Is it risk-on again for emerging markets? It’s an intriguing question that resonates a bit more these days, courtesy of rallies in several of the leading EM nations.

Is it time to pile in? I remain cautious for strategic allocations, but for speculative accounts there’s a case for thinking that there’s still room to run higher. For some details, let’s zoom in on some proxy ETFs, starting with a big-picture view by way of Vanguard FTSE Emerging Markets Index Fund ETF (NYSE:VWO).

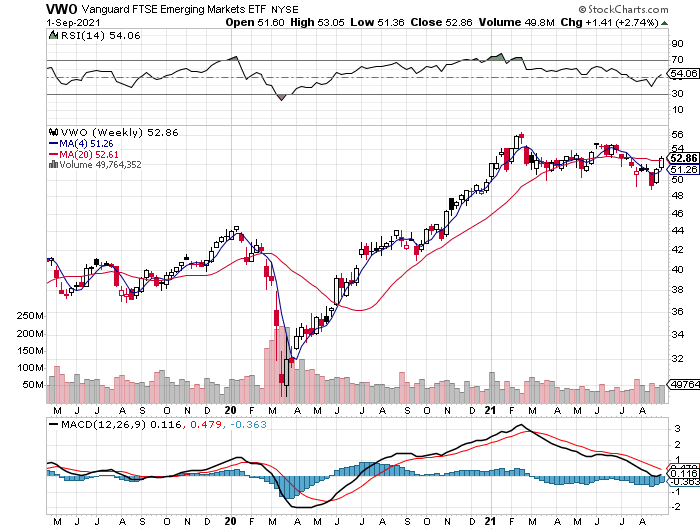

VWO is on track to post a second weekly gain, based on trading through today’s close (Wed., Sep. 1). After another day of running sharply higher, VWO closed at the highest level since mid-July. That still leaves the fund at a middling price within this year’s trading range, although two weeks of solid gains mark a change from the downside trend that prevailed for much of the summer, as the weekly chart below indicates.

Technically, the price action still looks like noise in a range, but keep your eye on this space for more hints that an upside breakout is brewing (or not). Meantime, let’s dig deeper and review what’s driving VWO’s recent pop.

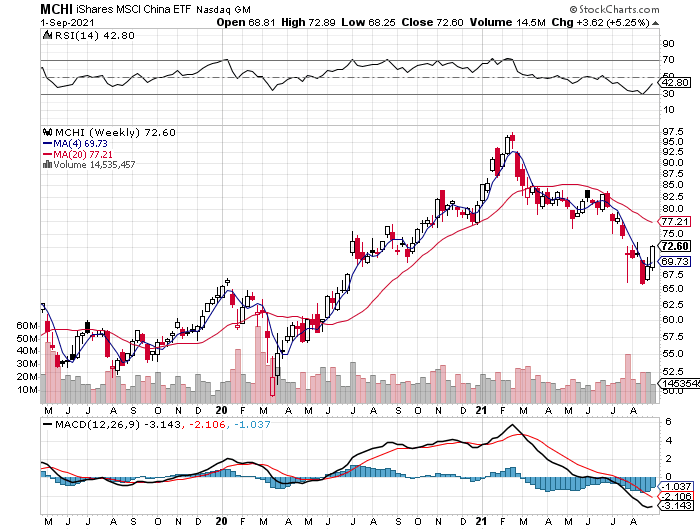

VWO’s biggest country holding is China, which represents roughly 37% of assets. As a proxy for China shares, consider iShares MSCI China ETF (NASDAQ:MCHI). After dropping for much of the summer, courtesy of Beijing’s crackdown on its tech industry, MCHI is showing signs of upside life again. It’s still too early to declare the worst has passed, but the bottom-feeders are nibbling and the current pop could run on. Nonetheless, count me as skeptical that we’ve seen the bottom.

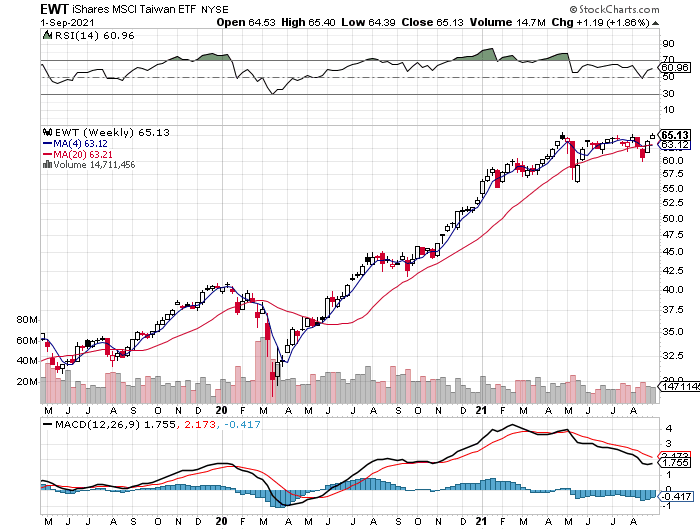

VWO’s second-biggest country weighting (~18%) is proxied by iShares MSCI Taiwan ETF (NYSE:EWT). On this front, the technicals still look bullish, although the rally from the pandemic low is getting a bit long in the tooth. EWT is basically at the highs reached in two previous rallies this year. If the fund can push decisively above the ~$65.5 mark, and hold the gain, that would support the case for expecting the rally to extend further into the autumn.

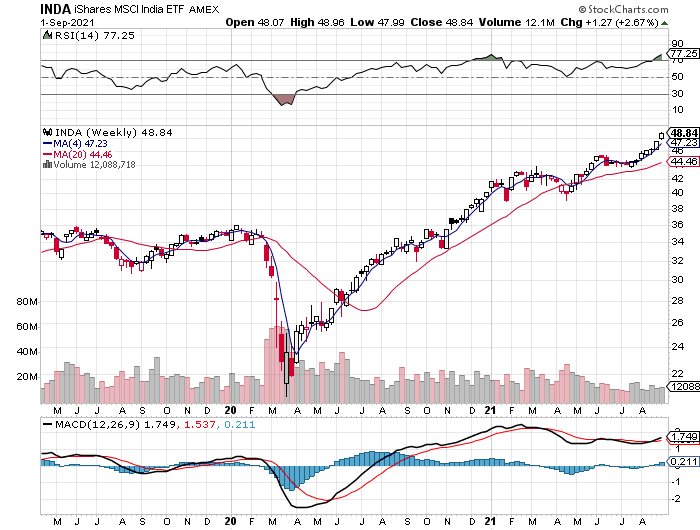

VWO’s third-biggest country holding is India at just below 14%. The iShares MSCI India ETF (NYSE:INDA) is red hot — the fund ticked up to yet another record high today. Impressive, but this is a fund that’s appears at risk of a correction. When and if we see a pullback, however, the upside trend history suggests a buying opportunity in the making.

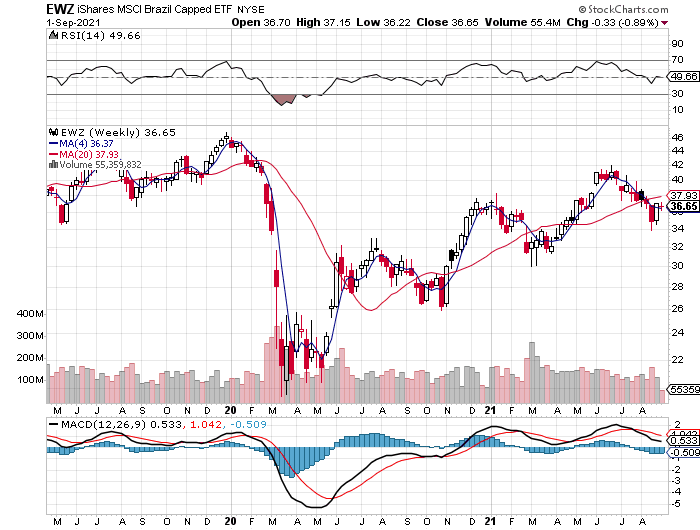

VWO’s fourth-biggest country allocation: Brazil. The iShares MSCI Brazil ETF (NYSE:EWZ) has been on a roller coaster ever since the coronavirus crash hit in March 2020, but the trend remains bullish, albeit with relatively wide swings along the way. For the near-term horizon, the key question: Is EWZ poised for another leg higher? If recent history’s a guide, the fund may be set to bounce anew as it rebounds off the recent low.

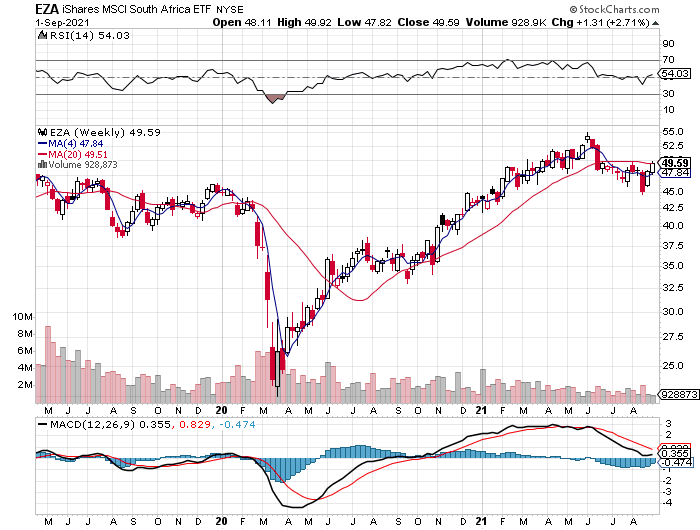

Finally, VWO’s fifth-highest country allocation is South Africa. The iShares MSCI South Africa ETF (NYSE:EZA) appears to be in the early stages of rolling over, although if the government’s reform efforts can persist, and deliver results (or at least some positive headlines) in the days and weeks ahead, EZA may be able to extend its recent rally.