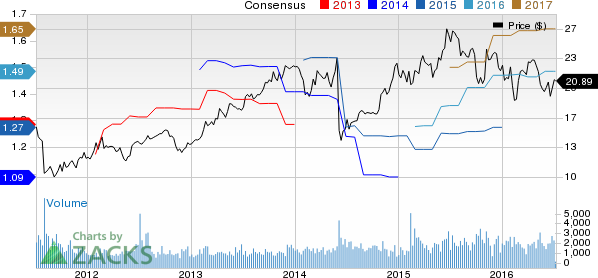

The Ensign Group Inc. (NASDAQ:ENSG) recently acquired Riverbend Post Acute Rehabilitation, a 161-bed skilled nursing and 10-bed assisted living facility in Kansas City, Kansas. Share price of the company rallied 1.31% to close at $20.89 on Jul 6.

Earlier operated by a non-profit organization, Riverbend had an occupancy rate of approximately 56% at the time of acquisition. The takeover expands Ensign’s presence in the Kansas City, where it has a number of facilities including healthcare resorts.

Post the takeover, Ensign’s portfolio will consist of 207 healthcare facilities, of which 35 are owned agencies, 16 hospice agencies, 16 home health agencies, three home care businesses and 17 urgent care clinics across 14 states.

Legend Healthcare Buyout

Meanwhile, in May, Ensign completed the acquisition of 18 skilled nursing facilities from Legend Healthcare in Texas. The portfolio largely consists of newer skilled nursing assets with a median age of eight years. The acquisition added 2,177 skilled nursing beds across 18 operations, which had an average occupancy of 77% as of May 1, 2016.

Moreover, Ensign’s home health and hospice portfolio subsidiary Cornerstone Healthcare acquired the assets of Hospice for Wright County on May 1. The hospice will be owned and operated by Heartland Healthcare and will do business in Wright County under the name Gateway Hospice.

FY16 Guidance

Following the closure of the Legend Healthcare acquisition, Ensign raised its full-year 2016 guidance. The company now expects revenues in the range of $1.625 billion to $1.66 billion and adjusted earnings of $1.45-$1.52 per share.

Ensign noted that its recently acquired basket now comprises 69 operations, which is a record. However, the company expects most of these acquisitions to start making significant contribution to the bottom line in the second half of 2016.

Stocks to Consider

Currently, Ensign carries a Zacks Rank #2 (Buy).

Other favorably ranked stocks in the broader medical sector include The Advisory Board Company (NASDAQ:ABCO) , BioTelemetry (NASDAQ:BEAT) and Abiomed (NASDAQ:ABMD) . All the three stocks sport a Rank #1 (Strong Buy).

ABIOMED INC (ABMD): Free Stock Analysis Report

BIOTELEMETRY (BEAT): Free Stock Analysis Report

ADVISORY BOARD (ABCO): Free Stock Analysis Report

ENSIGN GROUP (ENSG): Free Stock Analysis Report

Original post

Zacks Investment Research