Red ink, near and far

Another week, another run of big misses for US economic data. The previous week it was payrolls. Last week it was a trifecta of numbers: inflation, retail spending and industrial production.

The consumer price index (CPI) was much hotter than expected while retail spending and industrial output came in substantially below their respective consensus forecasts. The noise factor for US macro is sky high of late. The perception rollercoaster took markets along for the ride.

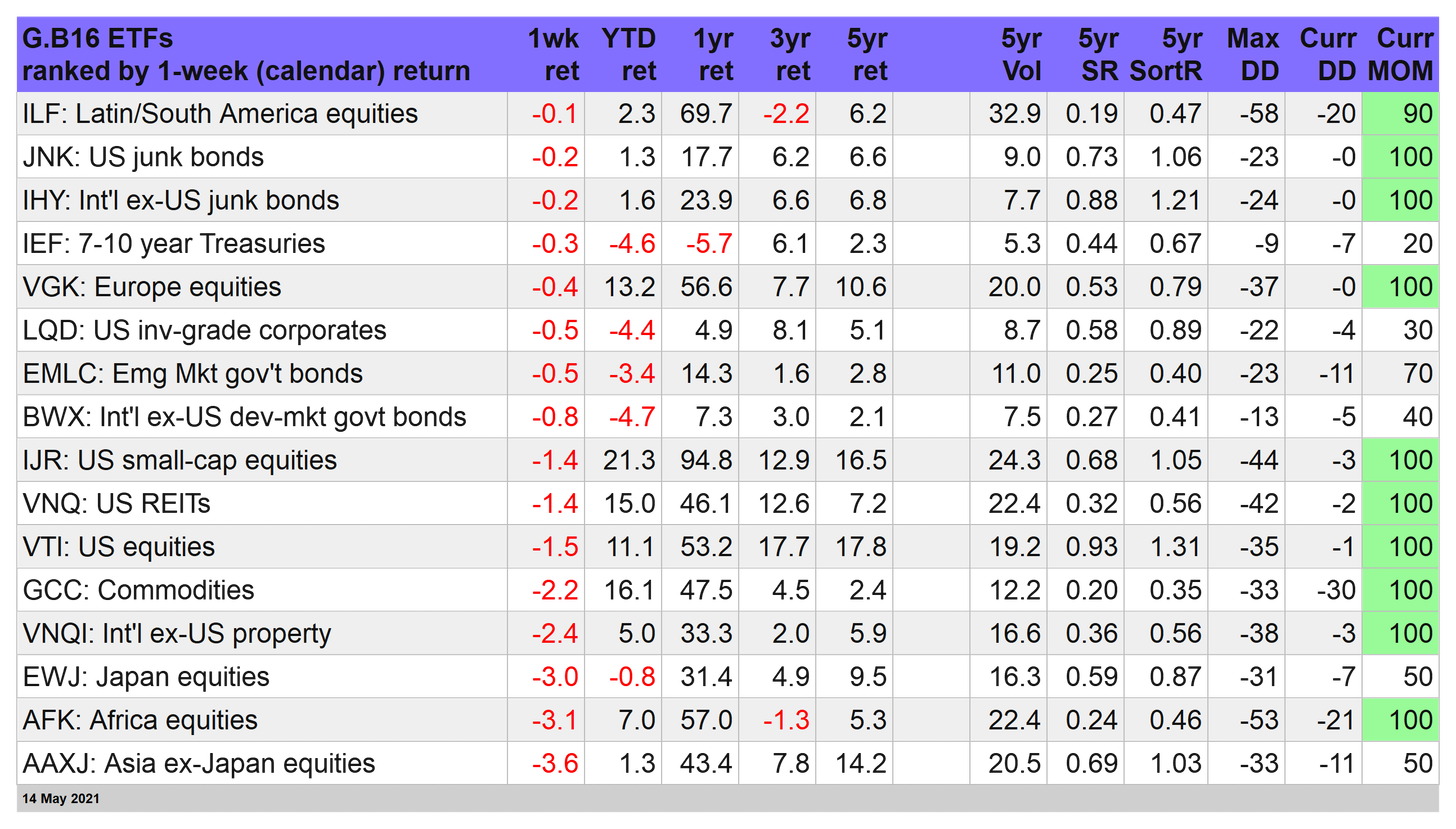

The key takeaway for last week’s update on markets: nothing was spared for our 16-fund global opportunity set. Losses ranged from relatively light (Latin/South America shares) to a steep haircut for Asia ex-Japan stocks.

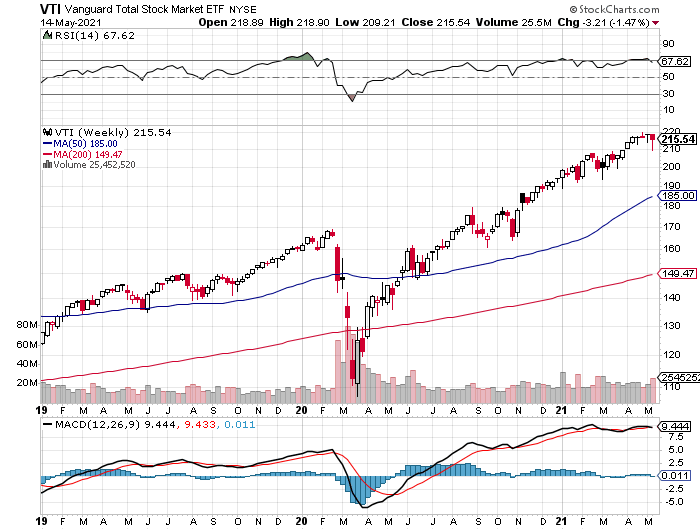

US shares may need a new catalyst to keep the party going. But after trillions in stimulus, signs that the worst of the pandemic in America is over, and a blowout gain in GDP for the first quarter, those former buy triggers will be tough acts to follow.

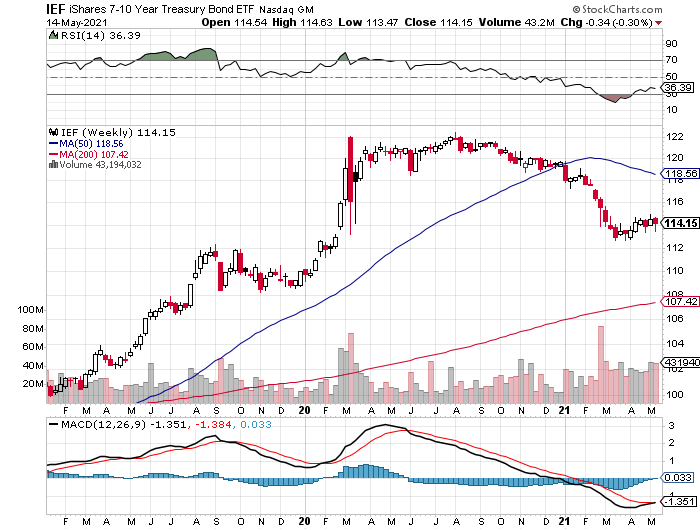

Meanwhile, US Treasuries continued to show an affinity for going nowhere fast. That’s in keeping with the benchmark 10-year Treasury yield’s ongoing flatlining exhibition: the benchmark rate was up fractionally last week to 1.63%, but continued to hold in a tight range as the crowd pondered whether to see the inflation threat as something more than a transitory affair.

Despite a furious debate on this front, iShares 7-10 Year Treasury Bond (NYSE:IEF) only ticked gently lower last week.

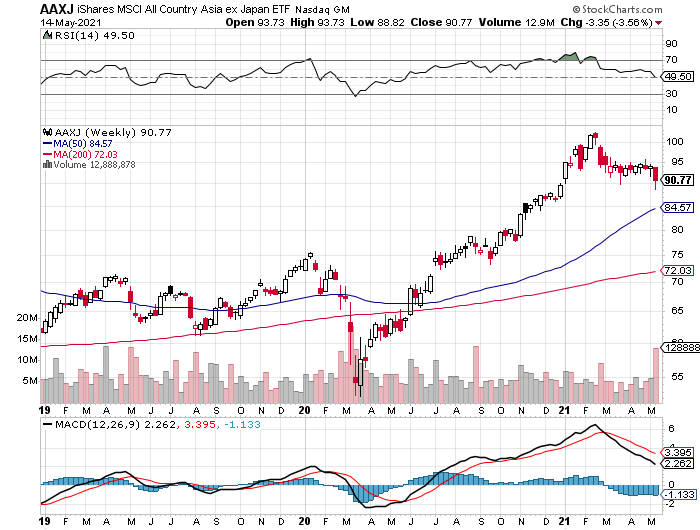

The biggest setback: stocks in Asia outside of Japan: iShares MSCI All Country Asia ex Japan ETF (NASDAQ:AAXJ) tumbled 3.6%, cutting the fund to its lowest close this year. Our momentum ranking for AAXJ has been looking increasingly shaky lately and the latest decline doesn’t help.

As the table above shows, AAXJ’s MOM score is now 50, the midway point between extreme bullish and bearish trending behavior. For details on all the strategy rules and risk metrics, see this summary.

No shelter in asset allocation

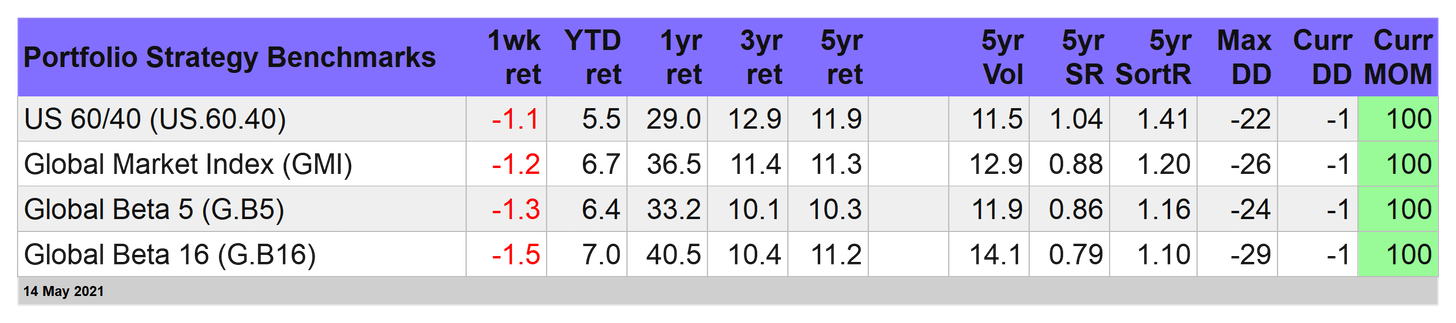

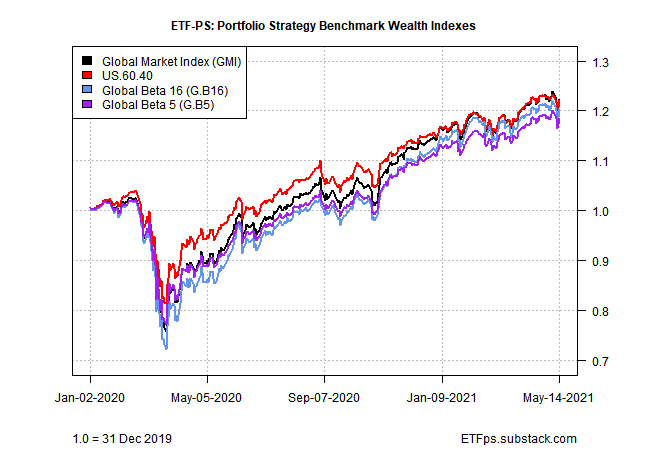

No one should be terribly surprised to find that with all slices of our 16-fund opportunity set tumbling last week, gravity also pulled the portfolio benchmarks lower too.

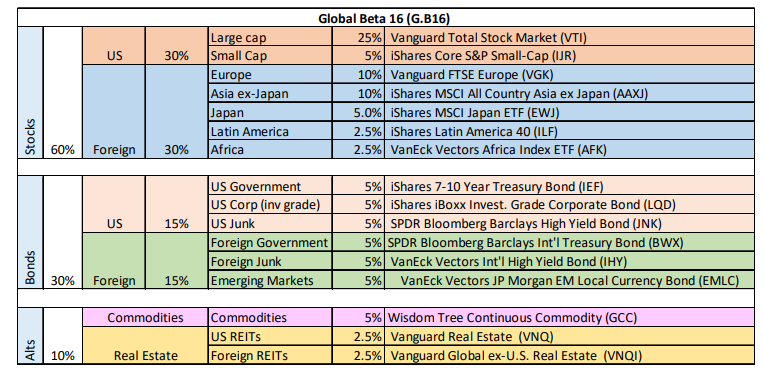

The deepest cut was logged by Global Beta 16 (G.B16), which holds all the 16 funds in the table above (see weights below). The 1.5% weekly decline cut the benchmark’s year-to-date gain to 7.0%. That’s still a solid advance, but G.B16’s edge in 2021 over its competitors is slipping.

We’ve seen this movie before, of course—markets correct, the crowd gets nervous, and then risk assets rally again. For the moment, that narrative’s as good as any, if only because it’s worked well for years. And it’ll continue to work… until it doesn’t.

Meantime, the markets need a new stimulant and the cupboard’s looking bare. Or is it?

President Joseph Biden is pushing his $2.3 trillion American Jobs Plan and there are signs that he’s making progress in convincing Congress to give it the green light in one form or another. Perhaps the party’s not quite over after all.