As expected, the Federal Reserve left interest rates unchanged in Wednesday's policy announcement. Despite widespread expectations of faster growth, the central bank reasoned (persuasively or not) that pandemic risk for the economy continues to lurk and so aggressive policy accommodation is still necessary.

Attempting to dance on this fine line, the FOMC statement advised:

“Amid progress on vaccinations and strong policy support, indicators of economic activity and employment have strengthened. The sectors most adversely affected by the pandemic remain weak but have shown improvement. Inflation has risen, largely reflecting transitory factors.”

Whatever the verdict on Fed policy, the policy announcement sets a new standard for hedging. Perhaps, then, it’s no surprise that the bond market mostly yawned this week through yesterday's close. The 10-year Treasury yield, at 1.63% for Apr. 28, remains within a tight range of recent vintage.

The iShares 7-10 Year Treasury Bond ETF (NYSE:IEF) is still churning in a box this week through Wednesday's close.

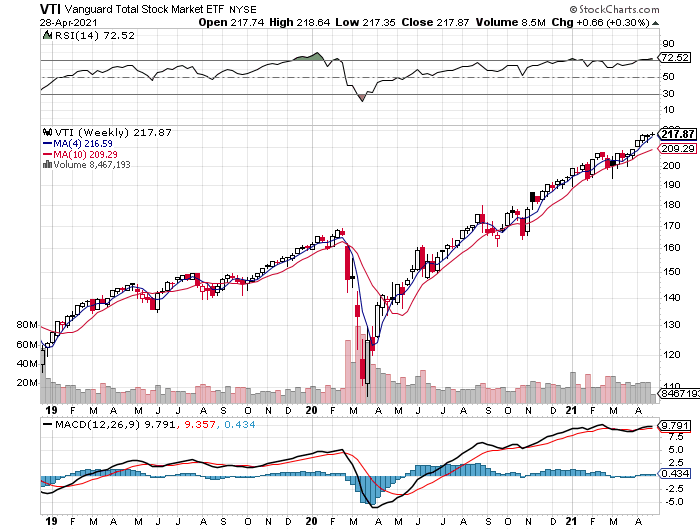

US stocks continue to post a strong upside trend, although that bias has been in hibernation lately. Here, too, the path of least resistance this week is treading water. The initial reaction of the Vanguard Total US Stock Market ETF (NYSE:VTI) to the Fed meeting was essentially one of napping.

For directional activity, the fishing’s better over at the commodities pool. WisdomTree Continuous Commodity Index Fund (NYSE:GCC), which equal weights a broad basket of goods, rose sharply Wednesday, marking the fifth straight daily gain. Expectations for the reflation trade to run on for some time continue to animate the commodities markets.

“The inflation question will continually return to investors’ minds this year,” predicts Andy Wong, senior investment manager of the international multi-asset team at Pictet Asset Management in Hong Kong. “The U.S. household balance sheet is the healthiest it has been for years, and ‘excess savings meets disrupted supply chains’ means dislocation in supply and demand.”

In the emerging markets equities space, the potential blowback from higher interest appeared to be offset by rising commodities prices. EM has often been sensitive to higher US rates, but many developing countries also benefit from higher commodities prices via exports. Perhaps the latter is resonating on a deeper level these days, or so it seems via Vanguard FTSE Emerging Markets ETF (NYSE:VWO).

Recently on these pages your editor wondered if the rally for VWO was wilting. If recent trading is an indication, the crowd appears to be having second thoughts. The combination of Fed policy on hold and rising commodities prices could be a powerful catalyst to reignite animal spirits in this corner.