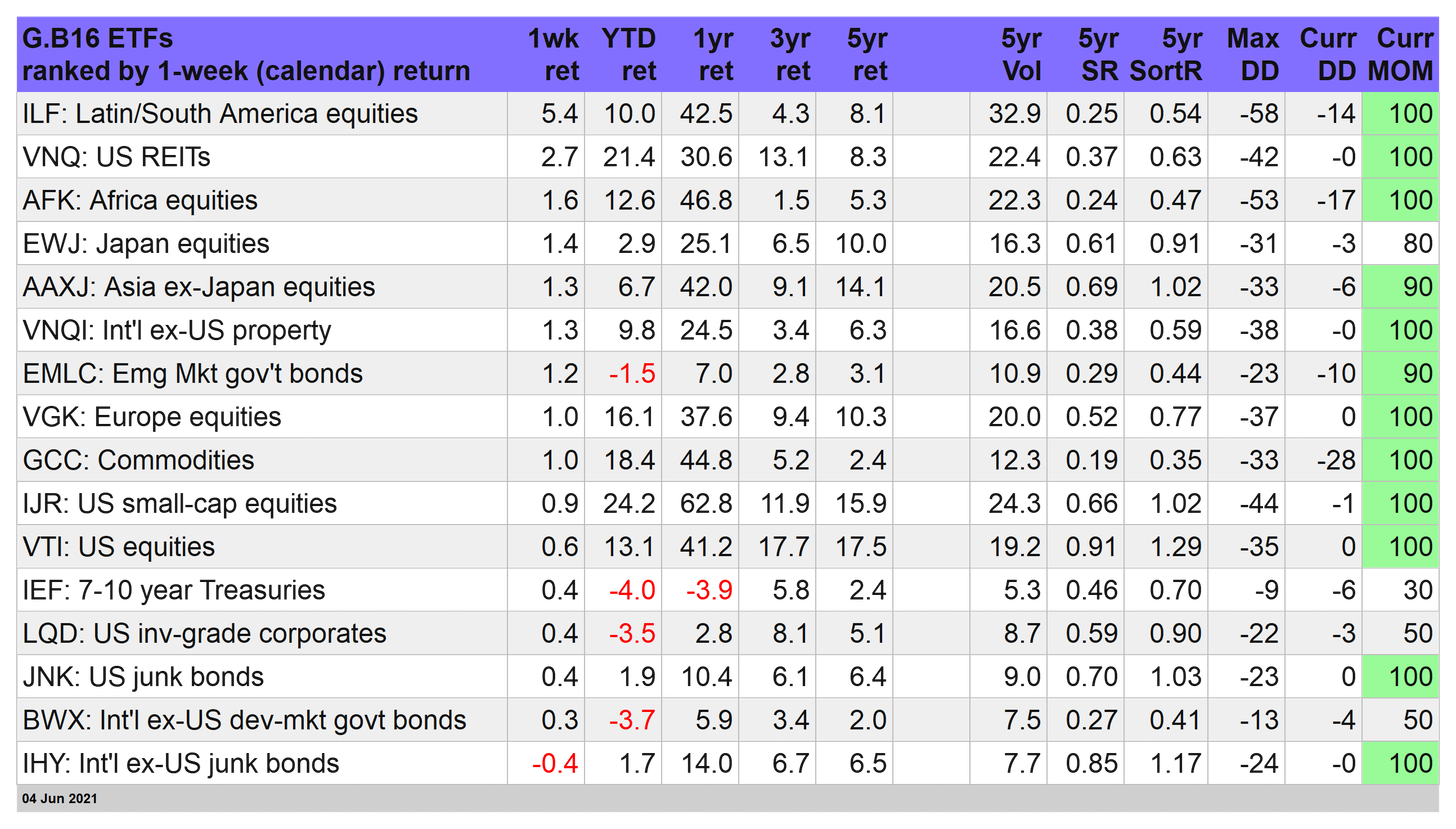

Beta risk keeps on giving

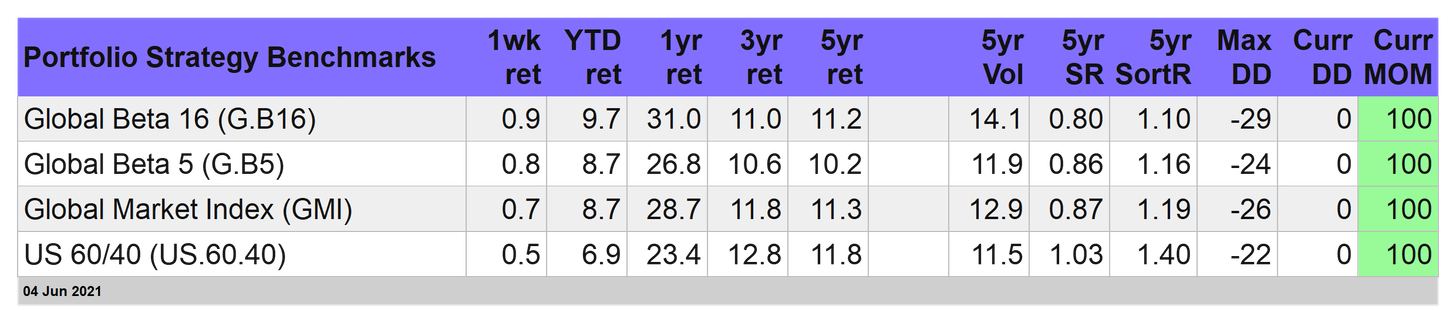

Once again it took real effort to lose money in global diversified portfolios last week. Unless you were concentrated in foreign junk bonds (the week’s only loser for our 16-fund global opportunity set), it was a winning week—again. For details on all the strategy rules and risk metrics, see this summary.

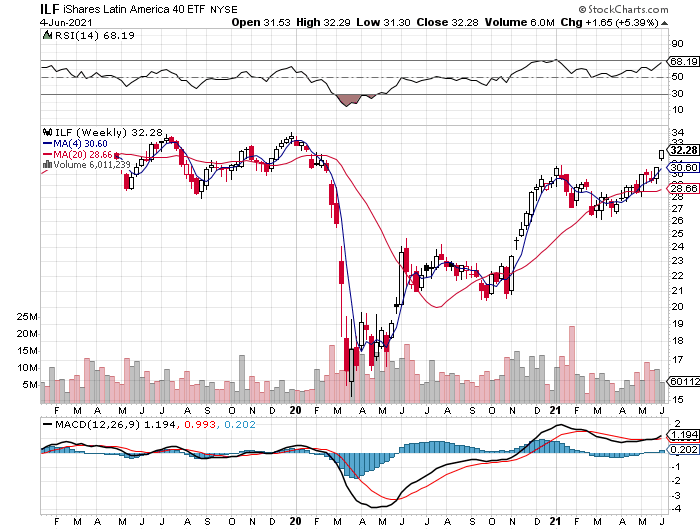

Leading the gainers for a second straight week through Friday's trading (June 4): iShares Latin America 40 ETF (NYSE:ILF), which rallied 5.4%. This slice of global markets continues to come alive as the ETF surged to its highest close since January 2020. ILF has recovered all of its pandemic losses (and then some).

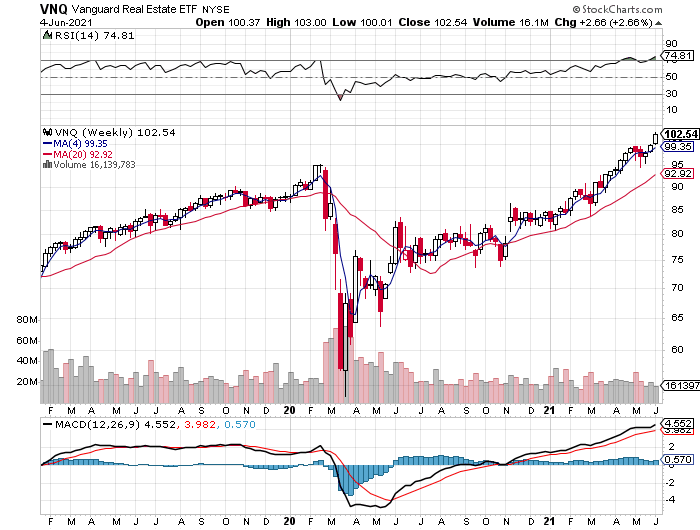

The second-best performer was well behind ILF. Nonetheless, US real estate investment trusts (REITs) continue to deliver solid gains. The latest installment: Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) rose 2.7% last week.

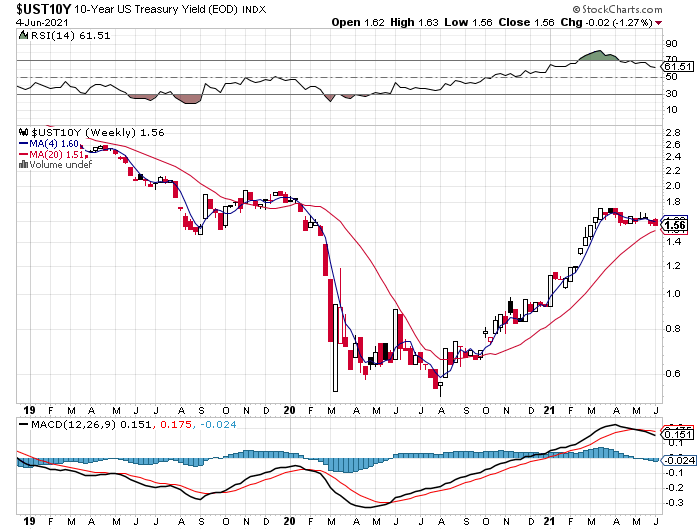

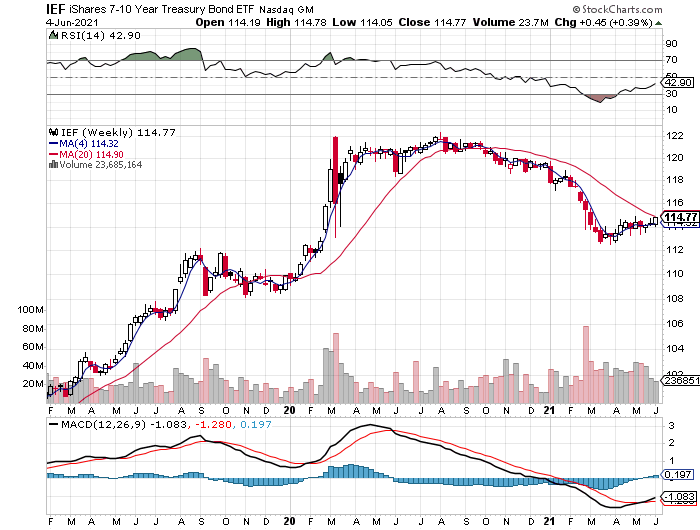

Boosting the allure of yield-oriented investments, such as REITs: fresh signs that US interest rates remain in a holding pattern after a months-long run of rising. But the upside bias ended in March, replaced by flatlining (with a bit of downside). The 10-year Treasury yield, for example, fell to 1.56% in Friday's session, close to the lowest level since March.

The softer-than-expected payrolls report probably played a role in the renewed fall in yields (and rise in bond prices). Economists were looking for a 650,000 gain in payrolls via Econoday.com’s consensus point forecast.

The actual result was well below at 559,000. A decent number on its face, but in the context of a labor market that’s still digging itself out of a pandemic hole it was a disappointing gain.

One takeaway is that the economic recovery may not be as strong as previously assumed, in which case the inflation threat may not be as acute as the hawks have been arguing.

The narrative certainly gave bonds a lift last week. The iShares 7-10 Year Treasury Bond ETF (NYSE:IEF) edged up 0.4% for the trading week, closing at its best level in three months.

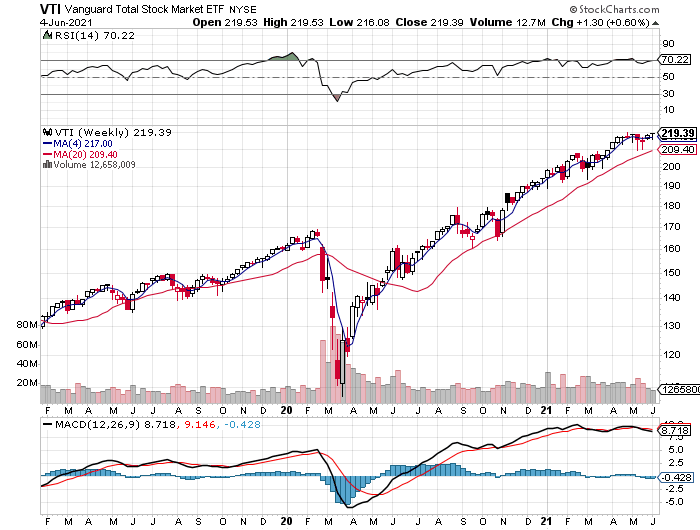

US stocks continued to post middling results relative to our global opportunity set. As we’ve been advising lately, foreign assets are looking stronger these days, boosting the outlook for globally diversified strategies. The week’s mid-range performance for American shares strengthened that view.

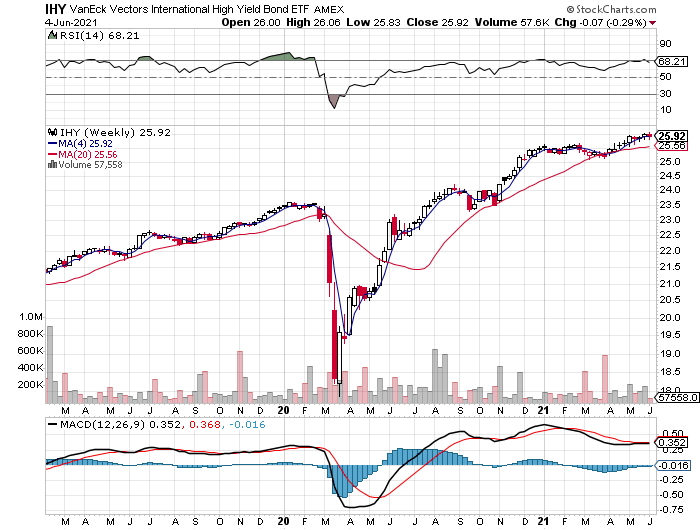

The week’s worst performer (and the only weekly loser on our list): foreign junk bonds: VanEck Vectors International High Yield Bond ETF (NYSE:IHY) slipped 0.3%.

Global asset allocation’s on a roll

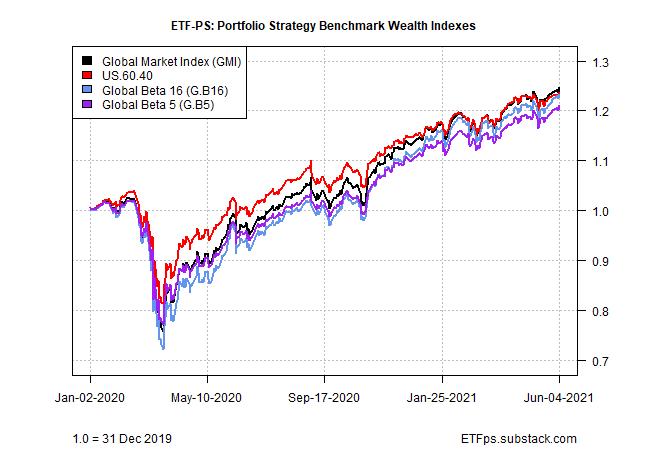

Holding a portfolio that includes assets outside the US continues to reap benefits. Once again, three of our portfolio benchmarks that diversify beyond America topped results the past week. The US 60/40 stocks/bonds index, by contrast, was still in last place in this four-horse race.

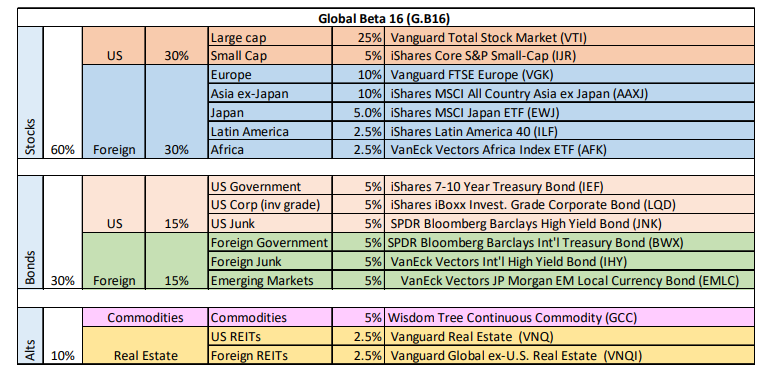

Year-to-date, Global Beta 16 (G.B16)—which holds all the funds in the table above in weights shown below—was still firmly in the lead with a 9.7% total return. The strategy’s trailing one-year gain was also the top performer for the portfolio benchmarks.

The future’s as uncertain as ever, but the case for going global appears to be reviving after a long run of playing second fiddle to US-focused portfolios.