Stocks continue to build bases as we progress into earnings season.

I see no reason in the charts to expect any meaningful downside yet.

Metals continued to show strength off lows but I am still weary that this strength is only fleeting with Chinese New Year right around the corner.

Gold gained 1.94% this past week and has been acting fine.

That said, I don’t see it really moving anywhere fast with only a couple weeks left of this current influx of Chinese buying.

We may see this move extend to the $1,240 resistance level but likely not above.

Silver rose 1.49% and is finding resistance at $17 now.

We may see silver breach $17 and move to $17.50 over the next couple of weeks but I’m not looking for real strength to take hold until the early spring.

Platinum only notched a 1.63% gain this past week but does look set for a bit more upside on this move.

This short-term uptrend should continue to the $1,025 level where the 200 day moving average sits, and will act as resistance.

Once the selling in gold subsides, it will in platinum as well.

As unrelated as they should be, platinum and gold are very correlated.

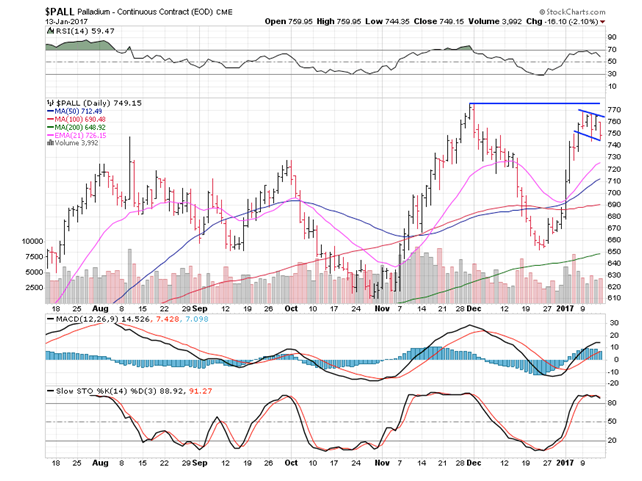

Palladium was the sole loser falling 1.21% for the week.

The $775 area is resistance and we are seeing that force exerted on palladium now as it looks to be setting up a bull flag for a potential breakout.

That said, it will be a hard move to sustain if gold and silver do indeed begin to slow.

Have a wonderful weekend and week ahead as our current market is a go!