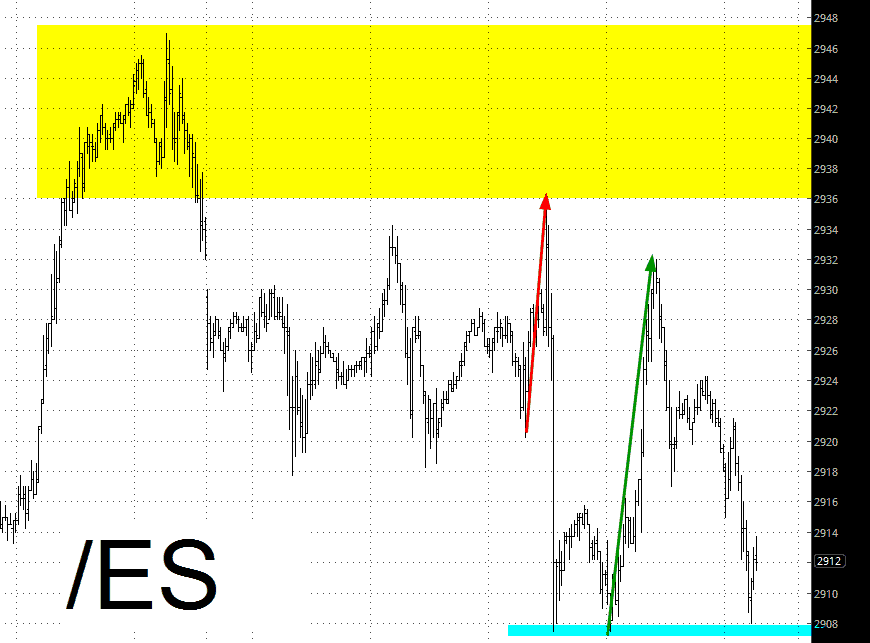

The quarter ends today (at least as far as equities go). As of this writing, it’s a fairly red screen. Looking at the ES below, we can see the first Rally For No Good Reason (RED arrow) took place after the Fed announced an interest rate increase and signaled they would no longer being “accommodative”. With an entire planet choking out debt, the best thing for it is to keep cranking up rates, thus, the rally.

Anyway, that completely to pieces and found support at 2900. And then yesterday, there was even larger Rally For Not Good Reason (GREEN) arrow, and I can’t even think of what would have caused this. Tearful testimony about events from 1982 surely couldn’t have been this inspiring to equity bulls (actually, given their mental issues, perhaps it was). That, too, has fallen to pieces, and we yet again fond support at 2900. What I’m hinting at here is that 2900 is important.

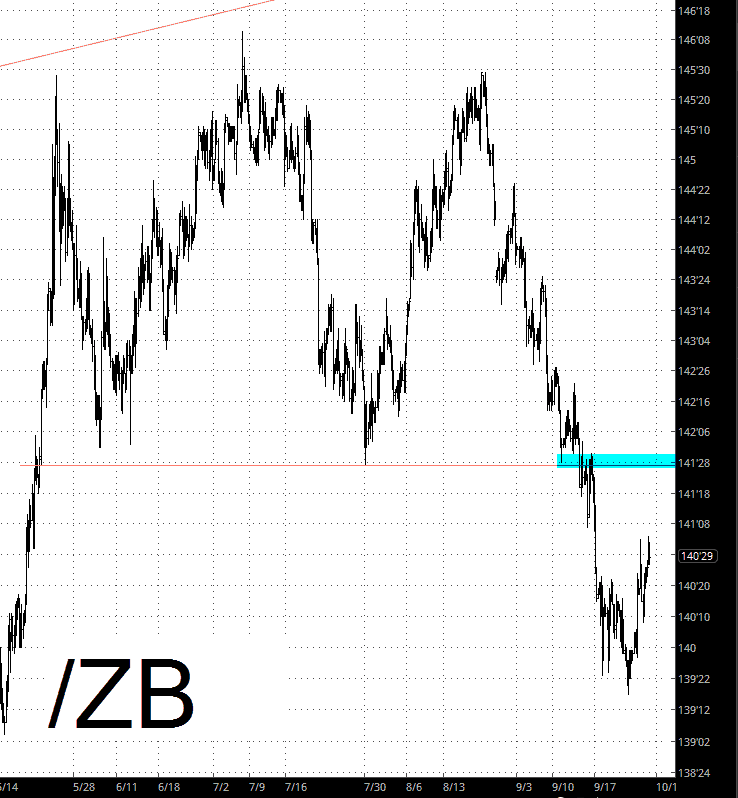

As for bonds, I think there’s a lead wall where I’ve drawn the tint. Hopefully we won’t even waste time getting that high, but anyway, that level is our ally.

I’ll close by saying a favorite quote from Mr. Rogers: “Remember, no matter how badly your day is going, it isn’t going as badly as the fellow who sold naked OTM put options on Tesla (NASDAQ:TSLA).“