Commodities continue to benefit from ongoing worries about inflation and real-time reports of price hikes for basic materials.

An equal-weighted ETF that targets a broad set of commodities is a good proxy for monitoring the bull trend.

WisdomTree Continuous Commodity Index Fund (NYSE:GCC) posted its fifth straight weekly gain at the close of trading on Friday (Apr. 30) and appears on track to make it six in a row as of Wednesday's (May 5), as the weekly chart below suggests.

Ongoing forecasts that inflation will heat up and stay up is a factor in GCC’s rise. Federal Reserve officials, however, beg to differ.

“Despite the ebbs and flows of the data, inflation is expected to remain close to 2% [the Fed’s moderate inflation target] over the forecast horizon,” says Boston Federal Reserve Bank President Eric Rosengren. “This does seem to me to be the most likely outcome, which should allow monetary policymakers to be patient in removing accommodation.”

Perhaps, but commodities markets are reacting, in part if not primarily, to growing reports of higher prices for supplies in the manufacturing and services sectors. The IHS Markit survey data for the Services PMI, for example, reports “input costs faced by service sector firms increased at an unprecedented rate in April.”

Similar news is coming from the manufacturing space as supply chain squeezes mount. “Suppliers have been able to command higher prices due to the strength of demand for inputs, pushing material costs higher at a rate not seen since 2008,” says Chris Williamson, chief business economist at IHS Markit, in the same survey linked above.

Rising costs for raw materials aren’t necessarily inflation per se, at least not generally. It’s an input, but there are other factors for assessing the inflation for the economy overall. Nonetheless, widespread gains in commodities are contributing to the perception, rightly or wrongly, that inflation overall is undergoing regime shift to the upside.

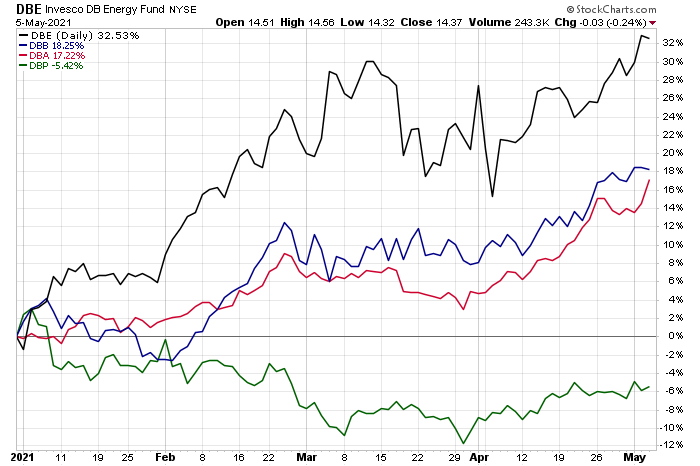

Consider that three broad categories of commodities via ETF proxies—energy—Invesco DB Energy Fund (NYSE:DBE), base metals—Invesco DB Base Metals Fund (NYSE:DBB) and agricultural products—Invesco DB Agriculture Fund (NYSE:DBA)—are posting handsome gains year to date.

The exception: precious metals—Invesco DB Precious Metals Fund (NYSE:DBP—which is moderately in the red so far in 2021.

The takeaway: the appetite for raw materials in the real economy is heating up.

Rosy economic expectations will help keep the commodities party going. Following a sizzling first-quarter GDP report, the Atlanta Fed’s current nowcast (May 4) for Q2 looks substantially stronger: +13.6%. It’s still early in the quarter and so it’s best to view this stellar estimate cautiously. But even if that estimate is cut in half, the outlook for the economy would remain hot.

Short of some exogenous macro shock out of the blue, the bull run for commodities appears set to run hot for the foreseeable future.