It’s been tempting to think that the worst had passed. But health experts (at least the respectable ones) have been warning otherwise. Markets are deciding to take another look at the risks and reprice assets accordingly.

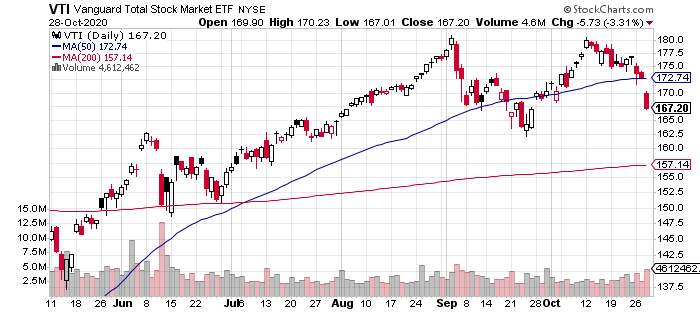

US stocks fell sharply yesterday, near the lowest level of the session (Oct. 28). Vanguard Total Stock Market Index Fund (NYSE:VTI) tumbled 3.3%, leaving the ETF at its lowest level since Sept. 25. To be fair, the US shares were probably due for a pullback—equity prices near record highs amid an ongoing and, more recently, worsening pandemic are an unstable coupling, after all.

Today’s sharp loss takes more of the hot air out of the market, but with next week’s contentious presidential election looming it may be premature to assume that the volatility surge has fully passed. Indeed, the VIX Index—a market-based estimate of near-term stock market volatility—soared to over 40 yesterday, reaching the highest level in four months. That’s Mr. Market’s forecast that anticipates there’s still more roller coaster ahead.

US Treasuries provided thin, if any, risk-off protection in today’s widespread selling of risk assets. After attempting to rally, the iShares 7-10 Year Treasury Bond (NYSE:IEF) ticked lower on the day. Even the shorter maturity iShares 1-3 Year Treasury Bond ETF (NASDAQ:SHY) couldn’t deliver a gain and ended the session unchanged vs. Tuesday’s close.

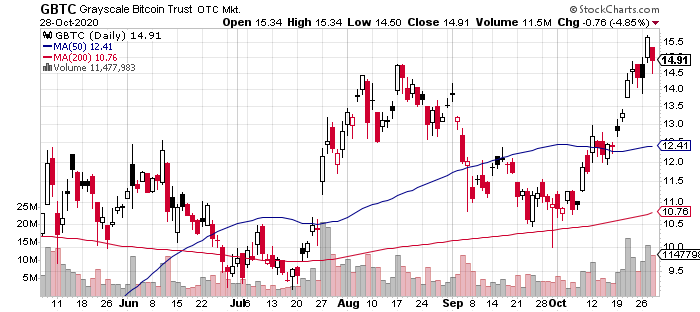

Several of the usual suspects on safe-haven short list had a bit of breakdown too. Gold certainly offered no shelter from the storm. SPDR Gold Shares (NYSE:GLD), which tracks the spot price of bullion, dropped 1.6% yesterday. Meantime, the perceived safe-haven darling of recent vintage—Bitcoin—stumbled as well. Bitcoin Investment Trust (OTC:GBTC), a proxy for the cryptocurrency, gave up 4.9% on Wednesday.

By contrast, US-minted paper was a port in the storm. Fiat currency risk may be under threat, but not today, at least not for the greenback. Despite its battered status in recent months, the US Dollar’s safe-haven status was back in vogue. Invesco DB US Dollar Index Bullish Fund (NYSE:UUP)—the ETF tracks the US Dollar Index—climbed 0.6% to an eight-day high.

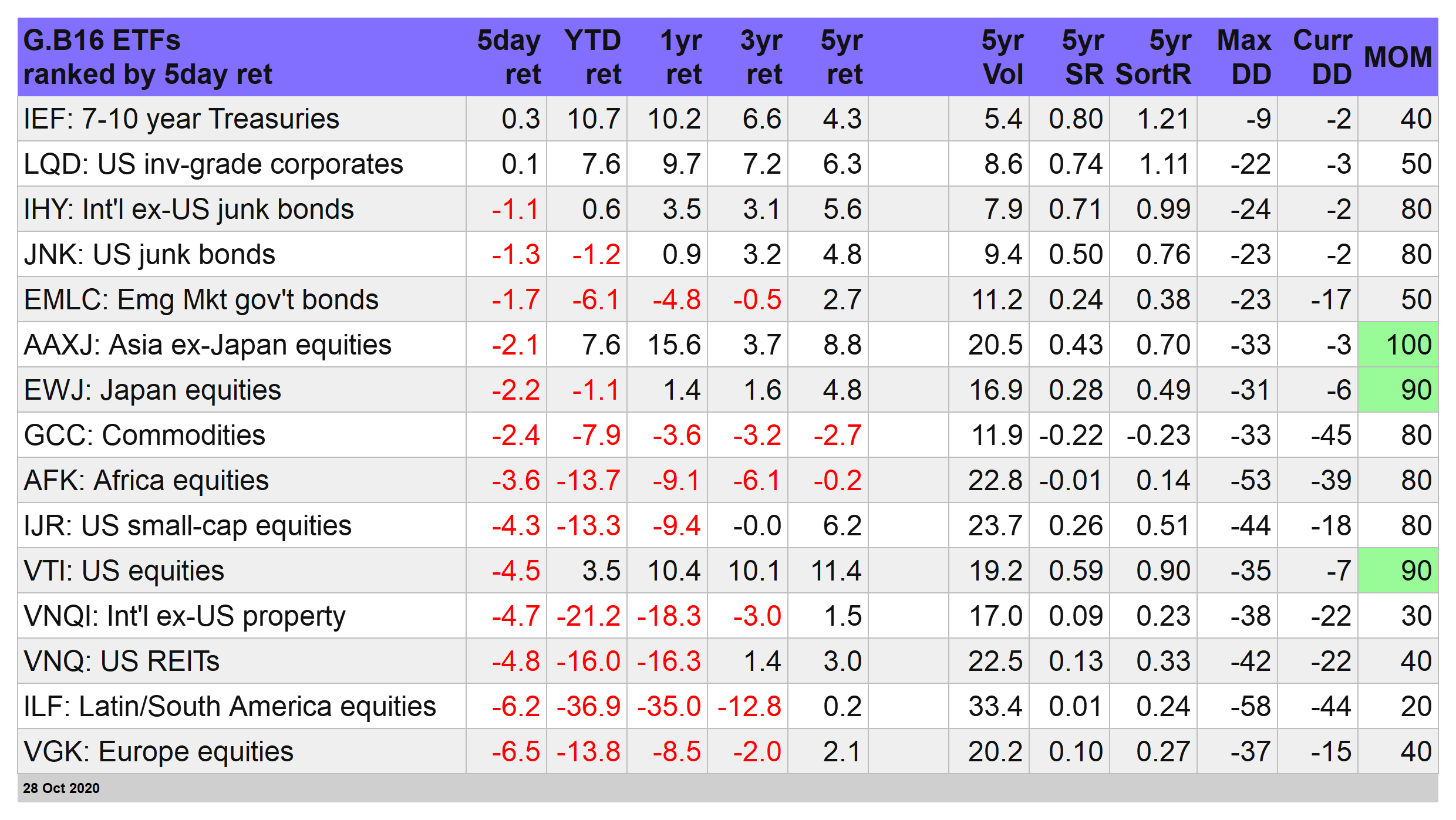

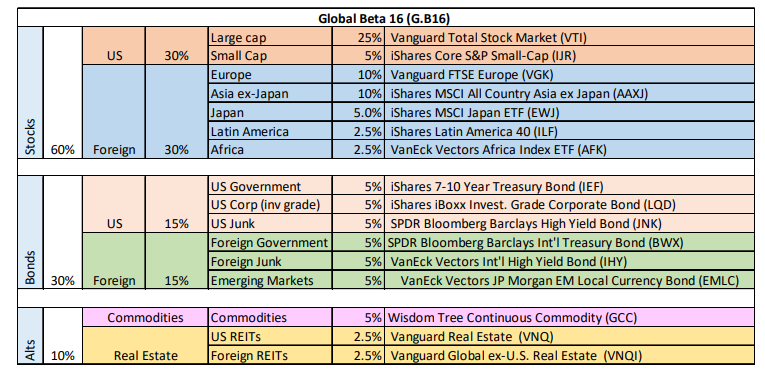

Reviewing the 16 funds that populate our broadest global benchmark shows that red ink is spreading across the market landscape. For the trailing 5 trading days through today’s close, only US Treasuries (IEF) and investment-grade corporates are posting gains.

Note, too, that our in-house momentum score (MOM column in table above) now reflects only three slice of global markets with high levels bullish bias (90 or 100): iShares MSCI All Country Asia ex Japan (NASDAQ:AAXJ), iShares MSCI Japan (NYSE:EWJ) and Vanguard Total Stock Market Index Fund (NYSE:VTI)). (For details on all the risk metrics as well as the strategies and benchmarks, see this summary.)

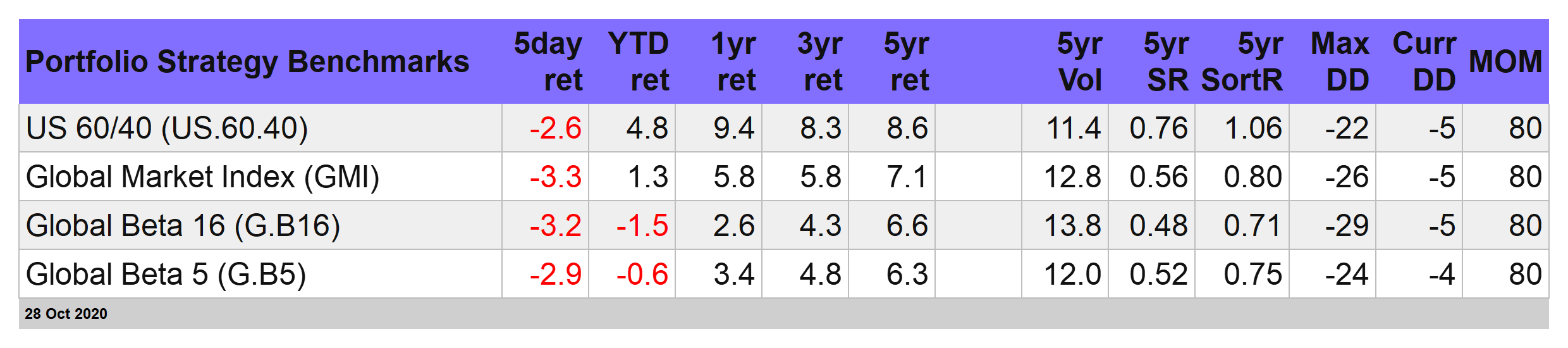

Global diversification has muted recent losses, but the setback in recent weeks is taking a toll. Our main benchmark—Global Beta 16 (G.B16), which holds all 16 funds in the table above in quasi-market-weighted allocations—is now in the red by 1.5% so far this year.

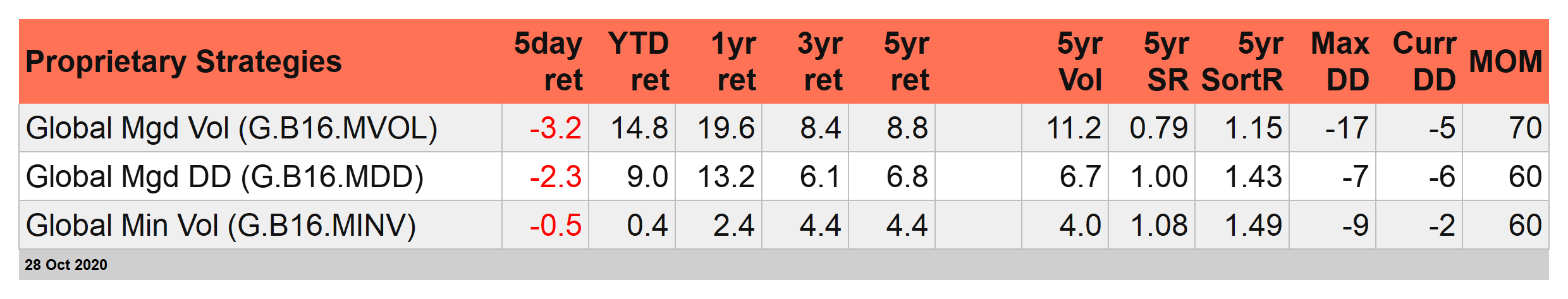

Our proprietary strategies are still holding on to gains for 2020 but the MOM scores for the portfolios have fallen to relatively middling levels recently, which suggests that headwinds are building.

Dr. Anthony Fauci, the top infectious-disease doctor in the US and a member of the White House coronavirus task force, advises that a Covid-19 vaccine won’t be available in America until January at the earliest. Meantime, the US is in a “bad place” with new reported cases rising to a record high in recent days while hospitalizations are surging in many parts of the nation. “We should have been way down in baseline and daily cases, and we’re not,” he says.

The Nov. 3 election in the US is just days away and uncertainty related to the outcome is high. With both sides reportedly unwilling to concede a loss, at least initially, an ensuing legal battle could delay the outcome by days or weeks.

Markets famously loathe uncertainty and so investor are warily eyeing the possibility of a shock that rocks the US political system to its core. If so, safe-haven assets and risk-managed portfolio strategies may face even greater stress tests before an unusually volatile year comes to a merciful close.