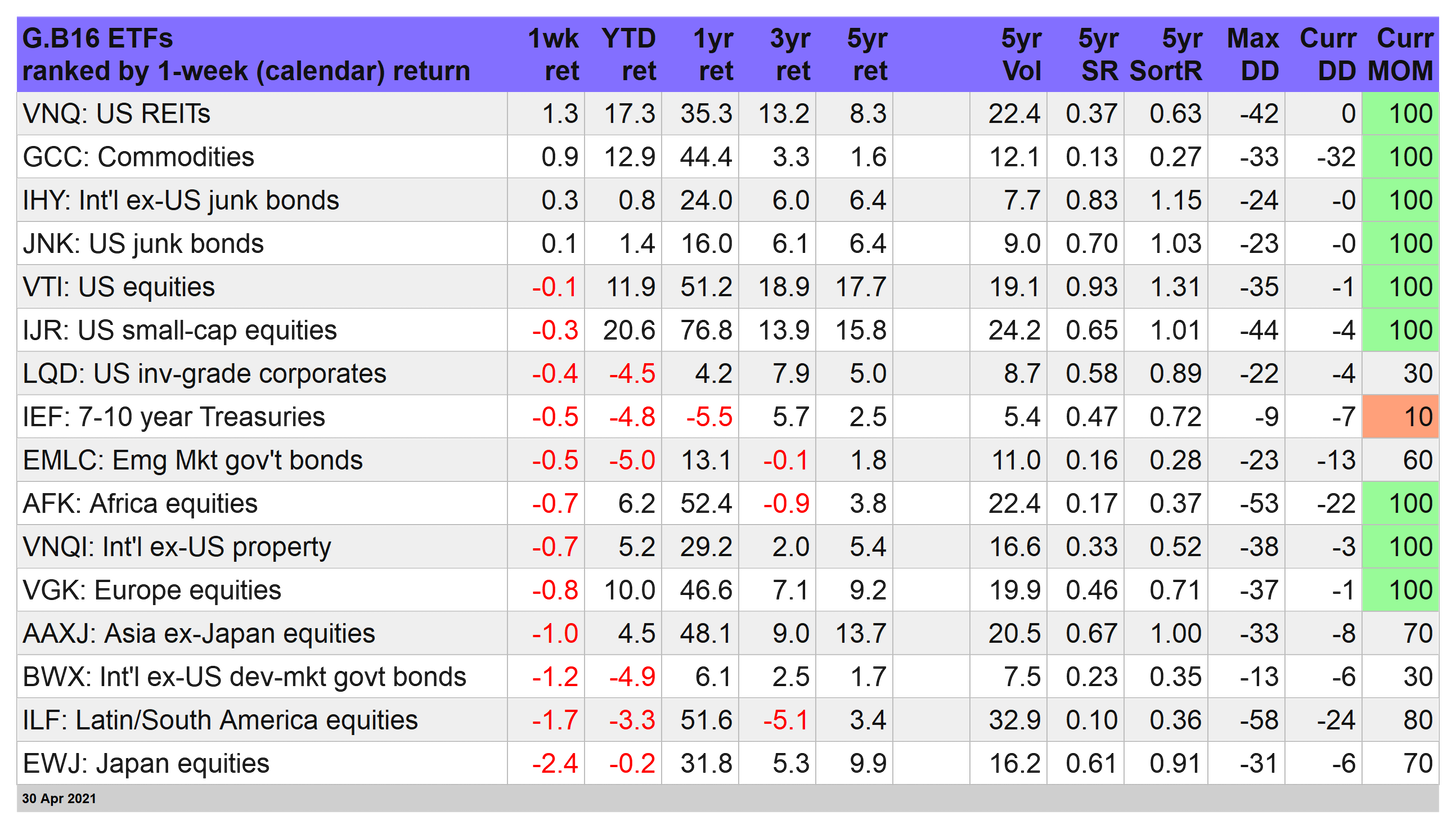

Keeping up with beta while maintaining a risk-management overlay remains challenging this year, but two of our three proprietary strategies dispatched some trivial success this week by losing slightly less than their benchmark. Not particularly impressive, but it beats a kick in the head.

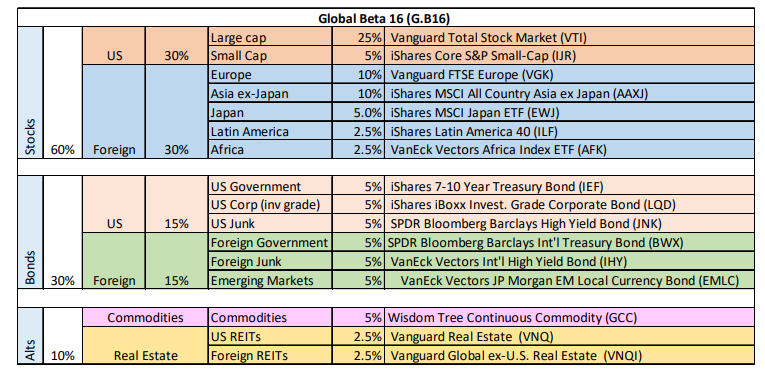

Global Managed Drawdown (G.16.MDD) and Global Momentum (G.B16.MOM) each retreated 0.3% last week (through Apr. 30), fractionally less than the 0.4% decline for Global 16 (G.B16), the 16-fund global opportunity set that’s targeted by the two strategies.

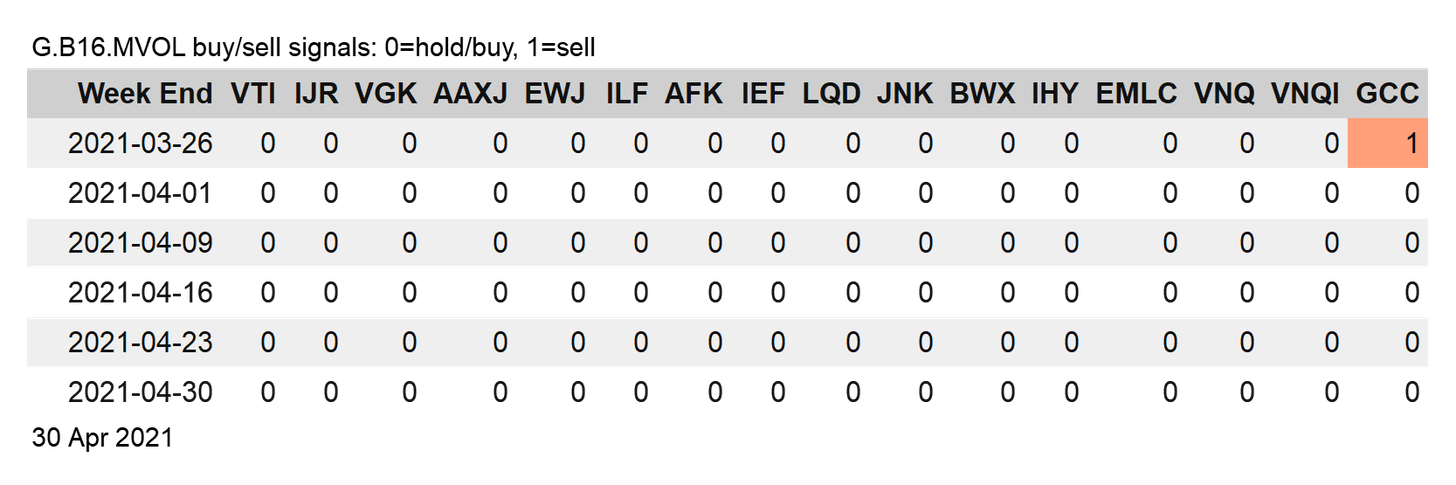

The third proprietary strategy, Global Managed Volatility (G.B16.MVOL), which also targets G.B16, shed 0.4%, matching the benchmark’s setback. For details on strategy rules and risk metrics in the tables below, please see this summary.

The performances differences don’t change the fact that the benchmark is still posting a healthy lead over the proprietary strategies. That’s unlikely to change in the near term if the bull run for risk assets rolls on, which is the implied forecast for the red-hot MOM scores in the tables above.

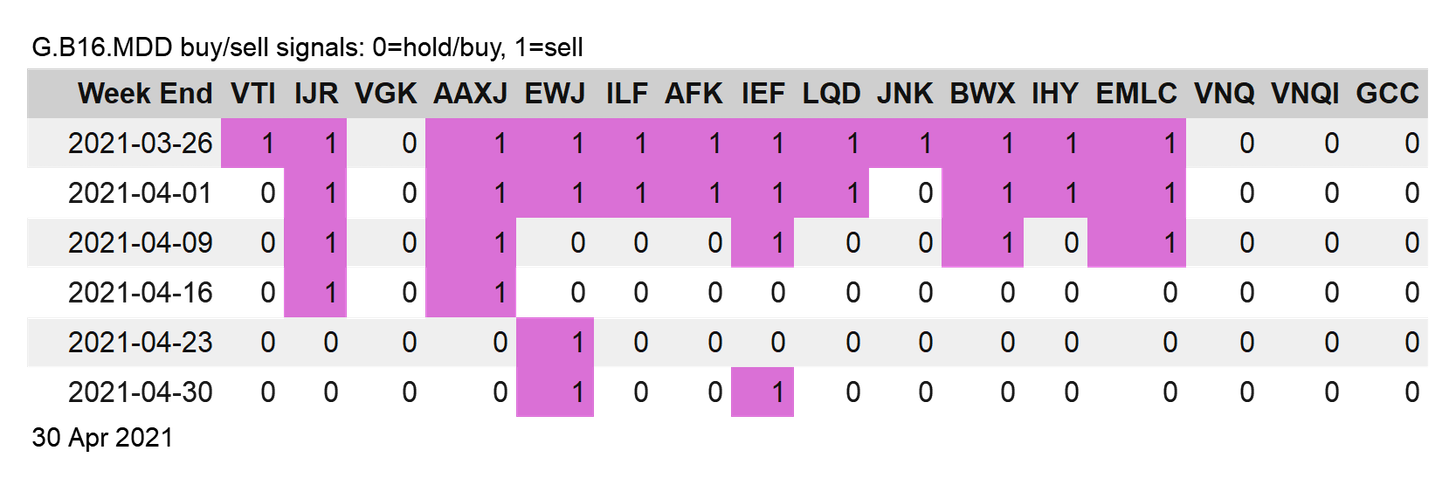

A correction of some depth would likely shift the year-to-date leadership away from G.B16. On that note, G.B16.MDD added a third fund to risk-off last week by selling iShares 7-10 Year Treasury Bond (NYSE:IEF). The strategy now has two of 16 funds in risk-off positions.

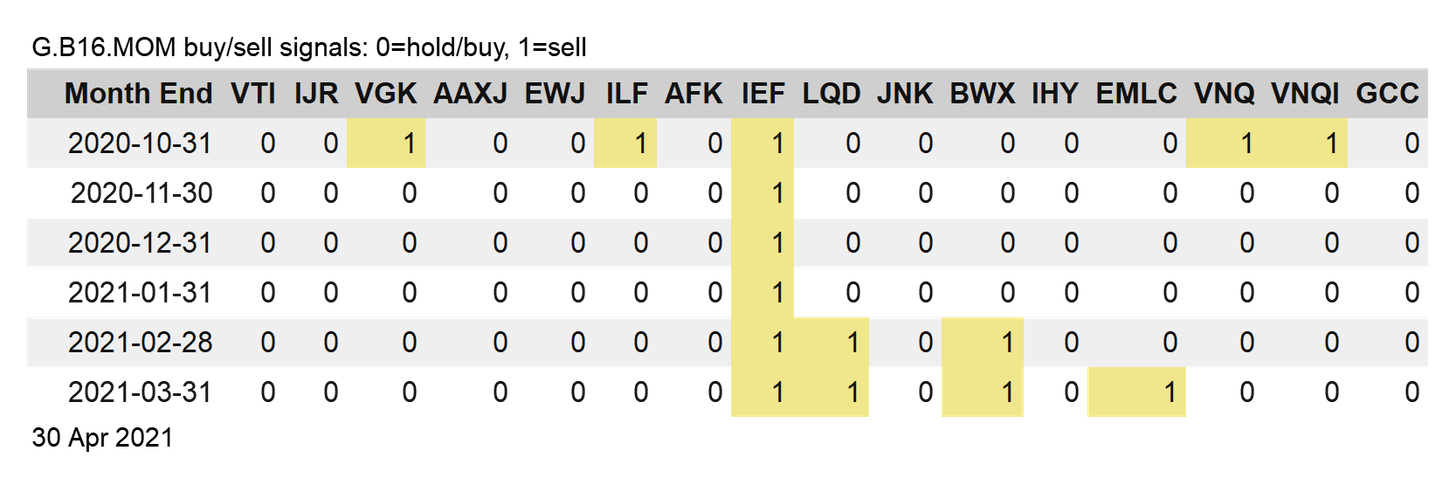

G.B16.MOM is also a bit more risk averse after the close of trading on Apr. 30. The strategy added VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC) to its risk-off holdings. As a result, four of its 16 fund buckets are now in cash.

G.B16.MVOL, by contrast, continues to be all in on risk-on. For a fifth straight week, the strategy holds all 16 ETFs in the G.B16 opportunity set. ■